Accruals On A Balance Sheet - The accounting and bookkeeping term accruals refers to adjustments that must be made before a company's financial statements are issued You'll learn how it tracks earnings and expenses when they happen, not. For example, you may work one day but not. Accruals reflect money earned or owed that hasn't changed hands yet. Know accrual accounting in a straightforward guide. Accruals refer to revenues earned or expenses incurred which have not yet been recorded through a cash transaction. In financial accounting, accruals refer to the recording of revenues a company has earned but has yet to receive payment for, and expenses that.

The accounting and bookkeeping term accruals refers to adjustments that must be made before a company's financial statements are issued For example, you may work one day but not. Accruals reflect money earned or owed that hasn't changed hands yet. Accruals refer to revenues earned or expenses incurred which have not yet been recorded through a cash transaction. In financial accounting, accruals refer to the recording of revenues a company has earned but has yet to receive payment for, and expenses that. You'll learn how it tracks earnings and expenses when they happen, not. Know accrual accounting in a straightforward guide.

In financial accounting, accruals refer to the recording of revenues a company has earned but has yet to receive payment for, and expenses that. The accounting and bookkeeping term accruals refers to adjustments that must be made before a company's financial statements are issued Accruals reflect money earned or owed that hasn't changed hands yet. Know accrual accounting in a straightforward guide. Accruals refer to revenues earned or expenses incurred which have not yet been recorded through a cash transaction. You'll learn how it tracks earnings and expenses when they happen, not. For example, you may work one day but not.

Accrual Accounting

In financial accounting, accruals refer to the recording of revenues a company has earned but has yet to receive payment for, and expenses that. Accruals refer to revenues earned or expenses incurred which have not yet been recorded through a cash transaction. For example, you may work one day but not. You'll learn how it tracks earnings and expenses when.

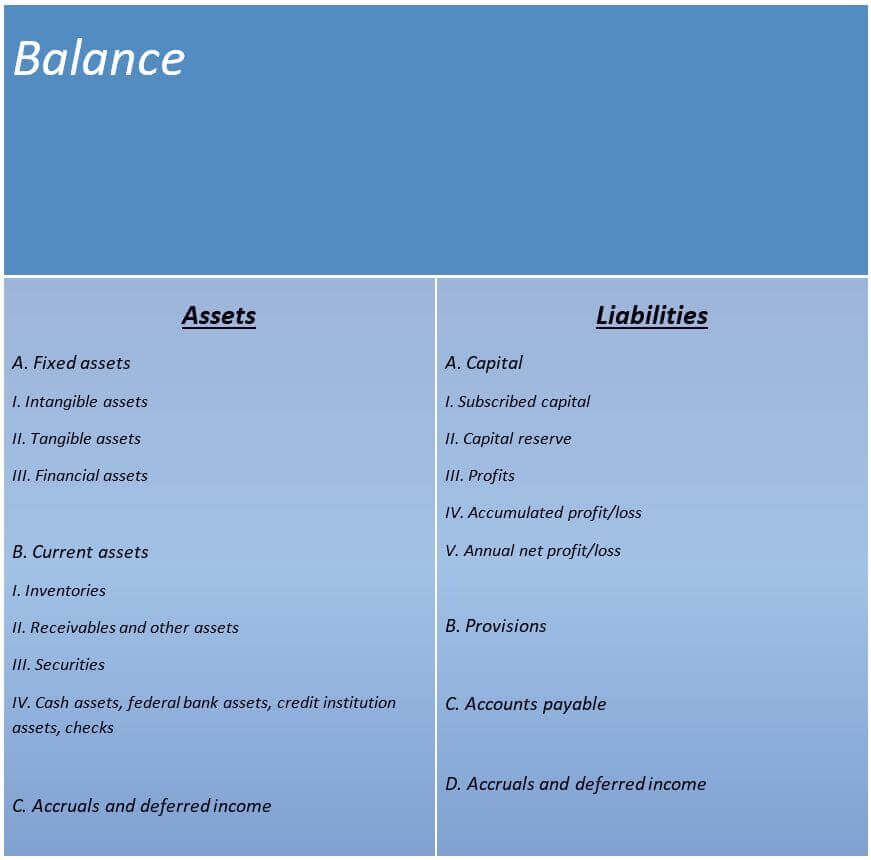

Where accruals appear on the balance sheet — AccountingTools

Accruals refer to revenues earned or expenses incurred which have not yet been recorded through a cash transaction. The accounting and bookkeeping term accruals refers to adjustments that must be made before a company's financial statements are issued Know accrual accounting in a straightforward guide. For example, you may work one day but not. Accruals reflect money earned or owed.

