8832 Form Deadline - This guide explains how us and foreign entities are. The form must be filed. Form 8832 is an irs tax document used by a business to choose how it will be classified for federal tax purposes. Explore practical examples and solutions for obtaining late election relief with form 8832, including common scenarios and filing. Businesses can elect to be. Information about form 8832, entity classification election, including recent updates, related forms, and instructions on how to file. Wondering what irs form 8832 is and whether it applies to your business?

Explore practical examples and solutions for obtaining late election relief with form 8832, including common scenarios and filing. Information about form 8832, entity classification election, including recent updates, related forms, and instructions on how to file. Businesses can elect to be. Form 8832 is an irs tax document used by a business to choose how it will be classified for federal tax purposes. Wondering what irs form 8832 is and whether it applies to your business? The form must be filed. This guide explains how us and foreign entities are.

Information about form 8832, entity classification election, including recent updates, related forms, and instructions on how to file. Form 8832 is an irs tax document used by a business to choose how it will be classified for federal tax purposes. Wondering what irs form 8832 is and whether it applies to your business? Explore practical examples and solutions for obtaining late election relief with form 8832, including common scenarios and filing. Businesses can elect to be. The form must be filed. This guide explains how us and foreign entities are.

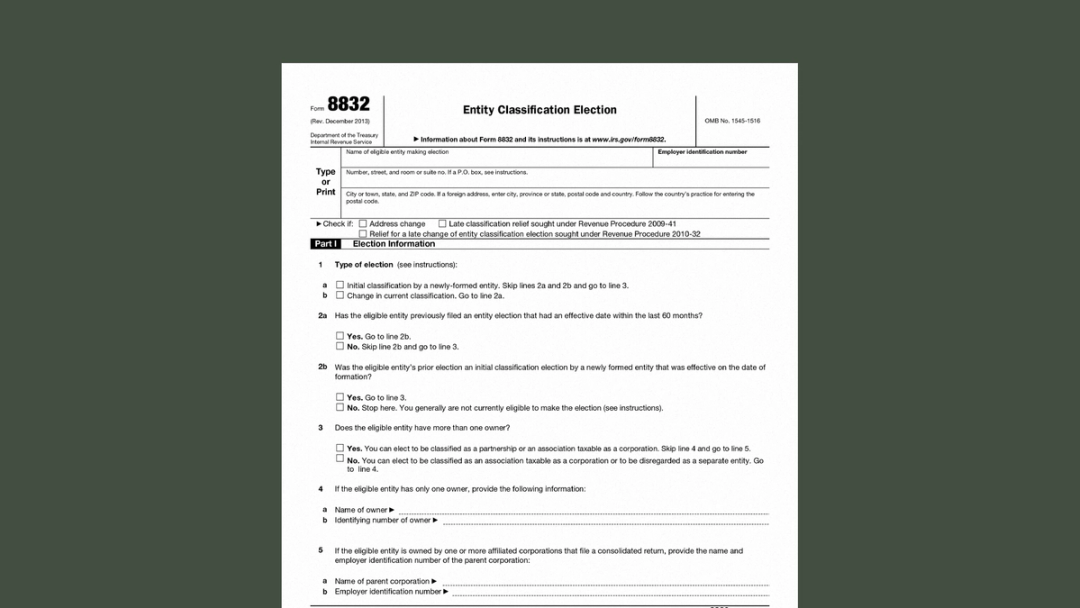

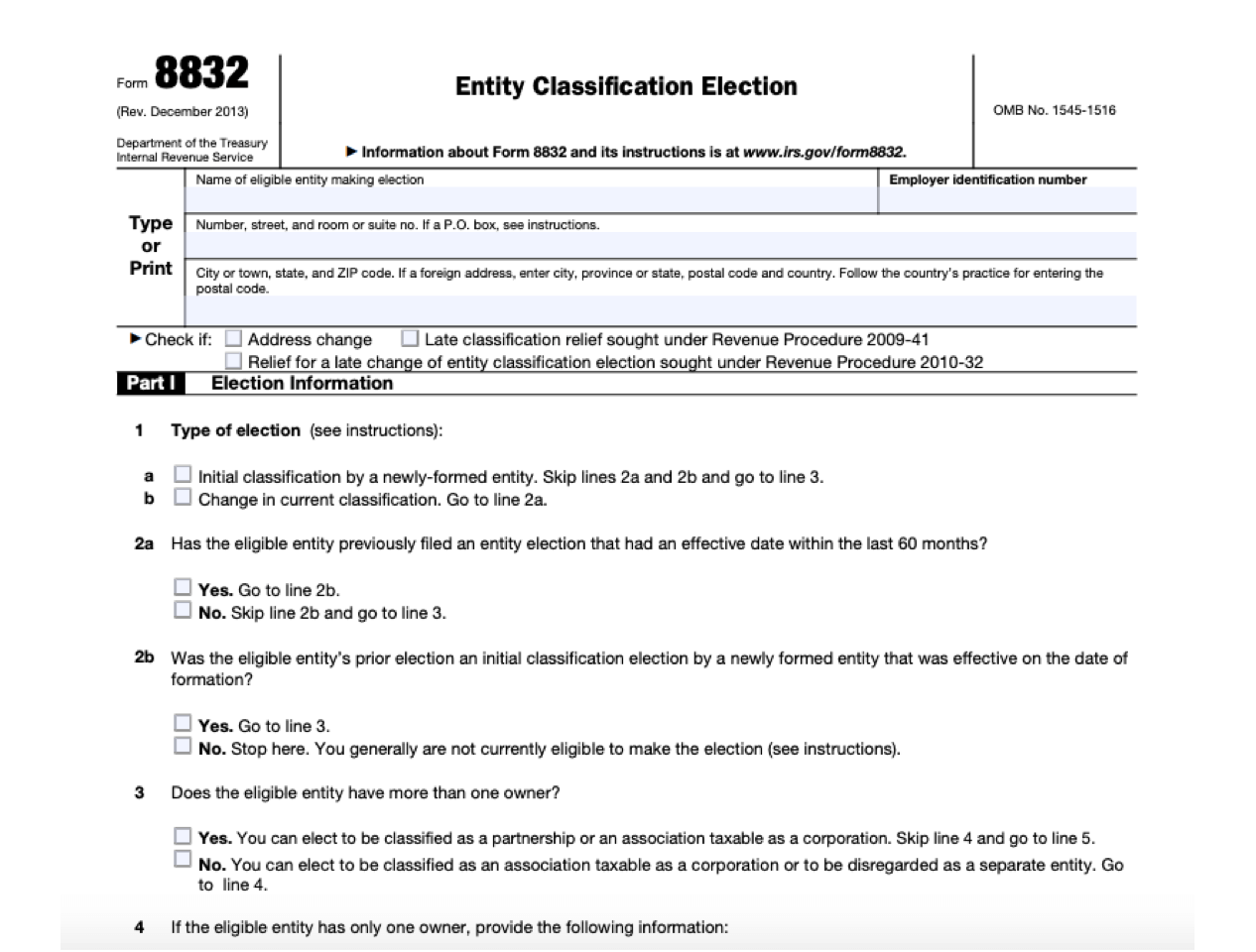

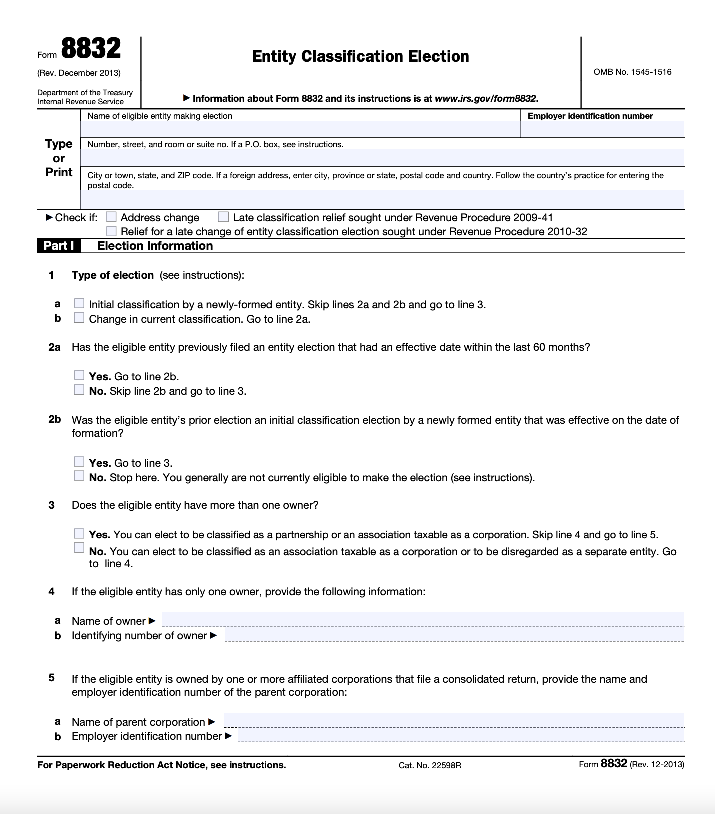

Understanding Form 8832 Entity Classification Election

Explore practical examples and solutions for obtaining late election relief with form 8832, including common scenarios and filing. Form 8832 is an irs tax document used by a business to choose how it will be classified for federal tax purposes. The form must be filed. Businesses can elect to be. This guide explains how us and foreign entities are.

