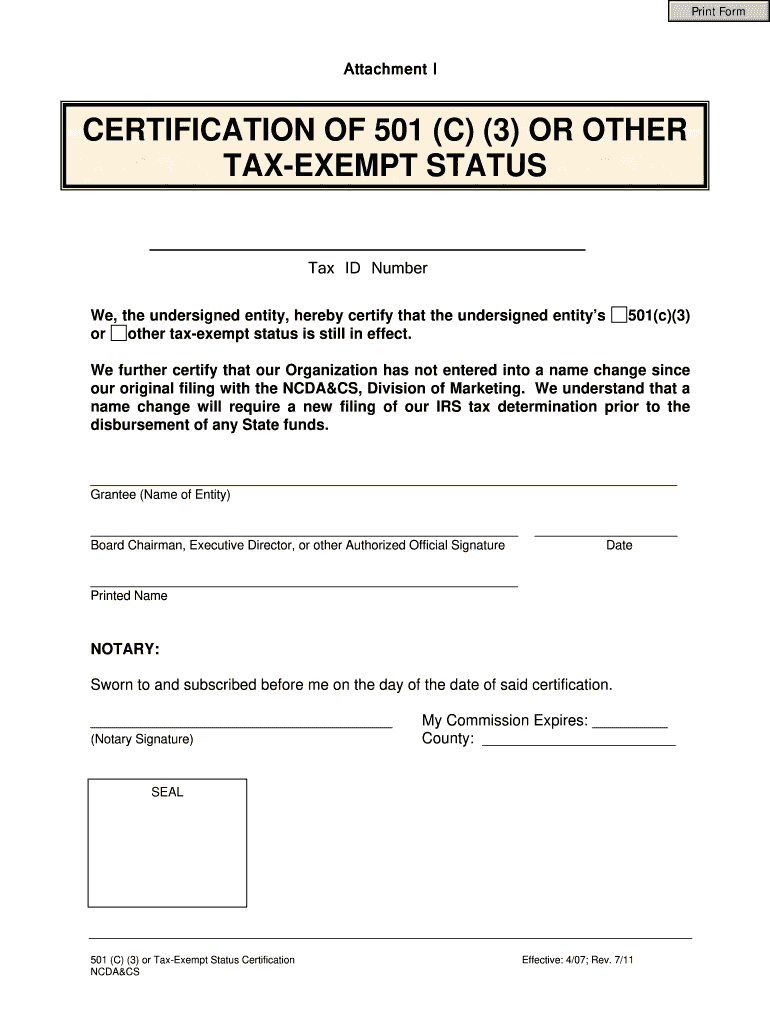

501-Llc Form - A 501 (c) organization is a nonprofit organization in the federal law of the united states according to internal revenue code (26 u.s.c. Organizations described in section 501 (c) (3) are commonly referred to as charitable organizations. Both nonprofit types have unique restrictions, pros and cons, so we compared 501 (c) (3) vs 501 (c) (4) to help you decide which is best.

Organizations described in section 501 (c) (3) are commonly referred to as charitable organizations. A 501 (c) organization is a nonprofit organization in the federal law of the united states according to internal revenue code (26 u.s.c. Both nonprofit types have unique restrictions, pros and cons, so we compared 501 (c) (3) vs 501 (c) (4) to help you decide which is best.

Both nonprofit types have unique restrictions, pros and cons, so we compared 501 (c) (3) vs 501 (c) (4) to help you decide which is best. A 501 (c) organization is a nonprofit organization in the federal law of the united states according to internal revenue code (26 u.s.c. Organizations described in section 501 (c) (3) are commonly referred to as charitable organizations.

