Debits And Credits In Accounting Cheat Sheet - In accounting, a “debit” refers to an entry made on the left side of an account. Debits are the opposite of credits in an accounting system. Debits and credits are used to record business transactions, which have a monetary impact on the financial statements of an. Learn the difference between credits and debits in accounting while getting your hands on a useful cheat sheet to help you along. Assets and expenses have natural debit balances, while liabilities and.

In accounting, a “debit” refers to an entry made on the left side of an account. Learn the difference between credits and debits in accounting while getting your hands on a useful cheat sheet to help you along. Debits and credits are used to record business transactions, which have a monetary impact on the financial statements of an. Assets and expenses have natural debit balances, while liabilities and. Debits are the opposite of credits in an accounting system.

Assets and expenses have natural debit balances, while liabilities and. Debits are the opposite of credits in an accounting system. Debits and credits are used to record business transactions, which have a monetary impact on the financial statements of an. Learn the difference between credits and debits in accounting while getting your hands on a useful cheat sheet to help you along. In accounting, a “debit” refers to an entry made on the left side of an account.

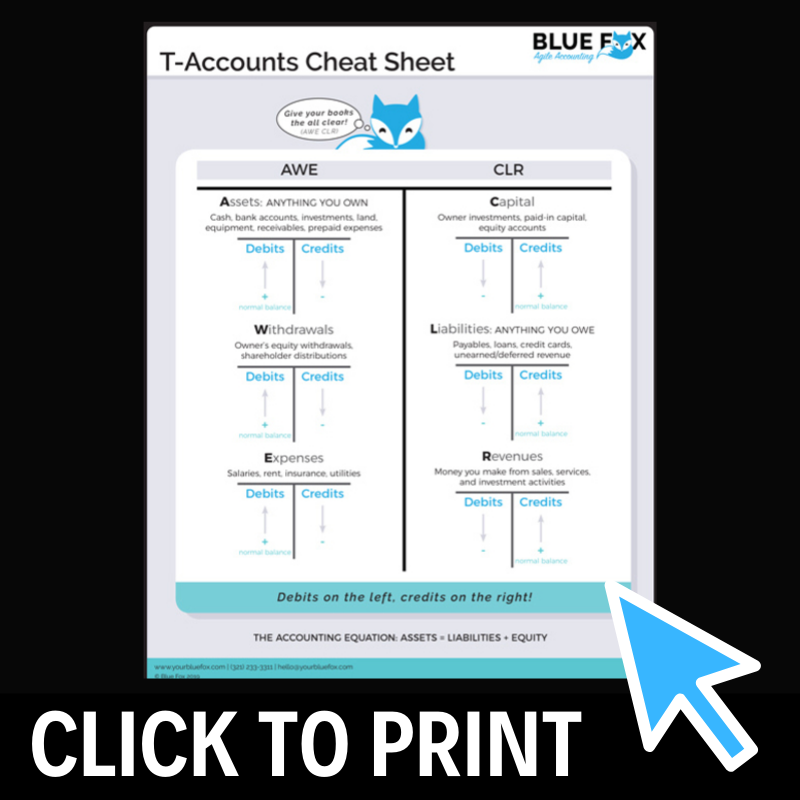

Printable Debits And Credits Cheat Sheet

Debits and credits are used to record business transactions, which have a monetary impact on the financial statements of an. Debits are the opposite of credits in an accounting system. In accounting, a “debit” refers to an entry made on the left side of an account. Learn the difference between credits and debits in accounting while getting your hands on.

Debits vs Credits Cheat Sheet Accounting basics, Accounting lessons

Assets and expenses have natural debit balances, while liabilities and. Learn the difference between credits and debits in accounting while getting your hands on a useful cheat sheet to help you along. Debits and credits are used to record business transactions, which have a monetary impact on the financial statements of an. In accounting, a “debit” refers to an entry.

Printable Debits And Credits Cheat Sheet Printable New Year Banners

In accounting, a “debit” refers to an entry made on the left side of an account. Debits are the opposite of credits in an accounting system. Assets and expenses have natural debit balances, while liabilities and. Debits and credits are used to record business transactions, which have a monetary impact on the financial statements of an. Learn the difference between.

Debits And Credits Cheat Sheet Accounting basics, Learn accounting

Debits and credits are used to record business transactions, which have a monetary impact on the financial statements of an. Learn the difference between credits and debits in accounting while getting your hands on a useful cheat sheet to help you along. Debits are the opposite of credits in an accounting system. Assets and expenses have natural debit balances, while.

Accounting debit credit cheat sheet ladegcrm

Assets and expenses have natural debit balances, while liabilities and. Debits are the opposite of credits in an accounting system. Learn the difference between credits and debits in accounting while getting your hands on a useful cheat sheet to help you along. Debits and credits are used to record business transactions, which have a monetary impact on the financial statements.

Printable Debits And Credits Cheat Sheet Printable Budget Sheets

Debits and credits are used to record business transactions, which have a monetary impact on the financial statements of an. Assets and expenses have natural debit balances, while liabilities and. In accounting, a “debit” refers to an entry made on the left side of an account. Learn the difference between credits and debits in accounting while getting your hands on.

Printable Debits And Credits Cheat Sheet

Debits are the opposite of credits in an accounting system. Learn the difference between credits and debits in accounting while getting your hands on a useful cheat sheet to help you along. Assets and expenses have natural debit balances, while liabilities and. Debits and credits are used to record business transactions, which have a monetary impact on the financial statements.

Free Download Debits and Credits Worksheet Accounting basics, Debit

Debits and credits are used to record business transactions, which have a monetary impact on the financial statements of an. In accounting, a “debit” refers to an entry made on the left side of an account. Learn the difference between credits and debits in accounting while getting your hands on a useful cheat sheet to help you along. Debits are.

Debits and credits cheat sheet used in bookkeeping doubleentry

Learn the difference between credits and debits in accounting while getting your hands on a useful cheat sheet to help you along. Debits are the opposite of credits in an accounting system. Debits and credits are used to record business transactions, which have a monetary impact on the financial statements of an. Assets and expenses have natural debit balances, while.

Printable Debits And Credits Cheat Sheet

Debits and credits are used to record business transactions, which have a monetary impact on the financial statements of an. In accounting, a “debit” refers to an entry made on the left side of an account. Assets and expenses have natural debit balances, while liabilities and. Debits are the opposite of credits in an accounting system. Learn the difference between.

Assets And Expenses Have Natural Debit Balances, While Liabilities And.

In accounting, a “debit” refers to an entry made on the left side of an account. Debits are the opposite of credits in an accounting system. Learn the difference between credits and debits in accounting while getting your hands on a useful cheat sheet to help you along. Debits and credits are used to record business transactions, which have a monetary impact on the financial statements of an.