Form 8832 A Simple Guide to Changing Your LLC’s Tax Status Ambrook

Businesses can elect to be. This guide explains how us and foreign entities are. Form 8832 is an irs tax document used by a business to choose how it will be classified for federal tax purposes. Wondering what irs form 8832 is and whether it applies to your business? Explore practical examples and solutions for obtaining late election relief with.

IRS Form 8978 Instructions Reporting Partner's Additional Taxes

Information about form 8832, entity classification election, including recent updates, related forms, and instructions on how to file. Explore practical examples and solutions for obtaining late election relief with form 8832, including common scenarios and filing. Form 8832 is an irs tax document used by a business to choose how it will be classified for federal tax purposes. Businesses can.

Electing C Corporation Tax Treatment for an LLC with IRS Form 8832

Businesses can elect to be. Explore practical examples and solutions for obtaining late election relief with form 8832, including common scenarios and filing. Information about form 8832, entity classification election, including recent updates, related forms, and instructions on how to file. Form 8832 is an irs tax document used by a business to choose how it will be classified for.

Form 8832 Instructions and Frequently Asked Questions

This guide explains how us and foreign entities are. Wondering what irs form 8832 is and whether it applies to your business? Explore practical examples and solutions for obtaining late election relief with form 8832, including common scenarios and filing. The form must be filed. Information about form 8832, entity classification election, including recent updates, related forms, and instructions on.

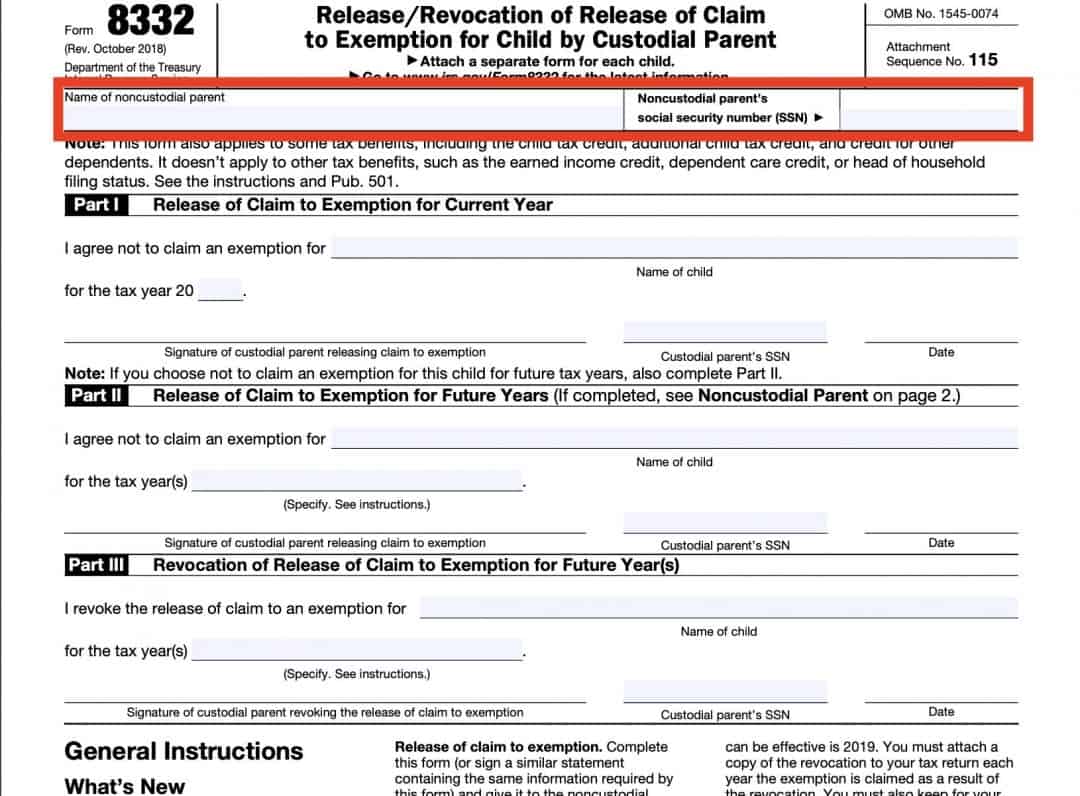

IRS Form 8332 A Guide for Custodial Parents

Explore practical examples and solutions for obtaining late election relief with form 8832, including common scenarios and filing. Wondering what irs form 8832 is and whether it applies to your business? Form 8832 is an irs tax document used by a business to choose how it will be classified for federal tax purposes. Information about form 8832, entity classification election,.