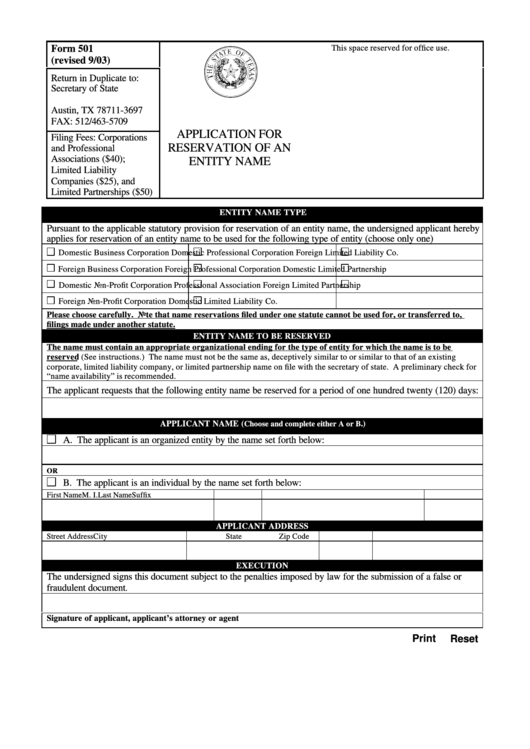

Fillable Form 501 Application For Reservation Of An Entity Name

Both nonprofit types have unique restrictions, pros and cons, so we compared 501 (c) (3) vs 501 (c) (4) to help you decide which is best. A 501 (c) organization is a nonprofit organization in the federal law of the united states according to internal revenue code (26 u.s.c. Organizations described in section 501 (c) (3) are commonly referred to.

501 llc Fill out & sign online DocHub

Organizations described in section 501 (c) (3) are commonly referred to as charitable organizations. Both nonprofit types have unique restrictions, pros and cons, so we compared 501 (c) (3) vs 501 (c) (4) to help you decide which is best. A 501 (c) organization is a nonprofit organization in the federal law of the united states according to internal revenue.

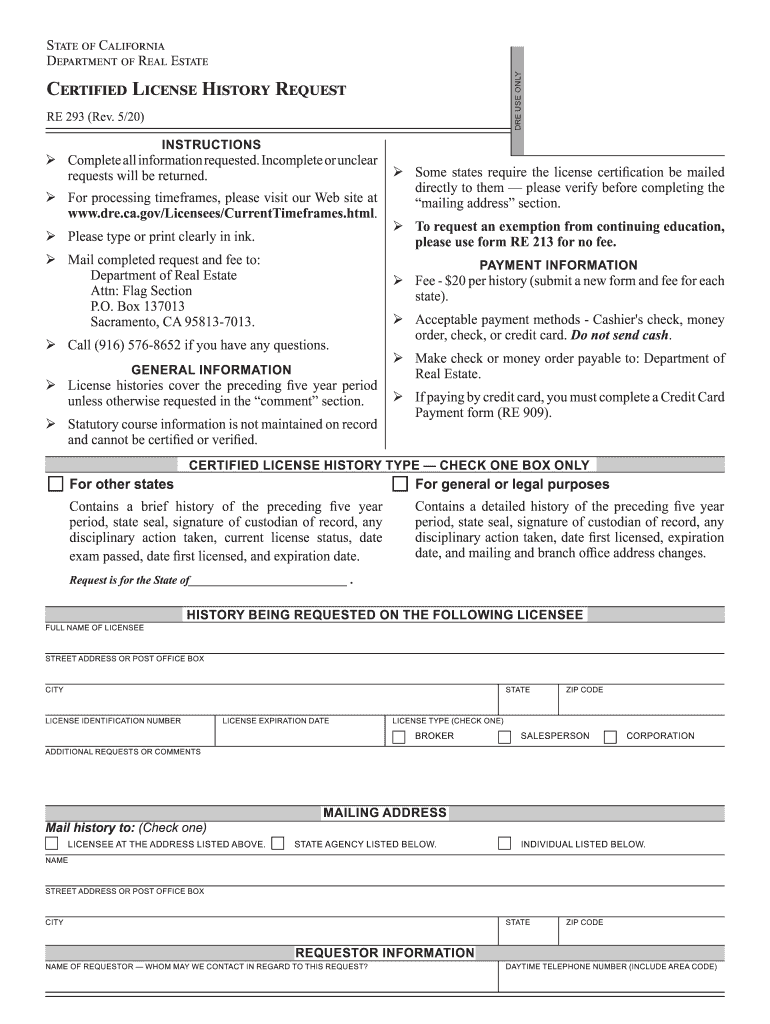

Fillable Online CA Form 501 Fax Email Print pdfFiller

Both nonprofit types have unique restrictions, pros and cons, so we compared 501 (c) (3) vs 501 (c) (4) to help you decide which is best. A 501 (c) organization is a nonprofit organization in the federal law of the united states according to internal revenue code (26 u.s.c. Organizations described in section 501 (c) (3) are commonly referred to.

