8843 Form Instructions - Form 8843 is not a u.s. It is an informational statement required by the irs for nonresidents for tax purposes. Government that you are eligible for nonresident alien status for tax purposes and therefore. The purpose of form 8843 is to demonstrate to the u.s. Information about form 8843, statement for exempt individuals and individuals with a medical condition, including recent.

Form 8843 is not a u.s. It is an informational statement required by the irs for nonresidents for tax purposes. Government that you are eligible for nonresident alien status for tax purposes and therefore. The purpose of form 8843 is to demonstrate to the u.s. Information about form 8843, statement for exempt individuals and individuals with a medical condition, including recent.

Government that you are eligible for nonresident alien status for tax purposes and therefore. Form 8843 is not a u.s. It is an informational statement required by the irs for nonresidents for tax purposes. The purpose of form 8843 is to demonstrate to the u.s. Information about form 8843, statement for exempt individuals and individuals with a medical condition, including recent.

Form 8843 정의와 제출 방법은? [2024] Sprintax

Information about form 8843, statement for exempt individuals and individuals with a medical condition, including recent. It is an informational statement required by the irs for nonresidents for tax purposes. The purpose of form 8843 is to demonstrate to the u.s. Government that you are eligible for nonresident alien status for tax purposes and therefore. Form 8843 is not a.

PTIN Renewal 2023 IRS Forms Zrivo

Form 8843 is not a u.s. Information about form 8843, statement for exempt individuals and individuals with a medical condition, including recent. It is an informational statement required by the irs for nonresidents for tax purposes. The purpose of form 8843 is to demonstrate to the u.s. Government that you are eligible for nonresident alien status for tax purposes and.

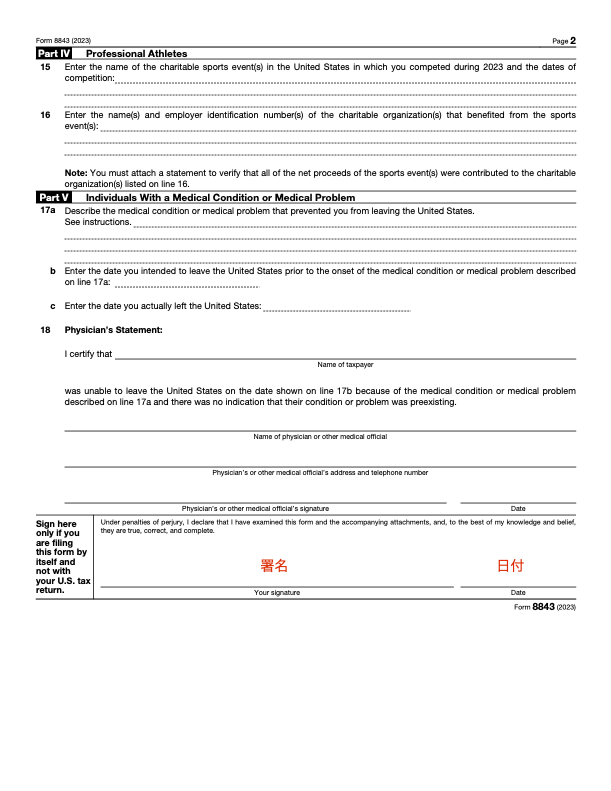

留学生报税如何填写Form8843? 辰星会计

Information about form 8843, statement for exempt individuals and individuals with a medical condition, including recent. Form 8843 is not a u.s. The purpose of form 8843 is to demonstrate to the u.s. It is an informational statement required by the irs for nonresidents for tax purposes. Government that you are eligible for nonresident alien status for tax purposes and.

全員必須!F1学生の確定申告 アメリカ留学のすゝめ

It is an informational statement required by the irs for nonresidents for tax purposes. The purpose of form 8843 is to demonstrate to the u.s. Government that you are eligible for nonresident alien status for tax purposes and therefore. Form 8843 is not a u.s. Information about form 8843, statement for exempt individuals and individuals with a medical condition, including.

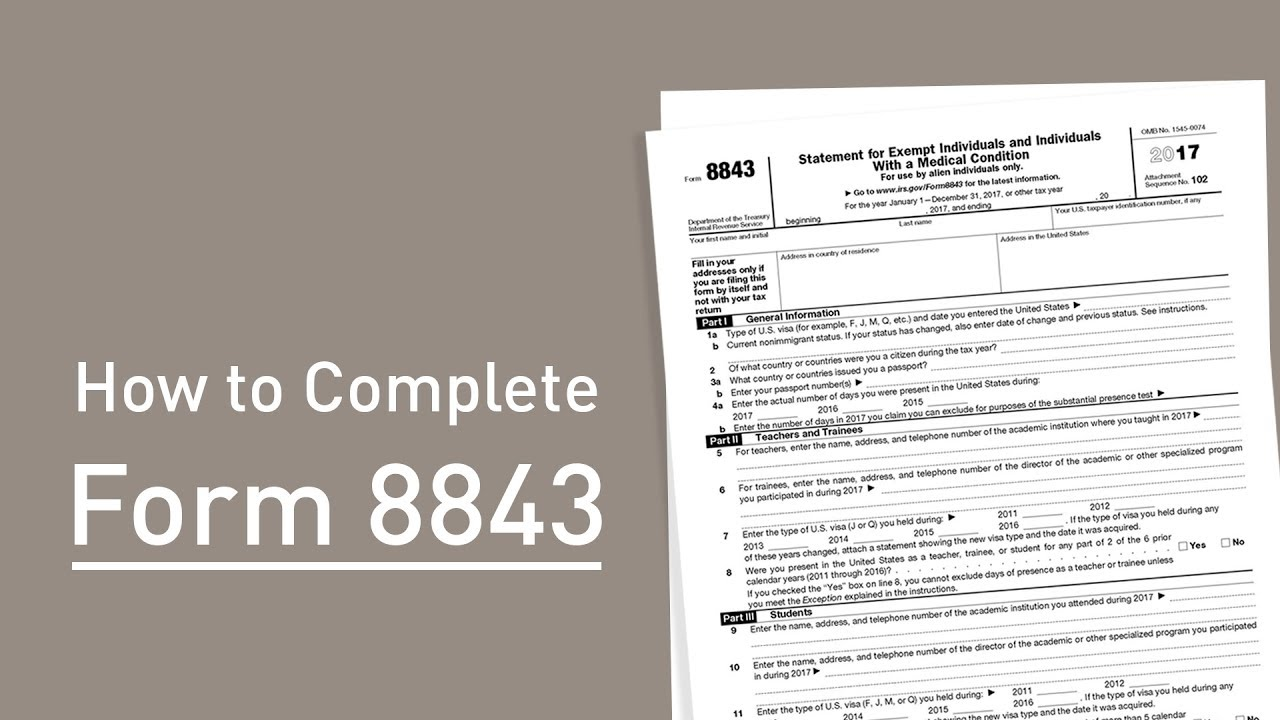

Internal Revenue Service Wage and Investment Stakeholder Partnerships

Form 8843 is not a u.s. The purpose of form 8843 is to demonstrate to the u.s. Government that you are eligible for nonresident alien status for tax purposes and therefore. It is an informational statement required by the irs for nonresidents for tax purposes. Information about form 8843, statement for exempt individuals and individuals with a medical condition, including.

[미국 인턴] 세금 신고(tax return), 8843 form 작성, 우체국 국제특송 네이버 블로그

Form 8843 is not a u.s. Information about form 8843, statement for exempt individuals and individuals with a medical condition, including recent. The purpose of form 8843 is to demonstrate to the u.s. Government that you are eligible for nonresident alien status for tax purposes and therefore. It is an informational statement required by the irs for nonresidents for tax.

SPECIFICATIONS to BE REMOVED BEFORE PRINTING INSTRUCTIONS to PRINTERS

Form 8843 is not a u.s. The purpose of form 8843 is to demonstrate to the u.s. It is an informational statement required by the irs for nonresidents for tax purposes. Information about form 8843, statement for exempt individuals and individuals with a medical condition, including recent. Government that you are eligible for nonresident alien status for tax purposes and.

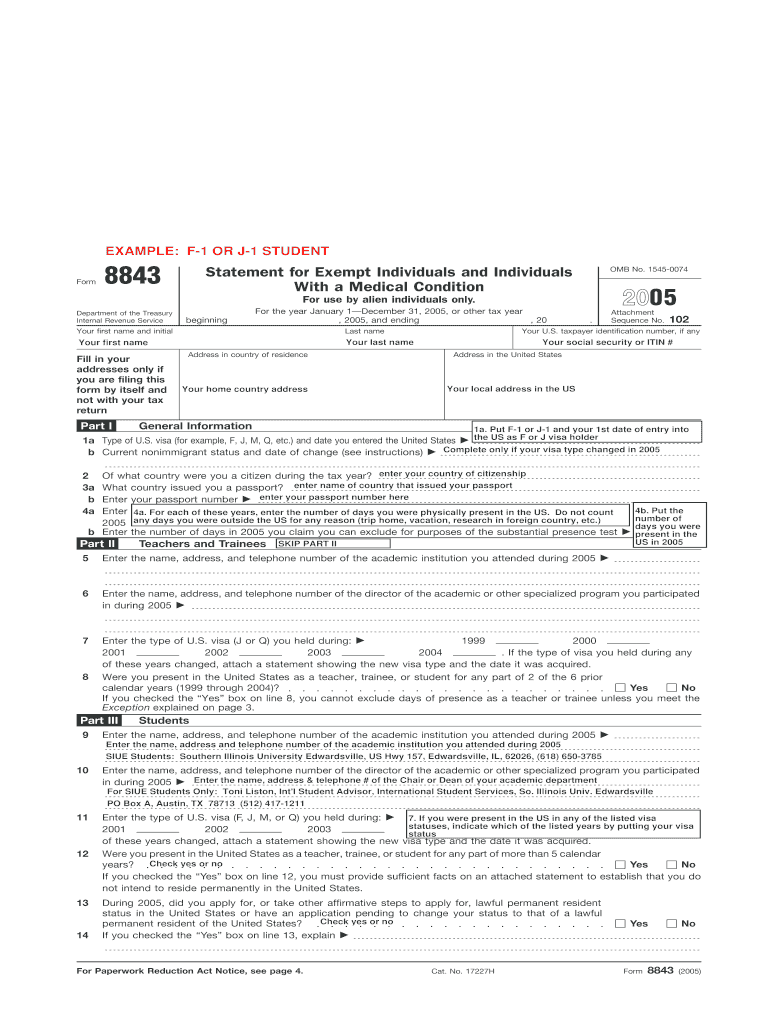

Instructions For Filing Form 8843 Statement For Exempt Individuals

It is an informational statement required by the irs for nonresidents for tax purposes. Form 8843 is not a u.s. Government that you are eligible for nonresident alien status for tax purposes and therefore. The purpose of form 8843 is to demonstrate to the u.s. Information about form 8843, statement for exempt individuals and individuals with a medical condition, including.

Form 8843 Statement for Exempt Individuals and Individuals with a

Government that you are eligible for nonresident alien status for tax purposes and therefore. Form 8843 is not a u.s. Information about form 8843, statement for exempt individuals and individuals with a medical condition, including recent. It is an informational statement required by the irs for nonresidents for tax purposes. The purpose of form 8843 is to demonstrate to the.

Tax Information—International Students ppt download

The purpose of form 8843 is to demonstrate to the u.s. Information about form 8843, statement for exempt individuals and individuals with a medical condition, including recent. It is an informational statement required by the irs for nonresidents for tax purposes. Government that you are eligible for nonresident alien status for tax purposes and therefore. Form 8843 is not a.

The Purpose Of Form 8843 Is To Demonstrate To The U.s.

Information about form 8843, statement for exempt individuals and individuals with a medical condition, including recent. It is an informational statement required by the irs for nonresidents for tax purposes. Government that you are eligible for nonresident alien status for tax purposes and therefore. Form 8843 is not a u.s.

![Form 8843 정의와 제출 방법은? [2024] Sprintax](https://blog.sprintax.com/wp-content/uploads/2023/04/양식-8843의-4부-및-5부.jpg)

+F.jpg)

![[미국 인턴] 세금 신고(tax return), 8843 form 작성, 우체국 국제특송 네이버 블로그](https://blogthumb.pstatic.net/MjAyNDA0MDFfMTg2/MDAxNzExOTc5OTgzOTYz.SAOKyafSswO5vDPMC3ZWz7hOzB-gckipXEk5HXWy4iog.aYkSYhTwRTbXLcL5W-ynvSPpCRugruQZIg2Ce0PDh4Yg.PNG/image.png?type=w2)