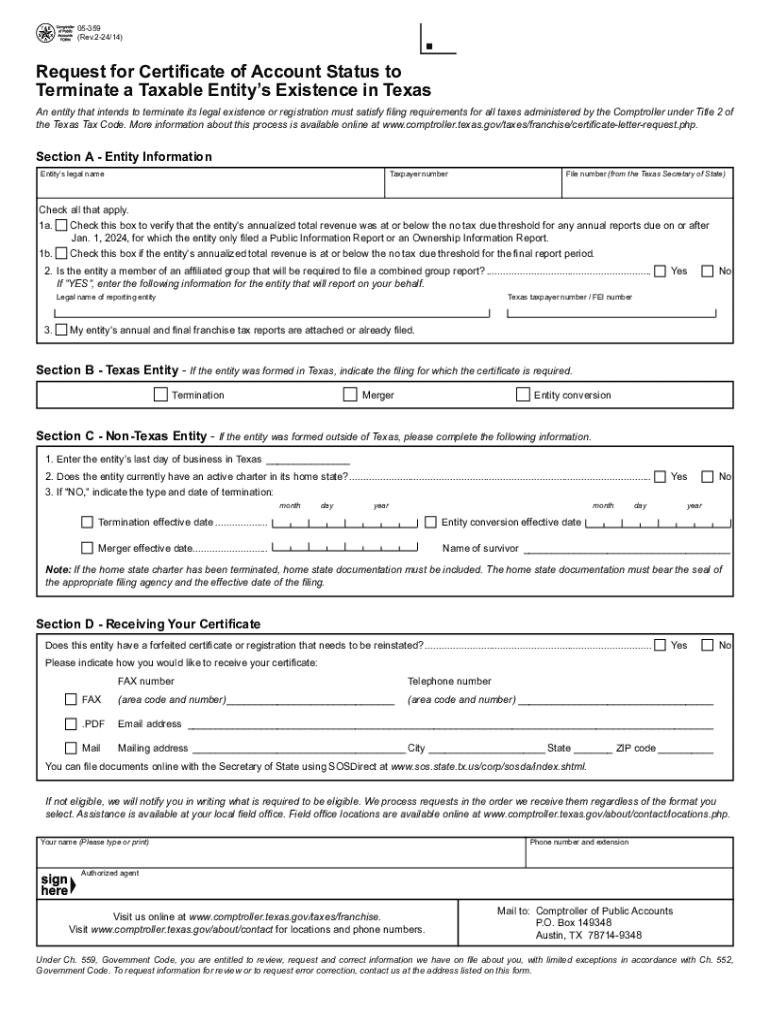

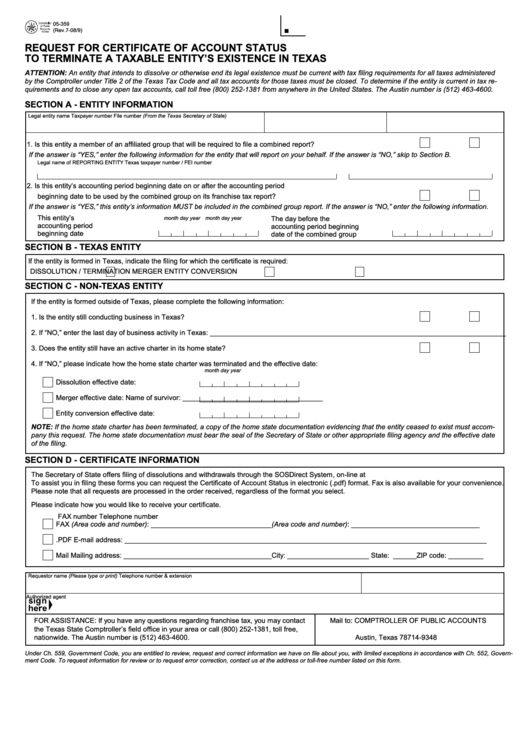

Comptroller Form 05 305 - Otherwise, you can also request a. The document is a texas franchise tax report form that outlines the filing requirements for taxpayers, including sections for reporting revenue, costs of. The report must be accompanied by a tax clearance letter from the texas comptroller of public accounts stating that the entity has satisfied all of its. Taxpayers and tax preparers who have the franchise tax webfile (xt) number or who have previously used webfile for franchise tax and are registered. You can send these forms through mail to the comptroller of texas or you can also send them by email.