Statement of Information (What Is It And How To File One)

Organizations described in section 501 (c) (3) are commonly referred to as charitable organizations. A 501 (c) organization is a nonprofit organization in the federal law of the united states according to internal revenue code (26 u.s.c. Both nonprofit types have unique restrictions, pros and cons, so we compared 501 (c) (3) vs 501 (c) (4) to help you decide.

Boi Form 501 For Mse PDF Exports Sole Proprietorship

Both nonprofit types have unique restrictions, pros and cons, so we compared 501 (c) (3) vs 501 (c) (4) to help you decide which is best. A 501 (c) organization is a nonprofit organization in the federal law of the united states according to internal revenue code (26 u.s.c. Organizations described in section 501 (c) (3) are commonly referred to.

501 llc form Fill out & sign online DocHub

A 501 (c) organization is a nonprofit organization in the federal law of the united states according to internal revenue code (26 u.s.c. Both nonprofit types have unique restrictions, pros and cons, so we compared 501 (c) (3) vs 501 (c) (4) to help you decide which is best. Organizations described in section 501 (c) (3) are commonly referred to.

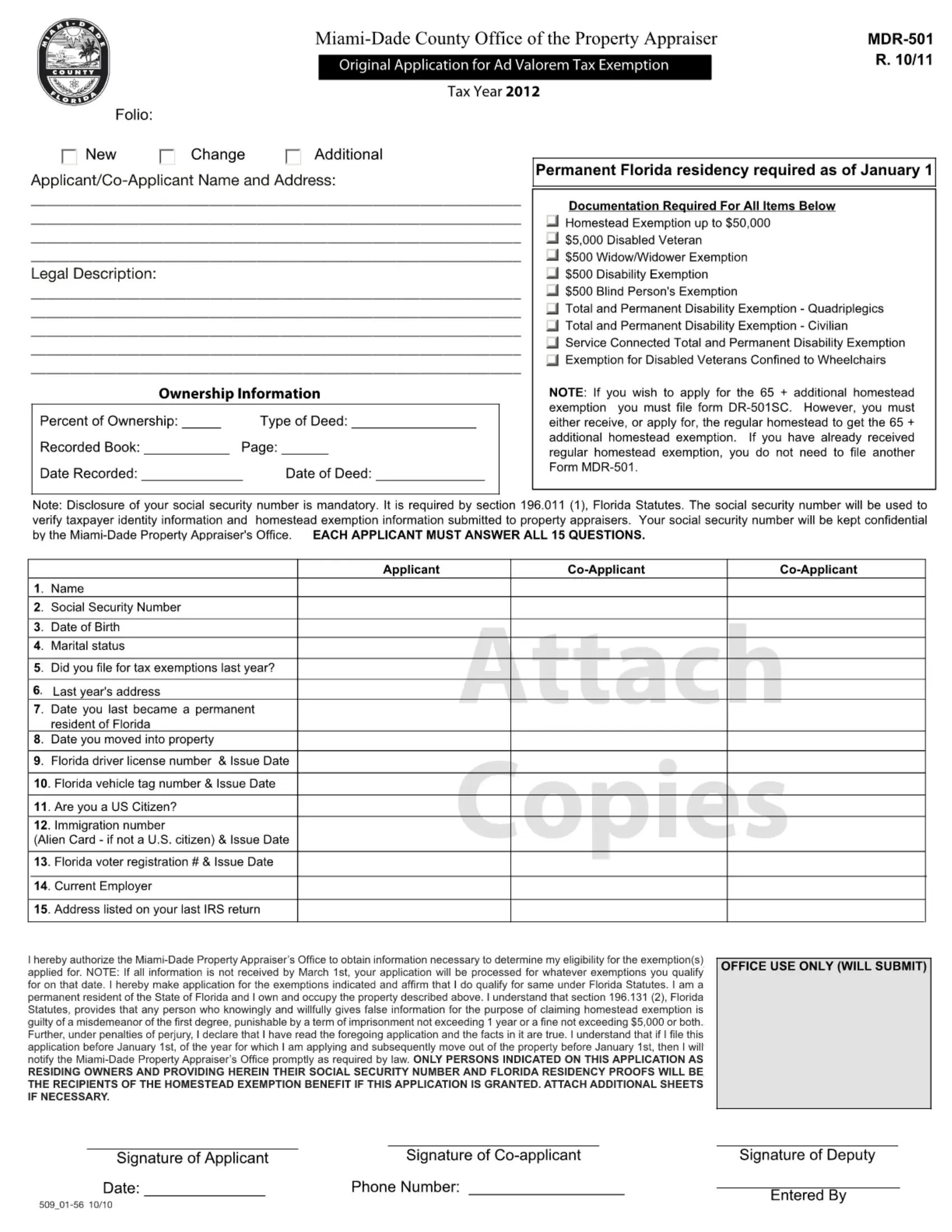

Mdr 501 Form ≡ Fill Out Printable PDF Forms Online

A 501 (c) organization is a nonprofit organization in the federal law of the united states according to internal revenue code (26 u.s.c. Both nonprofit types have unique restrictions, pros and cons, so we compared 501 (c) (3) vs 501 (c) (4) to help you decide which is best. Organizations described in section 501 (c) (3) are commonly referred to.

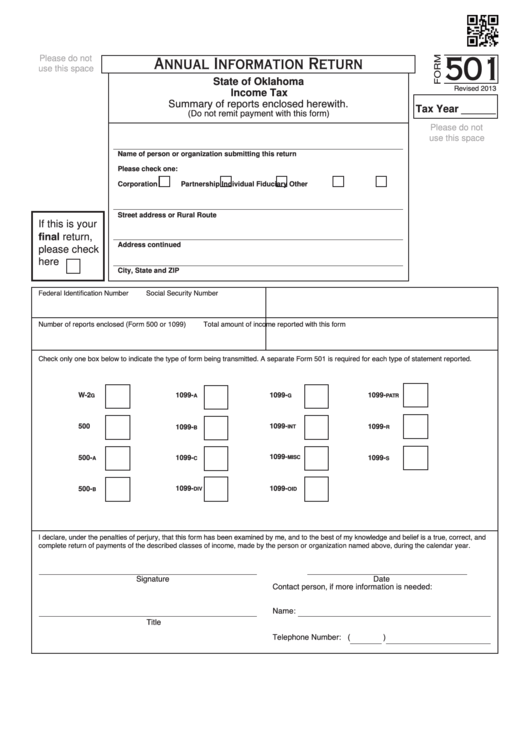

Fillable Form 501 Annual Information Return printable pdf download

A 501 (c) organization is a nonprofit organization in the federal law of the united states according to internal revenue code (26 u.s.c. Both nonprofit types have unique restrictions, pros and cons, so we compared 501 (c) (3) vs 501 (c) (4) to help you decide which is best. Organizations described in section 501 (c) (3) are commonly referred to.

