Calendar Spread Strategy - Calendar spreads are options strategies that require one long and short position at the same strike price with different expiration dates. There are many options strategies available to help reduce the risk of market volatility; A calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias. A calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same. The calendar spread is one method to use during. The calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in.

The calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in. A calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias. Calendar spreads are options strategies that require one long and short position at the same strike price with different expiration dates. A calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same. The calendar spread is one method to use during. There are many options strategies available to help reduce the risk of market volatility;

Calendar spreads are options strategies that require one long and short position at the same strike price with different expiration dates. A calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias. The calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in. There are many options strategies available to help reduce the risk of market volatility; The calendar spread is one method to use during. A calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same.

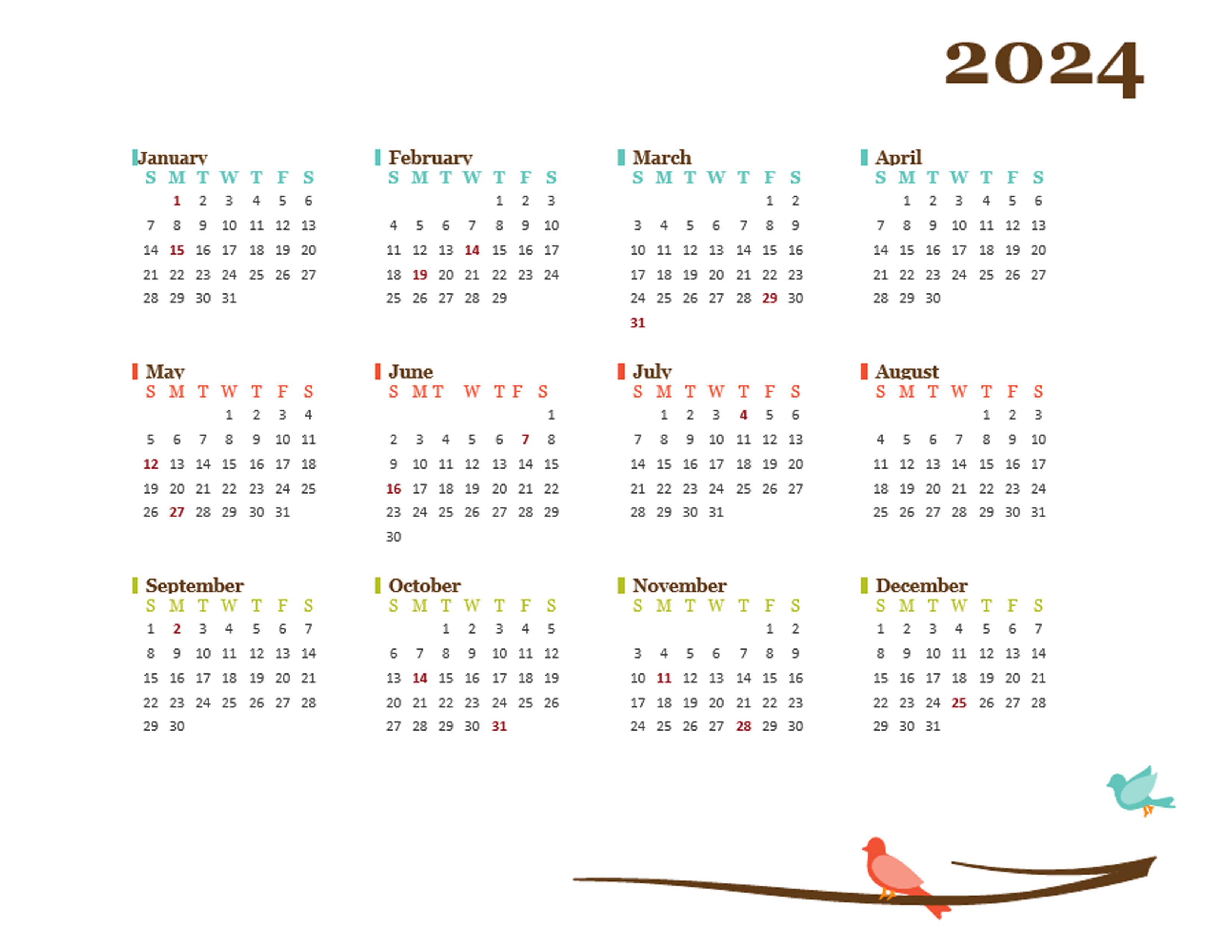

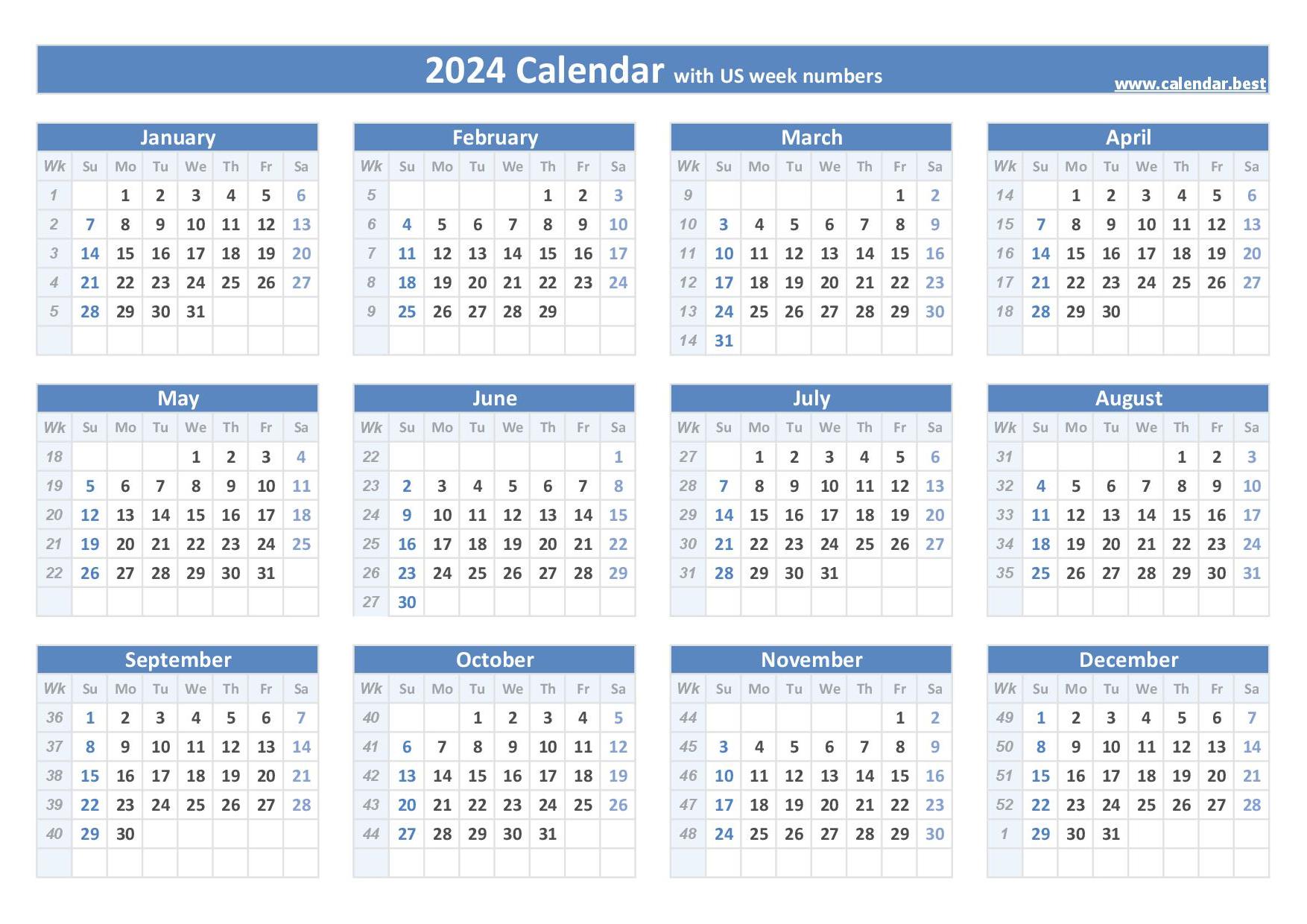

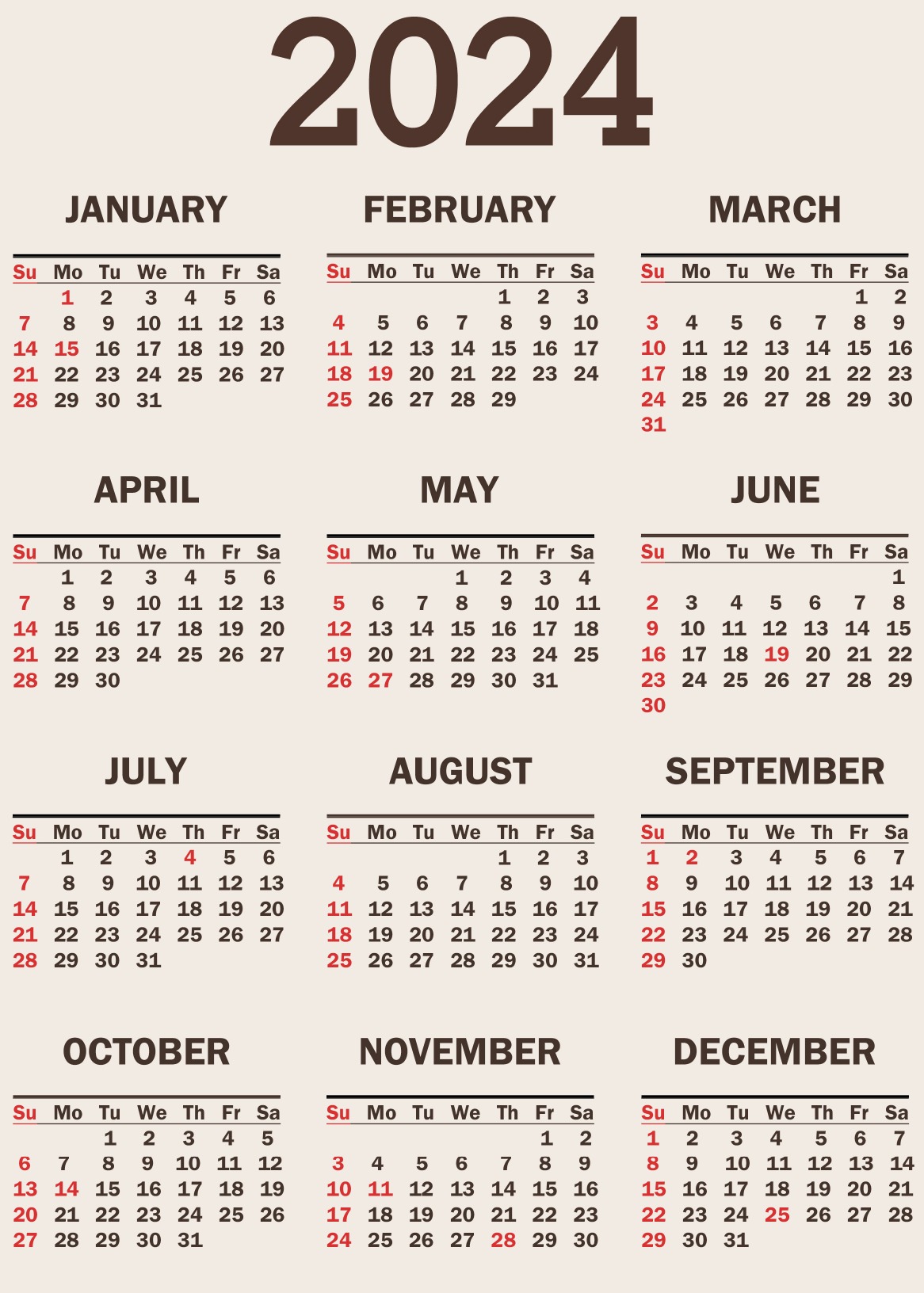

2024 Year Calendar Printable Word Calendar 2024 Year Free Pr

A calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias. There are many options strategies available to help reduce the risk of market volatility; The calendar spread is one method to use during. A calendar spread is an options or futures strategy where an investor simultaneously enters long and.