The document is a texas franchise tax report form that outlines the filing requirements for taxpayers, including sections for reporting revenue, costs of. You can send these forms through mail to the comptroller of texas or you can also send them by email. The report must be accompanied by a tax clearance letter from the texas comptroller of public accounts stating that the entity has satisfied all of its. Taxpayers and tax preparers who have the franchise tax webfile (xt) number or who have previously used webfile for franchise tax and are registered. Otherwise, you can also request a.

Taxpayers and tax preparers who have the franchise tax webfile (xt) number or who have previously used webfile for franchise tax and are registered. The report must be accompanied by a tax clearance letter from the texas comptroller of public accounts stating that the entity has satisfied all of its. Otherwise, you can also request a. You can send these forms through mail to the comptroller of texas or you can also send them by email. The document is a texas franchise tax report form that outlines the filing requirements for taxpayers, including sections for reporting revenue, costs of.

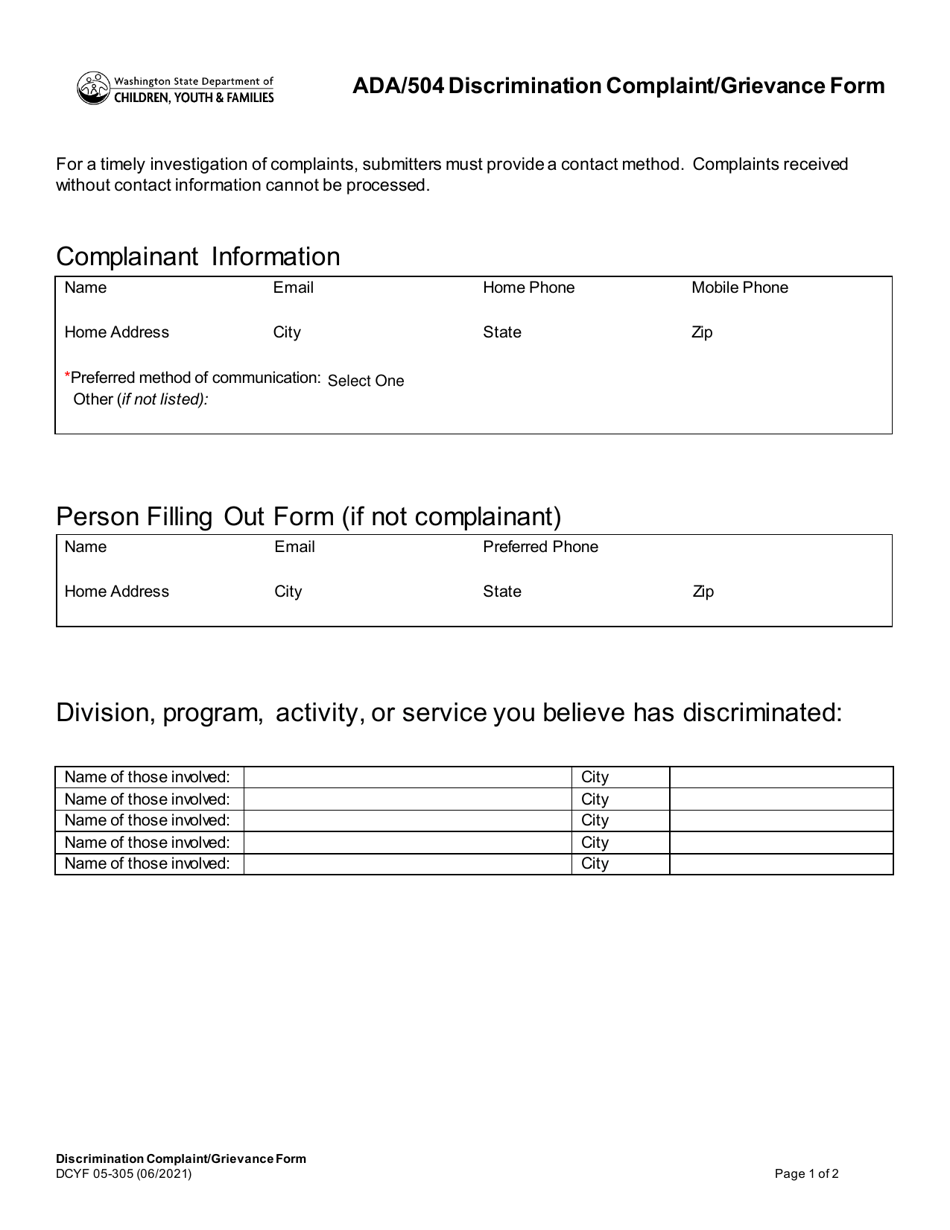

DCYF Form 05305 Fill Out, Sign Online and Download Fillable PDF

The report must be accompanied by a tax clearance letter from the texas comptroller of public accounts stating that the entity has satisfied all of its. Taxpayers and tax preparers who have the franchise tax webfile (xt) number or who have previously used webfile for franchise tax and are registered. The document is a texas franchise tax report form that.

