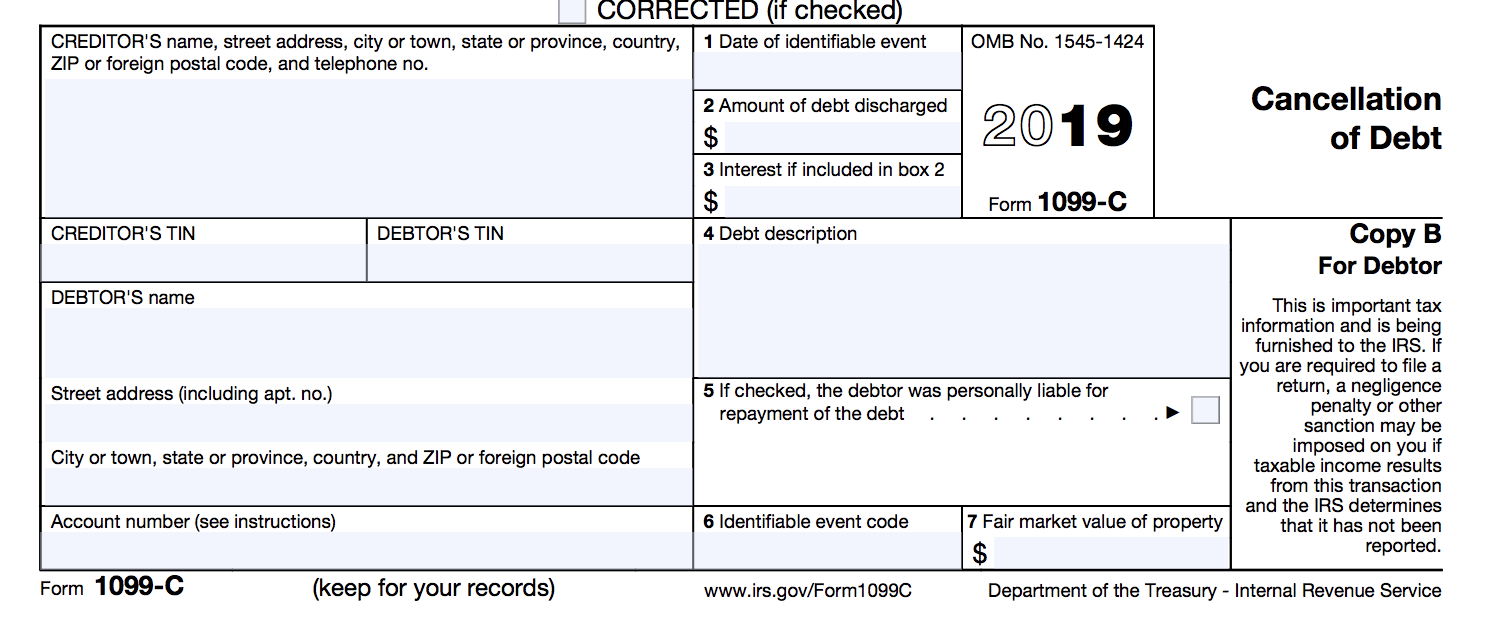

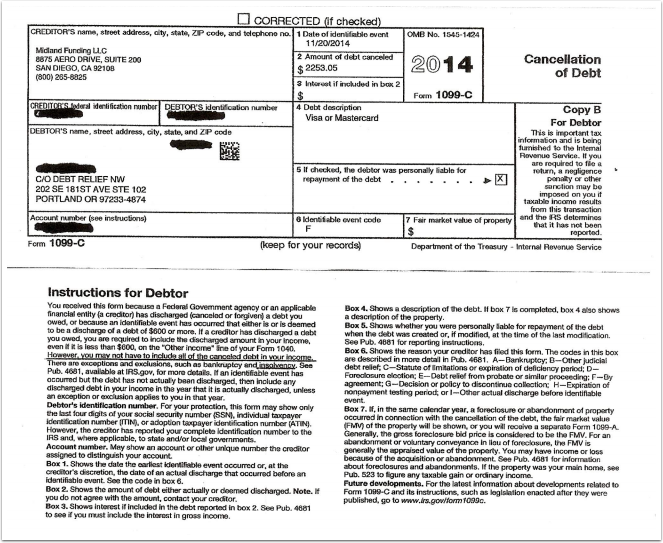

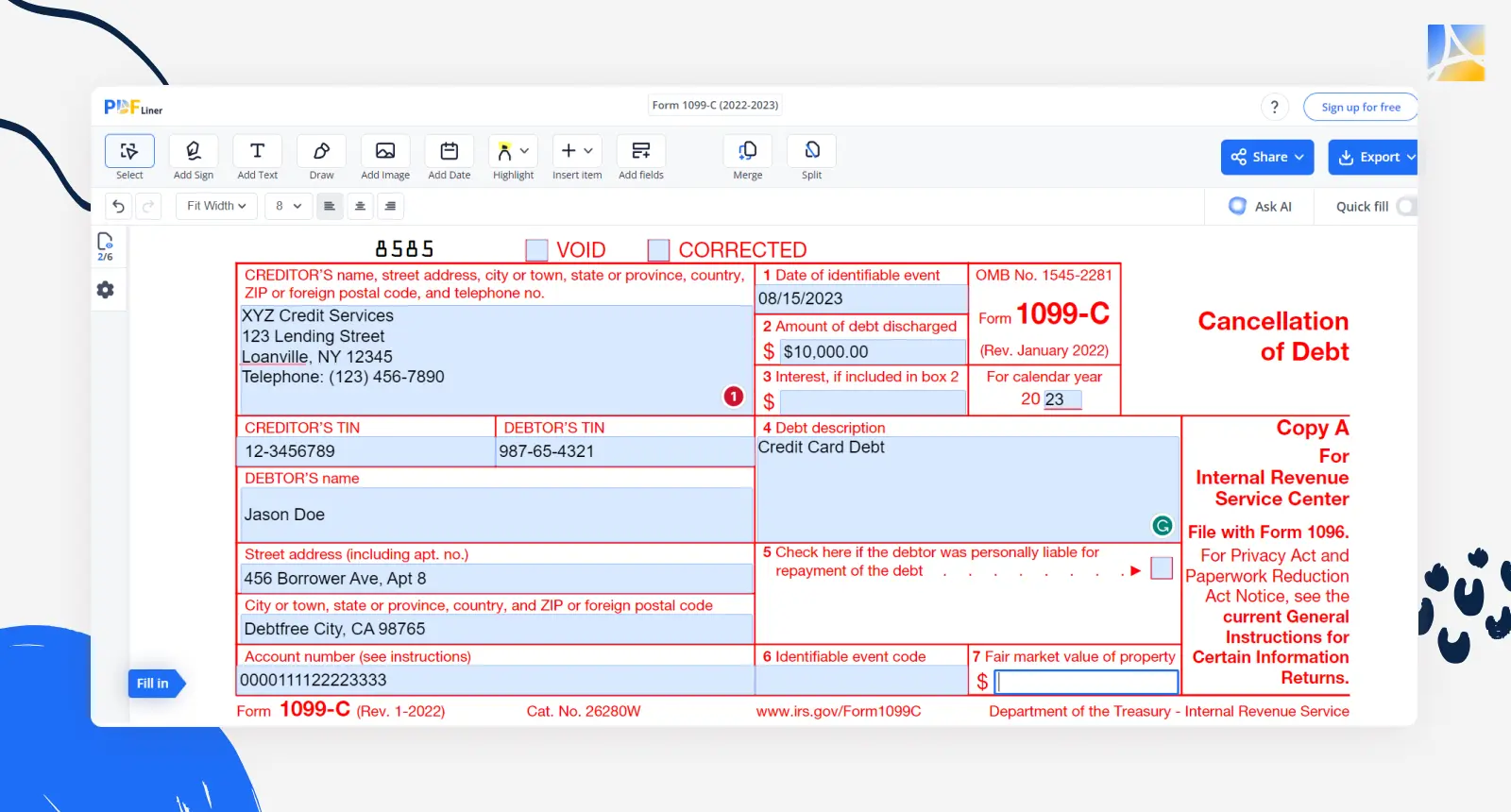

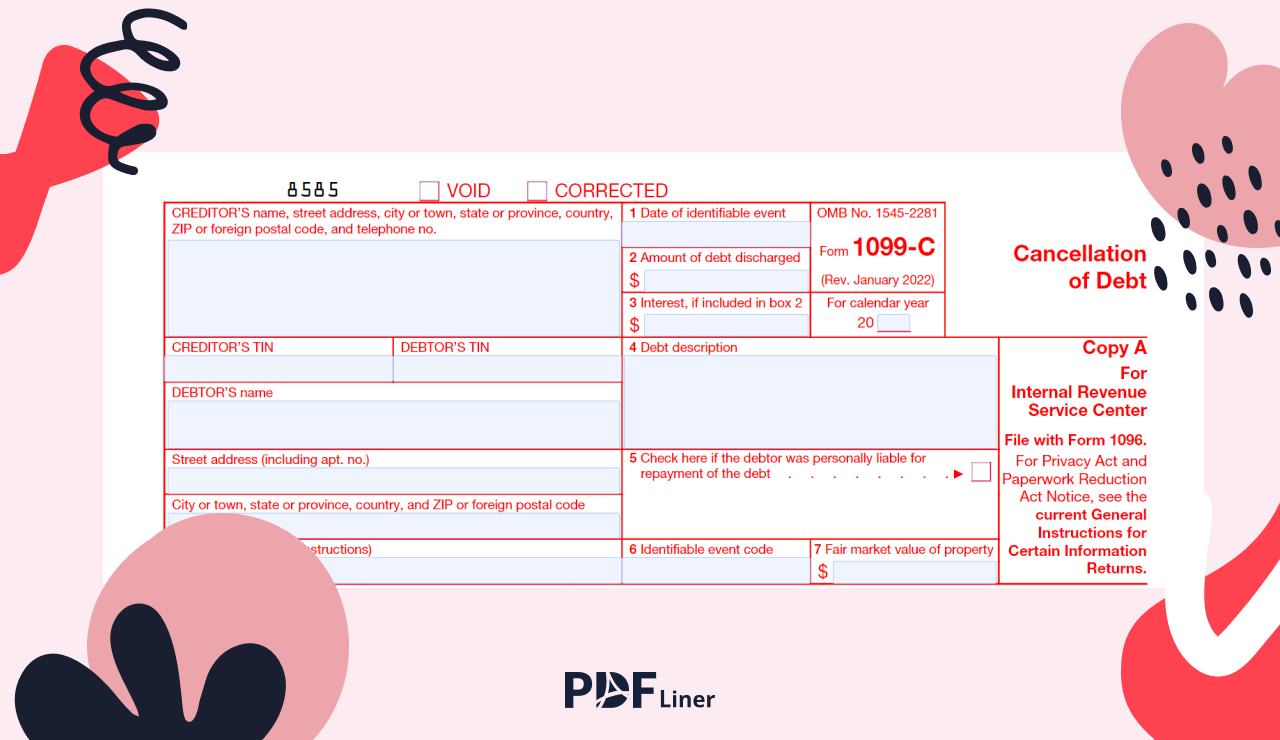

1099C Form Explained - Find out when canceled debt is considered taxable income, the exceptions that apply, and how to accurately. It signifies that a creditor has forgiven or.

It signifies that a creditor has forgiven or. Find out when canceled debt is considered taxable income, the exceptions that apply, and how to accurately.

It signifies that a creditor has forgiven or. Find out when canceled debt is considered taxable income, the exceptions that apply, and how to accurately.

Tax Form Explanation at Charlie King blog

Find out when canceled debt is considered taxable income, the exceptions that apply, and how to accurately. It signifies that a creditor has forgiven or.

What Is a 1099C Form Helpful Manual and Tips