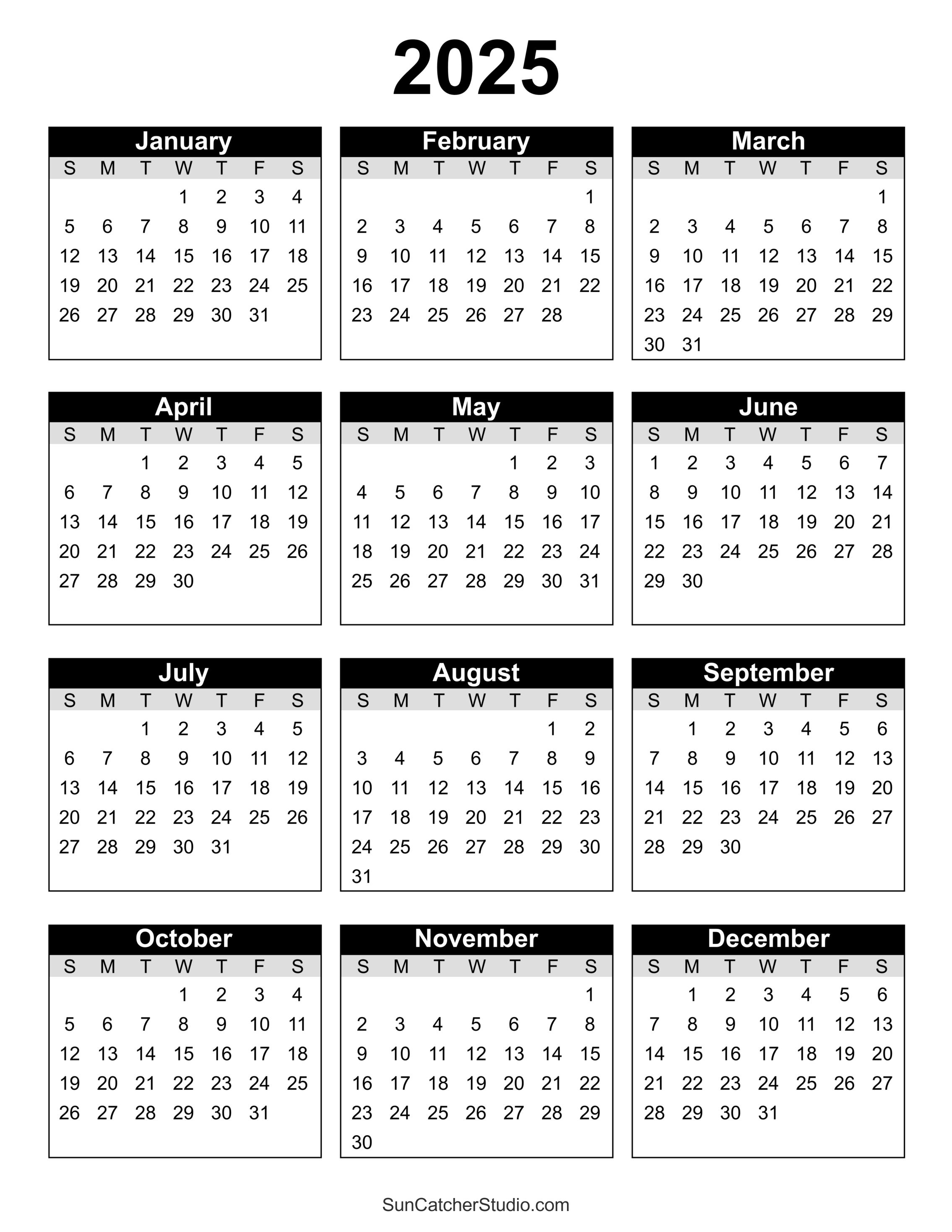

Photo Calendar 2025 Printable Free jeri laurella

There are many options strategies available to help reduce the risk of market volatility; A calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same. The calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in. Calendar spreads are options.