Form 05 305 Complete with ease airSlate SignNow

The document is a texas franchise tax report form that outlines the filing requirements for taxpayers, including sections for reporting revenue, costs of. Taxpayers and tax preparers who have the franchise tax webfile (xt) number or who have previously used webfile for franchise tax and are registered. Otherwise, you can also request a. The report must be accompanied by a.

FORM 05102 PDF

Taxpayers and tax preparers who have the franchise tax webfile (xt) number or who have previously used webfile for franchise tax and are registered. You can send these forms through mail to the comptroller of texas or you can also send them by email. Otherwise, you can also request a. The report must be accompanied by a tax clearance letter.

Form 05 305 certificate of account status to terminate texas

You can send these forms through mail to the comptroller of texas or you can also send them by email. Taxpayers and tax preparers who have the franchise tax webfile (xt) number or who have previously used webfile for franchise tax and are registered. The report must be accompanied by a tax clearance letter from the texas comptroller of public.

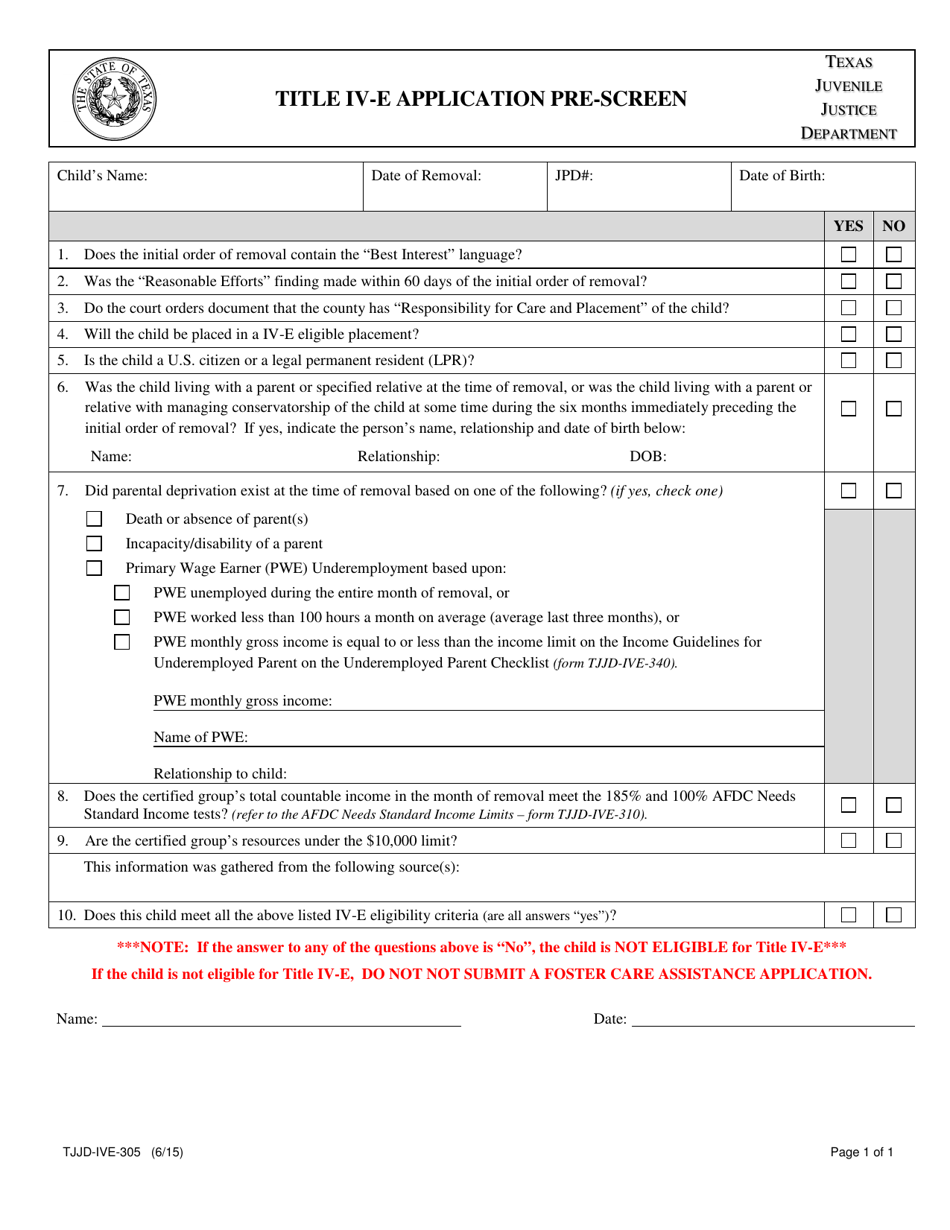

Form TJJDIVE305 Fill Out, Sign Online and Download Fillable PDF

You can send these forms through mail to the comptroller of texas or you can also send them by email. The report must be accompanied by a tax clearance letter from the texas comptroller of public accounts stating that the entity has satisfied all of its. Taxpayers and tax preparers who have the franchise tax webfile (xt) number or who.

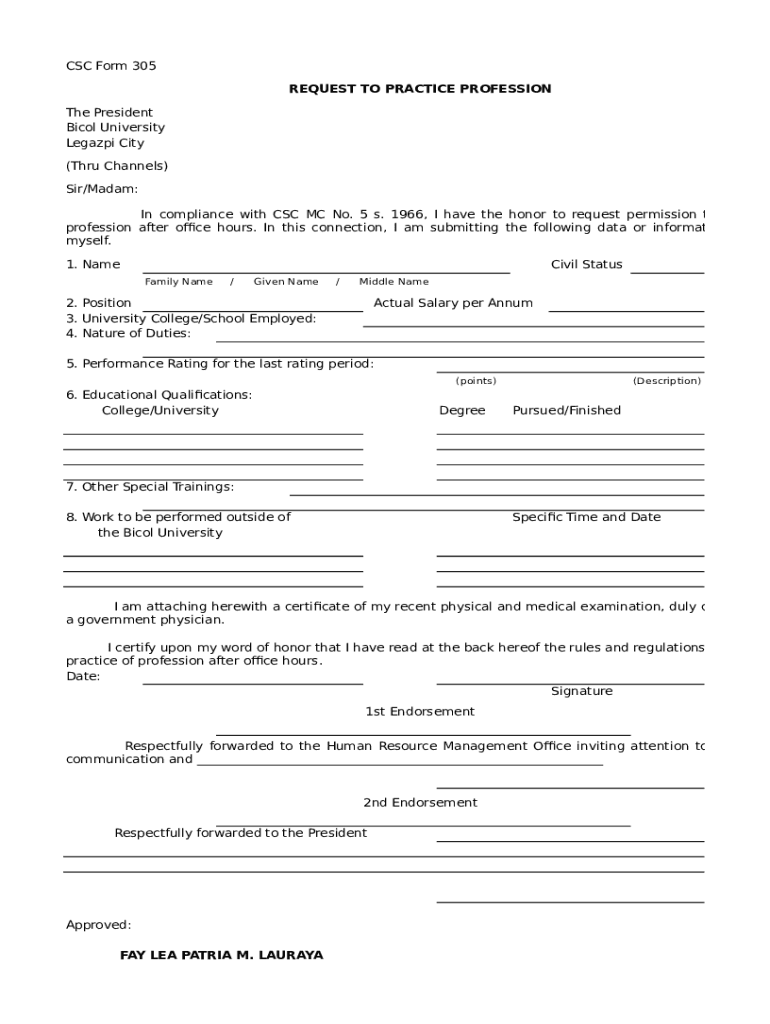

Csc Form 305 Complete with ease airSlate SignNow

Taxpayers and tax preparers who have the franchise tax webfile (xt) number or who have previously used webfile for franchise tax and are registered. You can send these forms through mail to the comptroller of texas or you can also send them by email. Otherwise, you can also request a. The report must be accompanied by a tax clearance letter.