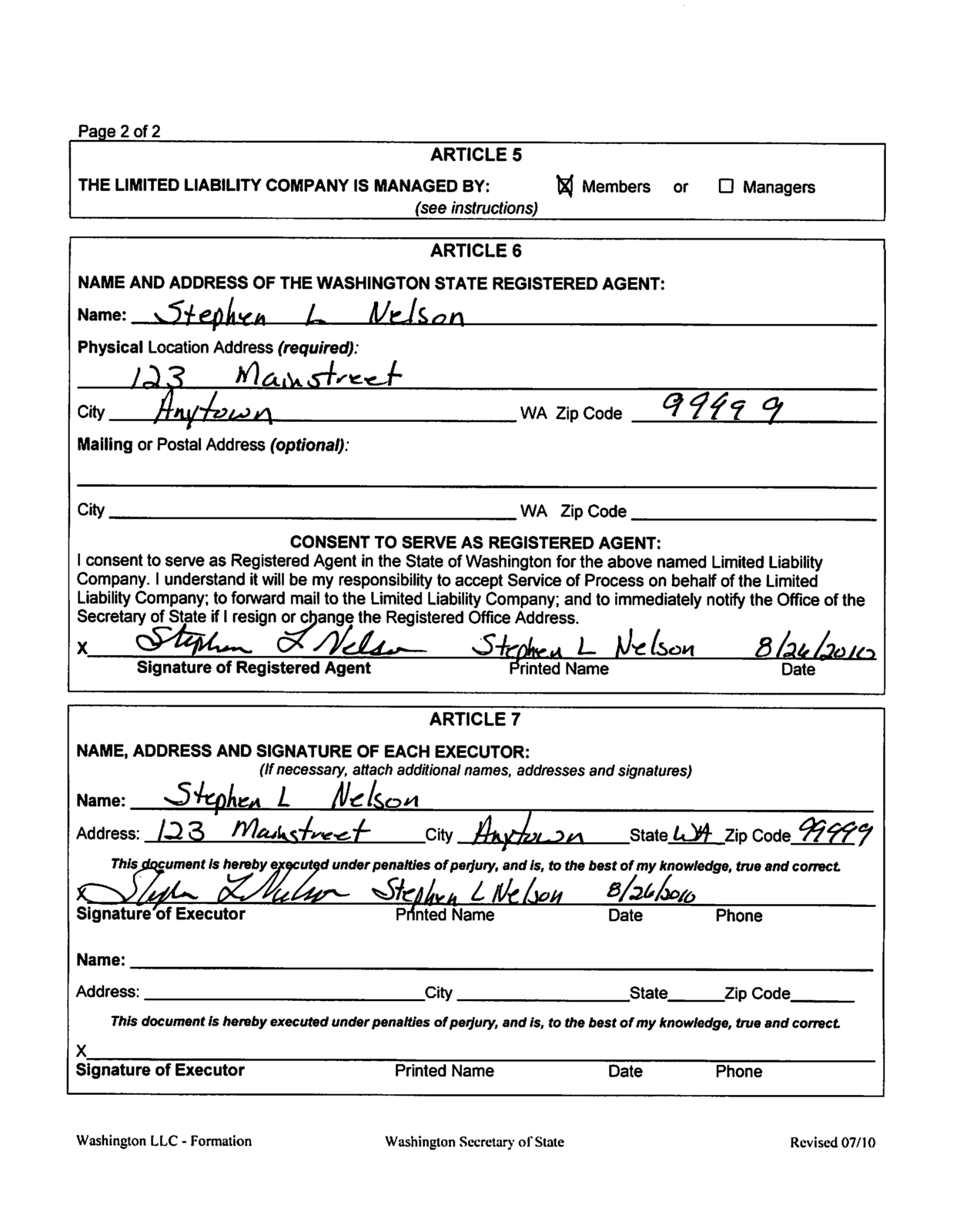

Forming a Washington State LLC Evergreen Small Business

Both nonprofit types have unique restrictions, pros and cons, so we compared 501 (c) (3) vs 501 (c) (4) to help you decide which is best. Organizations described in section 501 (c) (3) are commonly referred to as charitable organizations. A 501 (c) organization is a nonprofit organization in the federal law of the united states according to internal revenue.

501c Fill Online, Printable, Fillable, Blank pdfFiller

Organizations described in section 501 (c) (3) are commonly referred to as charitable organizations. Both nonprofit types have unique restrictions, pros and cons, so we compared 501 (c) (3) vs 501 (c) (4) to help you decide which is best. A 501 (c) organization is a nonprofit organization in the federal law of the united states according to internal revenue.

Organizations Described In Section 501 (C) (3) Are Commonly Referred To As Charitable Organizations.

A 501 (c) organization is a nonprofit organization in the federal law of the united states according to internal revenue code (26 u.s.c. Both nonprofit types have unique restrictions, pros and cons, so we compared 501 (c) (3) vs 501 (c) (4) to help you decide which is best.