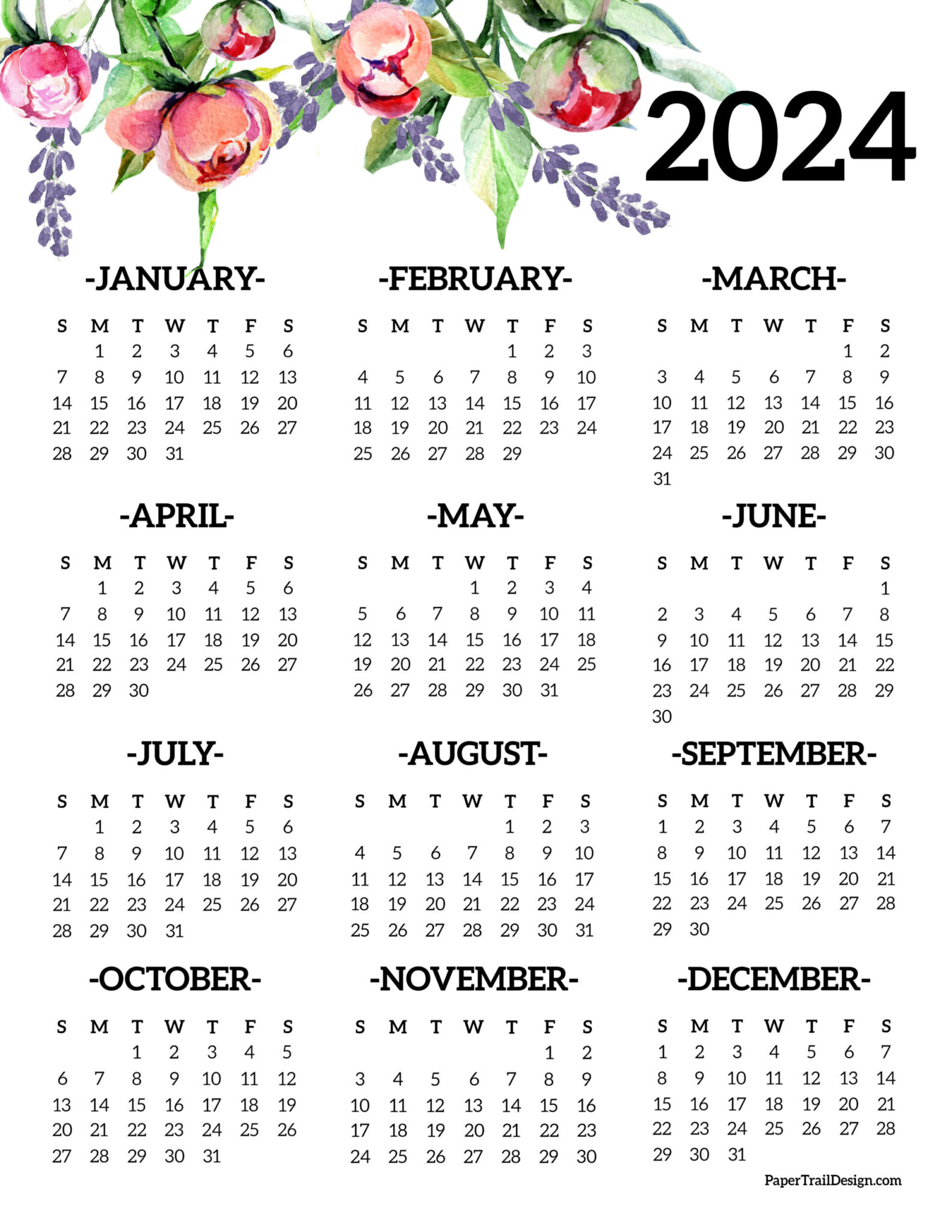

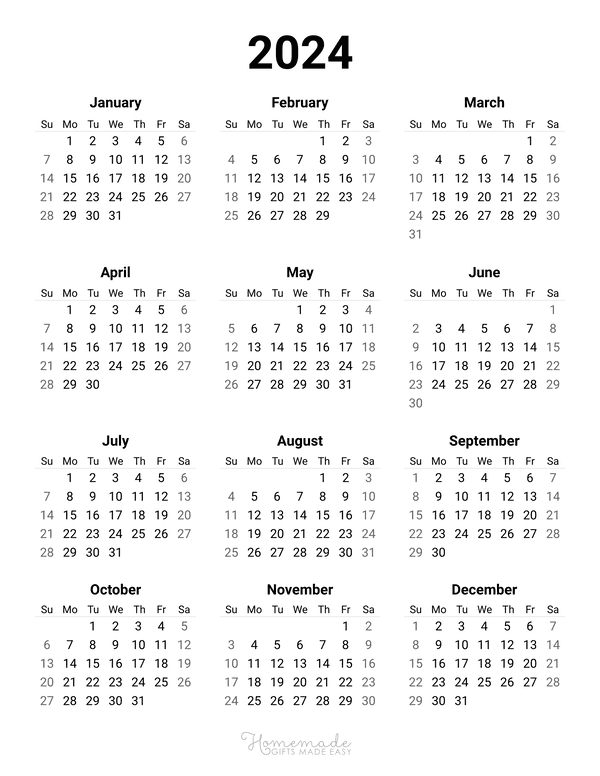

Calendar 2024 Printable One Page Paper Trail Design

Calendar spreads are options strategies that require one long and short position at the same strike price with different expiration dates. The calendar spread is one method to use during. A calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias. There are many options strategies available to help reduce.

Google Calendar Week Of January 28 2024 Noell Sharlene

The calendar spread is one method to use during. A calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias. A calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same. Calendar spreads are options strategies that require one long.