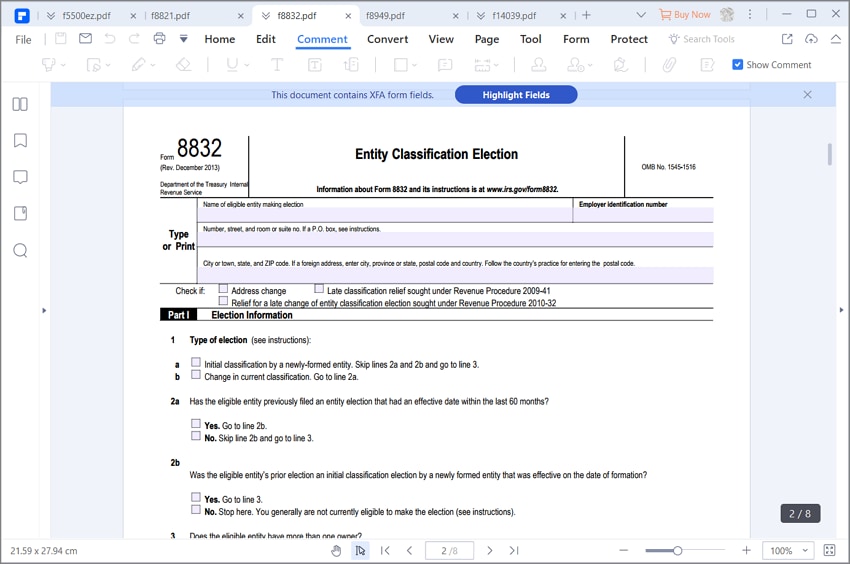

Irs Form 8832 Download Fillable Pdf Or Fill Online Entity Form 1120

This guide explains how us and foreign entities are. Information about form 8832, entity classification election, including recent updates, related forms, and instructions on how to file. Form 8832 is an irs tax document used by a business to choose how it will be classified for federal tax purposes. Explore practical examples and solutions for obtaining late election relief with.

IRS Form 8832 Instructions & FAQs

The form must be filed. Wondering what irs form 8832 is and whether it applies to your business? Businesses can elect to be. Explore practical examples and solutions for obtaining late election relief with form 8832, including common scenarios and filing. Form 8832 is an irs tax document used by a business to choose how it will be classified for.

Form 8832 Fillable and Printable blank PDFline

Businesses can elect to be. This guide explains how us and foreign entities are. The form must be filed. Wondering what irs form 8832 is and whether it applies to your business? Information about form 8832, entity classification election, including recent updates, related forms, and instructions on how to file.

What is Form 8832?

Information about form 8832, entity classification election, including recent updates, related forms, and instructions on how to file. Explore practical examples and solutions for obtaining late election relief with form 8832, including common scenarios and filing. Businesses can elect to be. Form 8832 is an irs tax document used by a business to choose how it will be classified for.

Businesses Can Elect To Be.

This guide explains how us and foreign entities are. Wondering what irs form 8832 is and whether it applies to your business? Information about form 8832, entity classification election, including recent updates, related forms, and instructions on how to file. The form must be filed.

Form 8832 Is An Irs Tax Document Used By A Business To Choose How It Will Be Classified For Federal Tax Purposes.

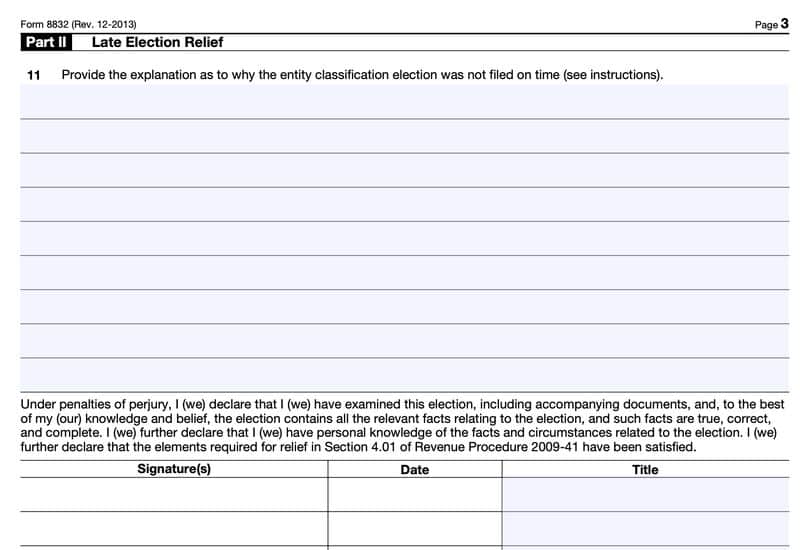

Explore practical examples and solutions for obtaining late election relief with form 8832, including common scenarios and filing.