Cash Accounting, Accrual Accounting, and Discounted Cash Flow Analysis

Accruals refer to revenues earned or expenses incurred which have not yet been recorded through a cash transaction. You'll learn how it tracks earnings and expenses when they happen, not. The accounting and bookkeeping term accruals refers to adjustments that must be made before a company's financial statements are issued Accruals reflect money earned or owed that hasn't changed hands.

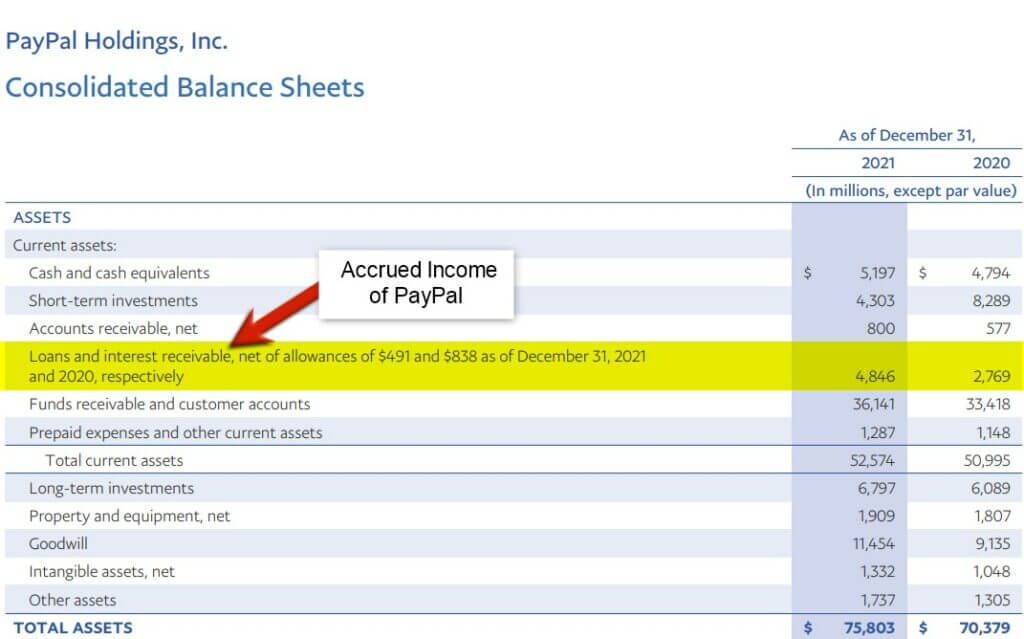

Accrued revenue how to record it in 2023 QuickBooks

In financial accounting, accruals refer to the recording of revenues a company has earned but has yet to receive payment for, and expenses that. The accounting and bookkeeping term accruals refers to adjustments that must be made before a company's financial statements are issued Accruals reflect money earned or owed that hasn't changed hands yet. Know accrual accounting in a.

Accountingplusconsulting Accounting Has Endured Given

Accruals refer to revenues earned or expenses incurred which have not yet been recorded through a cash transaction. Accruals reflect money earned or owed that hasn't changed hands yet. You'll learn how it tracks earnings and expenses when they happen, not. For example, you may work one day but not. The accounting and bookkeeping term accruals refers to adjustments that.