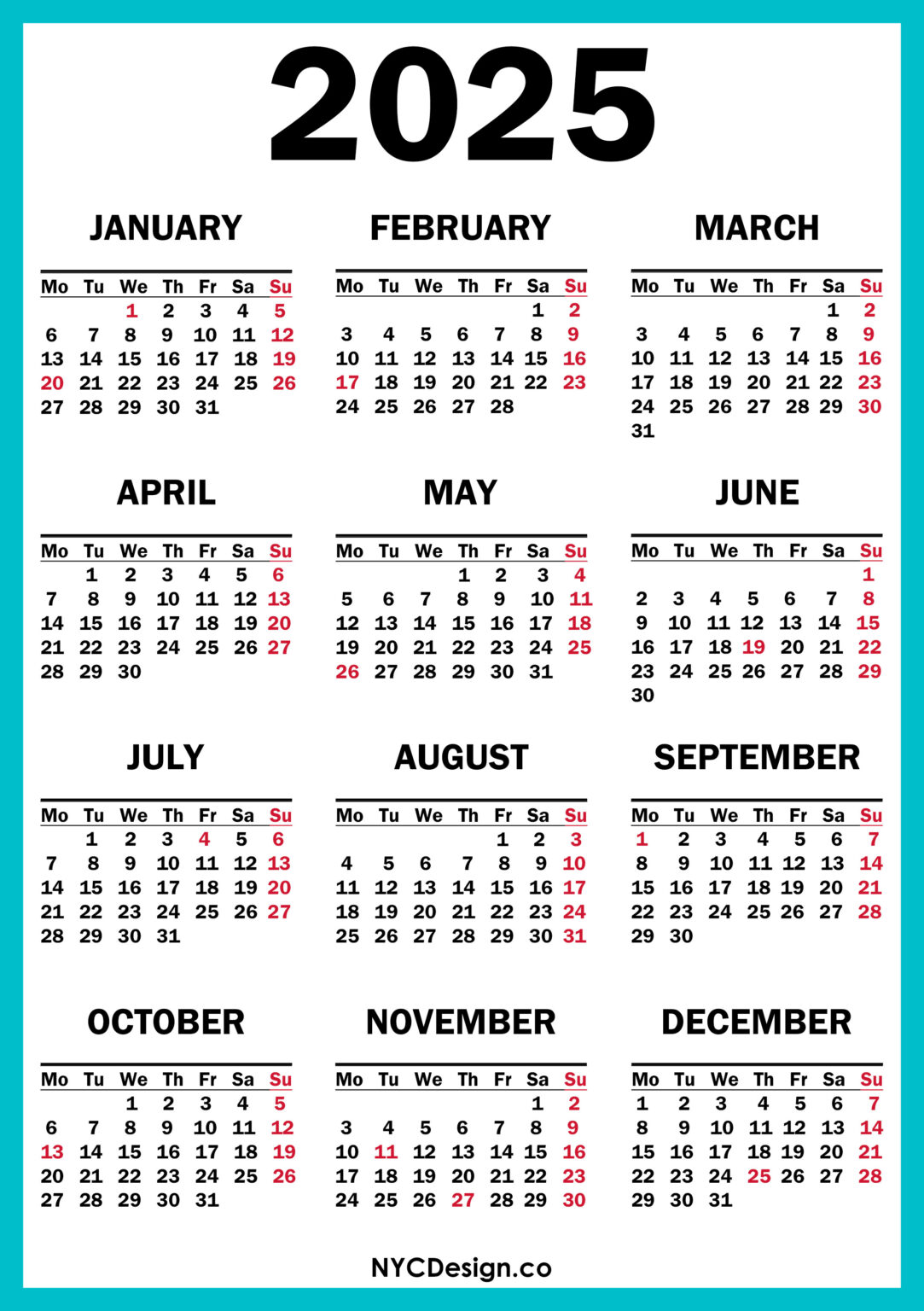

2025 Year Calendar With Holidays Printable Pdf Arly Marcia

A calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias. The calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in. The calendar spread is one method to use during. A calendar spread is an options or futures strategy.

Picture Of Calendar For 2025 Michelle Short

There are many options strategies available to help reduce the risk of market volatility; A calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same. Calendar spreads are options strategies that require one long and short position at the same strike price with different expiration dates. The calendar spread options.

Premium Vector A calendar for the calendar of the year

A calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same. The calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in. A calendar spread allows option traders to take advantage of elevated premium in near term options with a.

Printable Calendar 2024 Printable JD

Calendar spreads are options strategies that require one long and short position at the same strike price with different expiration dates. The calendar spread is one method to use during. There are many options strategies available to help reduce the risk of market volatility; A calendar spread is an options or futures strategy where an investor simultaneously enters long and.

Year At A Glance Calendar 2025 Free Printable Pdf Sophi Elisabet

A calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same. A calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias. There are many options strategies available to help reduce the risk of market volatility; Calendar spreads are options.

Free Printable Calendar For The Year 2025 Ines Riley

A calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias. A calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same. The calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels.

There Are Many Options Strategies Available To Help Reduce The Risk Of Market Volatility;

The calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in. The calendar spread is one method to use during. Calendar spreads are options strategies that require one long and short position at the same strike price with different expiration dates. A calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias.