163 J Form - Navigate the irrevocable section 163 (j) election. 163 (j) business interest limitation, this item discusses how the rules for calculating ati have. Calculate adjusted taxable income for form 8990 follow these steps to force the application to calculate taxable income and other amounts for. After providing some background on the sec. Information about form 8990, limitation on business interest expense under section 163 (j), including recent updates, related forms and instructions on.

163 (j) business interest limitation, this item discusses how the rules for calculating ati have. Navigate the irrevocable section 163 (j) election. Calculate adjusted taxable income for form 8990 follow these steps to force the application to calculate taxable income and other amounts for. After providing some background on the sec. Information about form 8990, limitation on business interest expense under section 163 (j), including recent updates, related forms and instructions on.

Navigate the irrevocable section 163 (j) election. Information about form 8990, limitation on business interest expense under section 163 (j), including recent updates, related forms and instructions on. Calculate adjusted taxable income for form 8990 follow these steps to force the application to calculate taxable income and other amounts for. After providing some background on the sec. 163 (j) business interest limitation, this item discusses how the rules for calculating ati have.

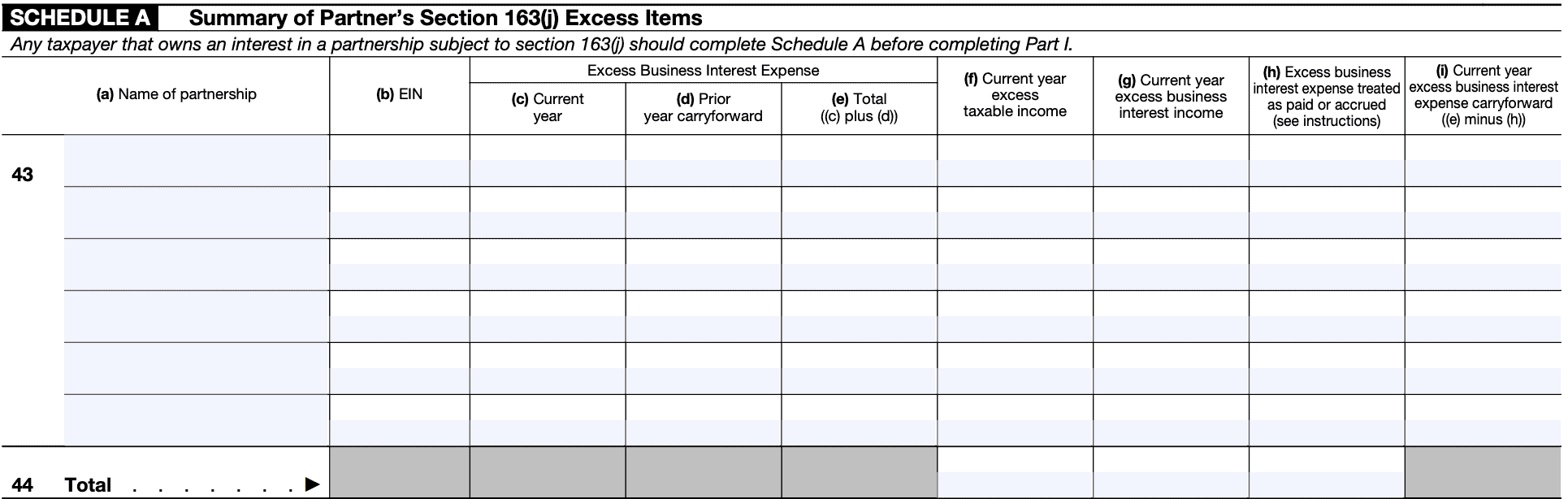

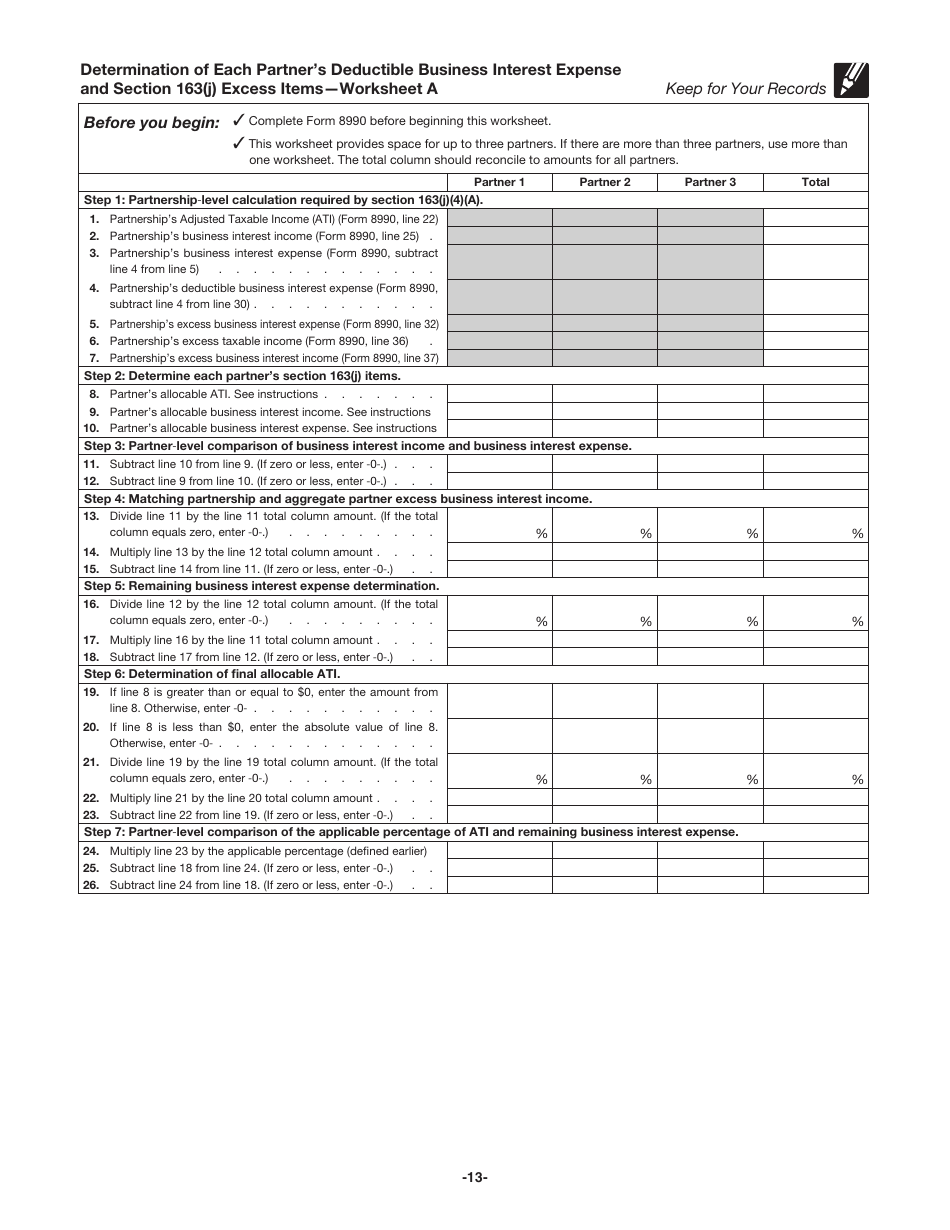

IRS Form 8990 walkthrough (Limitation on Business Interest Expenses

After providing some background on the sec. Calculate adjusted taxable income for form 8990 follow these steps to force the application to calculate taxable income and other amounts for. Information about form 8990, limitation on business interest expense under section 163 (j), including recent updates, related forms and instructions on. Navigate the irrevocable section 163 (j) election. 163 (j) business.

Download Instructions for IRS Form 8990 Limitation on Business Interest

Navigate the irrevocable section 163 (j) election. Information about form 8990, limitation on business interest expense under section 163 (j), including recent updates, related forms and instructions on. 163 (j) business interest limitation, this item discusses how the rules for calculating ati have. After providing some background on the sec. Calculate adjusted taxable income for form 8990 follow these steps.

IRS Form 8990 Instructions Business Interest Expense Limitation

Information about form 8990, limitation on business interest expense under section 163 (j), including recent updates, related forms and instructions on. After providing some background on the sec. 163 (j) business interest limitation, this item discusses how the rules for calculating ati have. Calculate adjusted taxable income for form 8990 follow these steps to force the application to calculate taxable.

Download Instructions for IRS Form 8990 Limitation on Business Interest

After providing some background on the sec. Information about form 8990, limitation on business interest expense under section 163 (j), including recent updates, related forms and instructions on. 163 (j) business interest limitation, this item discusses how the rules for calculating ati have. Navigate the irrevocable section 163 (j) election. Calculate adjusted taxable income for form 8990 follow these steps.

What is J Form in India for Studying Abroad?

After providing some background on the sec. Information about form 8990, limitation on business interest expense under section 163 (j), including recent updates, related forms and instructions on. Navigate the irrevocable section 163 (j) election. Calculate adjusted taxable income for form 8990 follow these steps to force the application to calculate taxable income and other amounts for. 163 (j) business.

Sec. 163(j) planning considerations PDF Expense Lease

After providing some background on the sec. 163 (j) business interest limitation, this item discusses how the rules for calculating ati have. Calculate adjusted taxable income for form 8990 follow these steps to force the application to calculate taxable income and other amounts for. Information about form 8990, limitation on business interest expense under section 163 (j), including recent updates,.

Fillable Form 8926 Disqualified Corporate Interest Expense Disallowed

Navigate the irrevocable section 163 (j) election. After providing some background on the sec. Information about form 8990, limitation on business interest expense under section 163 (j), including recent updates, related forms and instructions on. 163 (j) business interest limitation, this item discusses how the rules for calculating ati have. Calculate adjusted taxable income for form 8990 follow these steps.

How To Calculate Adjusted Taxable For 163(J)?

After providing some background on the sec. Calculate adjusted taxable income for form 8990 follow these steps to force the application to calculate taxable income and other amounts for. Information about form 8990, limitation on business interest expense under section 163 (j), including recent updates, related forms and instructions on. 163 (j) business interest limitation, this item discusses how the.

Download Instructions for IRS Form 8990 Limitation on Business Interest

Information about form 8990, limitation on business interest expense under section 163 (j), including recent updates, related forms and instructions on. After providing some background on the sec. Navigate the irrevocable section 163 (j) election. 163 (j) business interest limitation, this item discusses how the rules for calculating ati have. Calculate adjusted taxable income for form 8990 follow these steps.

Download Instructions for IRS Form 8990 Limitation on Business Interest

After providing some background on the sec. Information about form 8990, limitation on business interest expense under section 163 (j), including recent updates, related forms and instructions on. 163 (j) business interest limitation, this item discusses how the rules for calculating ati have. Navigate the irrevocable section 163 (j) election. Calculate adjusted taxable income for form 8990 follow these steps.

After Providing Some Background On The Sec.

163 (j) business interest limitation, this item discusses how the rules for calculating ati have. Navigate the irrevocable section 163 (j) election. Information about form 8990, limitation on business interest expense under section 163 (j), including recent updates, related forms and instructions on. Calculate adjusted taxable income for form 8990 follow these steps to force the application to calculate taxable income and other amounts for.