It signifies that a creditor has forgiven or. Find out when canceled debt is considered taxable income, the exceptions that apply, and how to accurately.

Form 1099C Definition

It signifies that a creditor has forgiven or. Find out when canceled debt is considered taxable income, the exceptions that apply, and how to accurately.

IRS Form 1099C Taxes on Discharged Debt SuperMoney

Find out when canceled debt is considered taxable income, the exceptions that apply, and how to accurately. It signifies that a creditor has forgiven or.

1099 C. DEBT CANCELLATIONExplained YouTube

Find out when canceled debt is considered taxable income, the exceptions that apply, and how to accurately. It signifies that a creditor has forgiven or.

What is a 1099C and What to do About it!

It signifies that a creditor has forgiven or. Find out when canceled debt is considered taxable income, the exceptions that apply, and how to accurately.

All 21 Types of 1099 Tax Forms, Explained The Tech Edvocate

Find out when canceled debt is considered taxable income, the exceptions that apply, and how to accurately. It signifies that a creditor has forgiven or.

Form 1099C Cancellation of Debt

It signifies that a creditor has forgiven or. Find out when canceled debt is considered taxable income, the exceptions that apply, and how to accurately.

Understand All 20 Types of 1099 Forms With Examples

It signifies that a creditor has forgiven or. Find out when canceled debt is considered taxable income, the exceptions that apply, and how to accurately.

It Signifies That A Creditor Has Forgiven Or.

Find out when canceled debt is considered taxable income, the exceptions that apply, and how to accurately.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at10.56.32AM-37cc88c042894d73946efcc05529c80f.png)