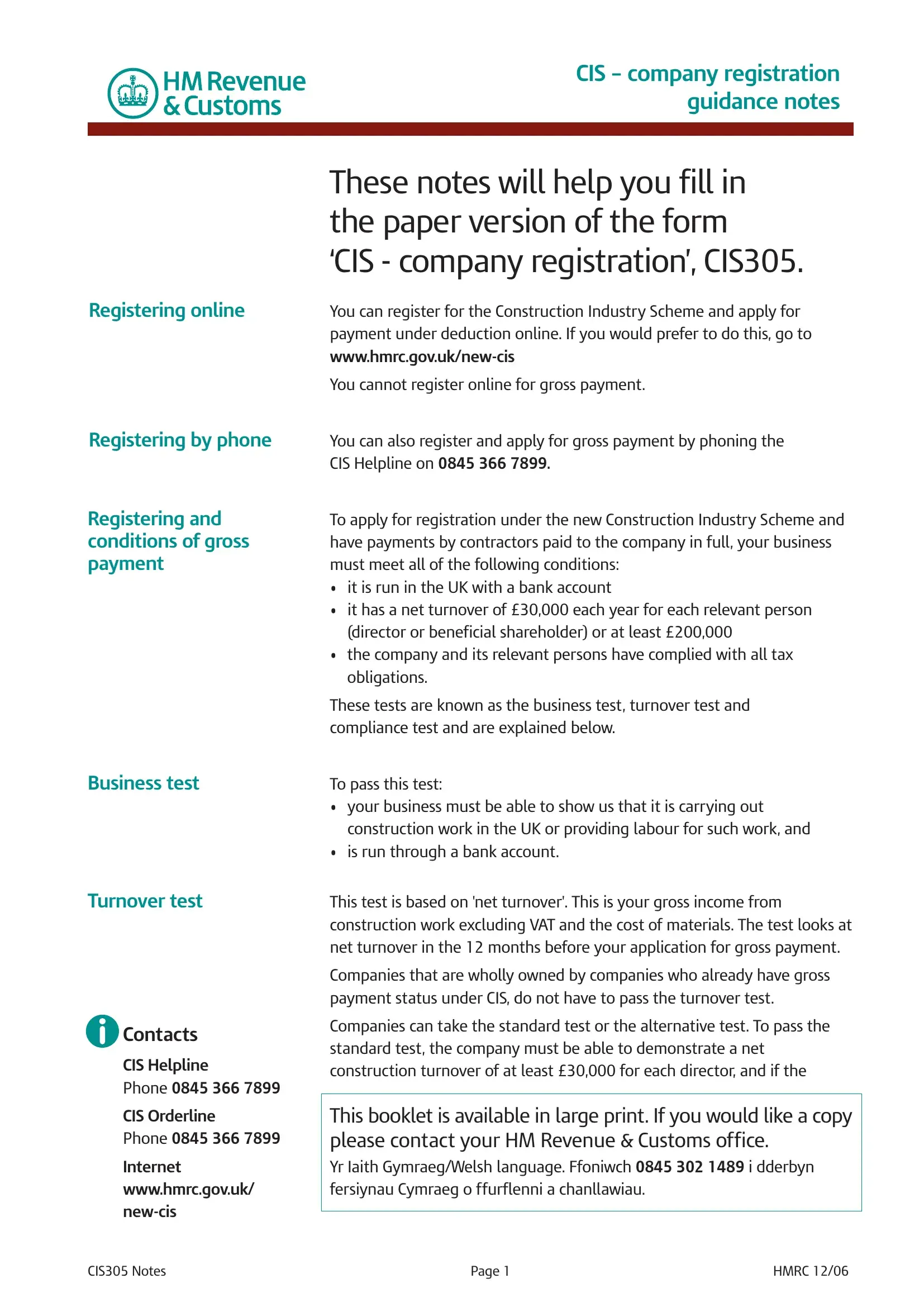

Form Cis305 ≡ Fill Out Printable PDF Forms Online

Otherwise, you can also request a. Taxpayers and tax preparers who have the franchise tax webfile (xt) number or who have previously used webfile for franchise tax and are registered. The document is a texas franchise tax report form that outlines the filing requirements for taxpayers, including sections for reporting revenue, costs of. You can send these forms through mail.

05 163 form 2023 Fill out & sign online DocHub

You can send these forms through mail to the comptroller of texas or you can also send them by email. Otherwise, you can also request a. The report must be accompanied by a tax clearance letter from the texas comptroller of public accounts stating that the entity has satisfied all of its. Taxpayers and tax preparers who have the franchise.

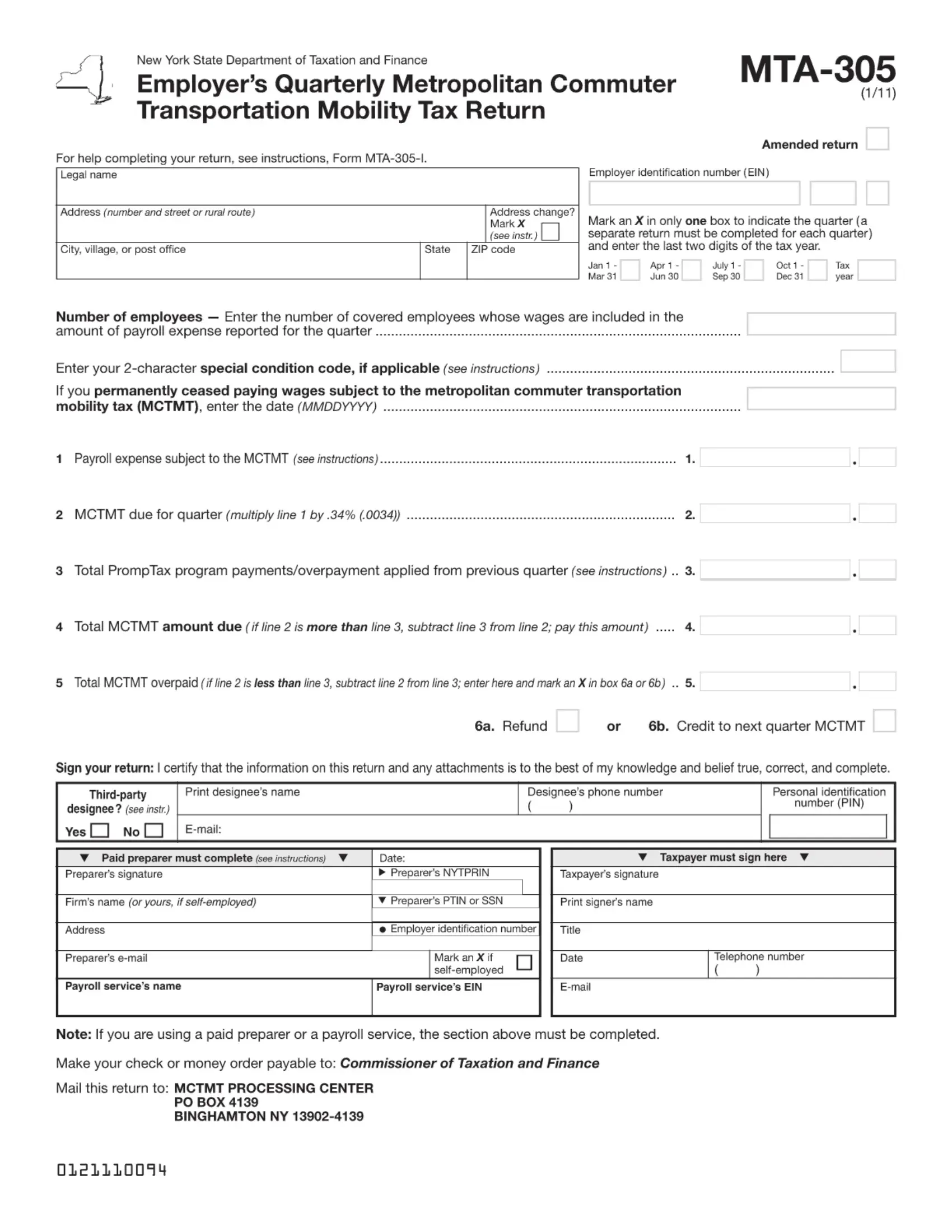

Form Mta 305 ≡ Fill Out Printable PDF Forms Online

Taxpayers and tax preparers who have the franchise tax webfile (xt) number or who have previously used webfile for franchise tax and are registered. The document is a texas franchise tax report form that outlines the filing requirements for taxpayers, including sections for reporting revenue, costs of. You can send these forms through mail to the comptroller of texas or.

Top Texas Form 05359 Templates free to download in PDF format

You can send these forms through mail to the comptroller of texas or you can also send them by email. The report must be accompanied by a tax clearance letter from the texas comptroller of public accounts stating that the entity has satisfied all of its. Otherwise, you can also request a. The document is a texas franchise tax report.

The Document Is A Texas Franchise Tax Report Form That Outlines The Filing Requirements For Taxpayers, Including Sections For Reporting Revenue, Costs Of.

Taxpayers and tax preparers who have the franchise tax webfile (xt) number or who have previously used webfile for franchise tax and are registered. You can send these forms through mail to the comptroller of texas or you can also send them by email. Otherwise, you can also request a. The report must be accompanied by a tax clearance letter from the texas comptroller of public accounts stating that the entity has satisfied all of its.