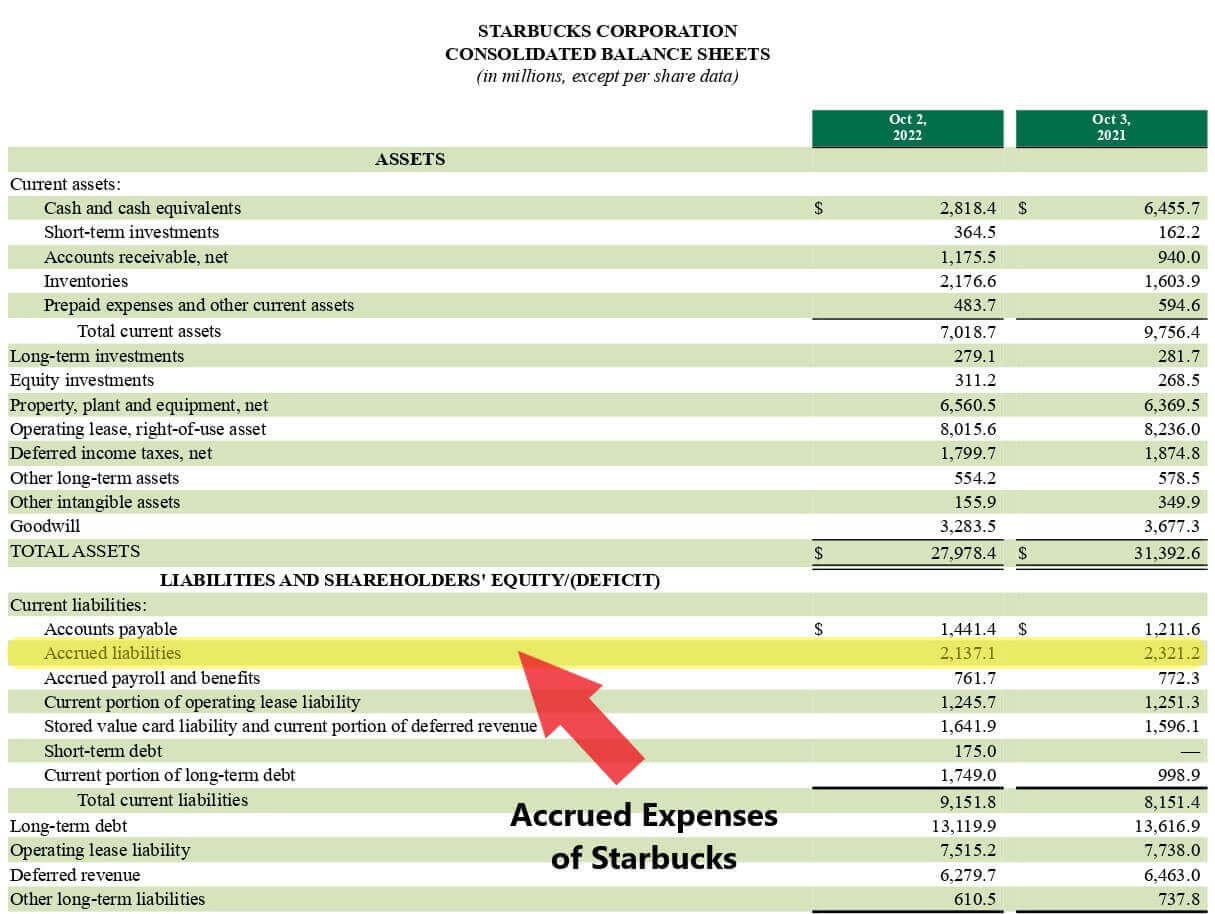

Accrued Expense Examples of Accrued Expenses

In financial accounting, accruals refer to the recording of revenues a company has earned but has yet to receive payment for, and expenses that. You'll learn how it tracks earnings and expenses when they happen, not. For example, you may work one day but not. Accruals refer to revenues earned or expenses incurred which have not yet been recorded through.

What Are Accrued Liabilities? (Examples, What's Included, & Benefits)

Know accrual accounting in a straightforward guide. For example, you may work one day but not. You'll learn how it tracks earnings and expenses when they happen, not. Accruals refer to revenues earned or expenses incurred which have not yet been recorded through a cash transaction. Accruals reflect money earned or owed that hasn't changed hands yet.

Accruals in accounting the facts IONOS CA

Accruals reflect money earned or owed that hasn't changed hands yet. You'll learn how it tracks earnings and expenses when they happen, not. The accounting and bookkeeping term accruals refers to adjustments that must be made before a company's financial statements are issued In financial accounting, accruals refer to the recording of revenues a company has earned but has yet.

What is Accrued Journal Entry, Examples, How it Works?

The accounting and bookkeeping term accruals refers to adjustments that must be made before a company's financial statements are issued Accruals reflect money earned or owed that hasn't changed hands yet. Know accrual accounting in a straightforward guide. For example, you may work one day but not. In financial accounting, accruals refer to the recording of revenues a company has.

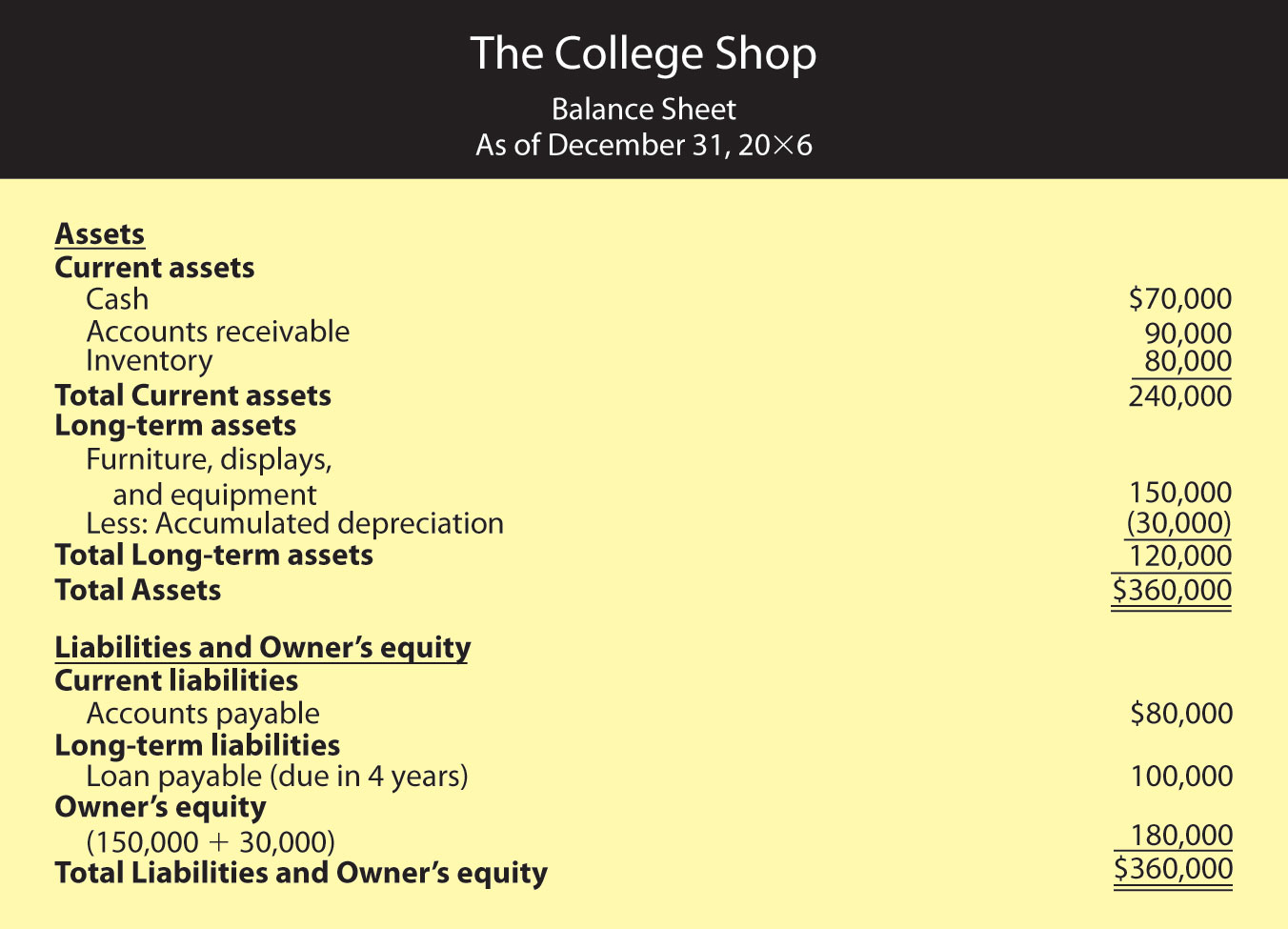

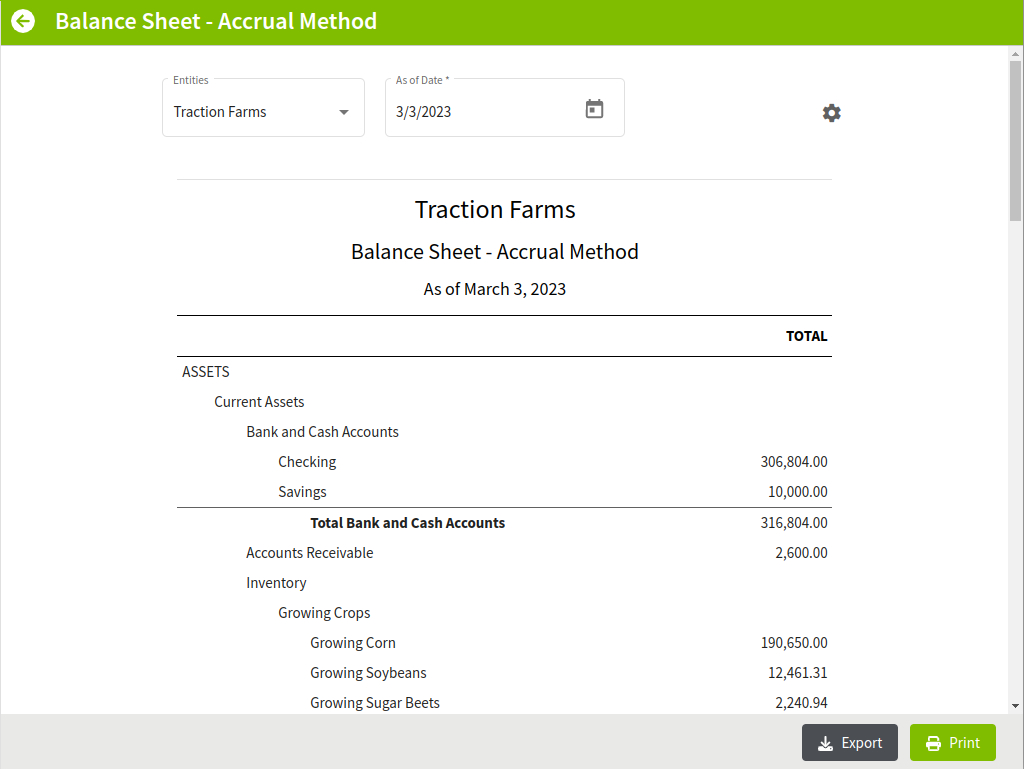

How do I create an Accrual Balance Sheet?

For example, you may work one day but not. Accruals reflect money earned or owed that hasn't changed hands yet. In financial accounting, accruals refer to the recording of revenues a company has earned but has yet to receive payment for, and expenses that. You'll learn how it tracks earnings and expenses when they happen, not. Accruals refer to revenues.

In Financial Accounting, Accruals Refer To The Recording Of Revenues A Company Has Earned But Has Yet To Receive Payment For, And Expenses That.

Accruals reflect money earned or owed that hasn't changed hands yet. You'll learn how it tracks earnings and expenses when they happen, not. Know accrual accounting in a straightforward guide. Accruals refer to revenues earned or expenses incurred which have not yet been recorded through a cash transaction.

The Accounting And Bookkeeping Term Accruals Refers To Adjustments That Must Be Made Before A Company's Financial Statements Are Issued

For example, you may work one day but not.