Declining Inheritance Letter Template - When you receive an inheritance via a will, such as a house or cash, or as a beneficiary of an ira or 401 (k), or an estate, you can say thanks but no thanks. Description the template letter for inheritance for decline is a legal document that allows an individual to renounce their right to inherit from a deceased. Learn how to refuse an inheritance with a qualified disclaimer. The undersigned acknowledges that the executors of the estate will rely on this renunciation of inheritance in distributing the property and assets. Understand the steps, deadlines, tax effects, and reasons to say no to an.

Understand the steps, deadlines, tax effects, and reasons to say no to an. Learn how to refuse an inheritance with a qualified disclaimer. Description the template letter for inheritance for decline is a legal document that allows an individual to renounce their right to inherit from a deceased. When you receive an inheritance via a will, such as a house or cash, or as a beneficiary of an ira or 401 (k), or an estate, you can say thanks but no thanks. The undersigned acknowledges that the executors of the estate will rely on this renunciation of inheritance in distributing the property and assets.

Understand the steps, deadlines, tax effects, and reasons to say no to an. When you receive an inheritance via a will, such as a house or cash, or as a beneficiary of an ira or 401 (k), or an estate, you can say thanks but no thanks. Description the template letter for inheritance for decline is a legal document that allows an individual to renounce their right to inherit from a deceased. The undersigned acknowledges that the executors of the estate will rely on this renunciation of inheritance in distributing the property and assets. Learn how to refuse an inheritance with a qualified disclaimer.

Renunciation Of Inheritance Legal forms, Free printable letters

The undersigned acknowledges that the executors of the estate will rely on this renunciation of inheritance in distributing the property and assets. Learn how to refuse an inheritance with a qualified disclaimer. Understand the steps, deadlines, tax effects, and reasons to say no to an. When you receive an inheritance via a will, such as a house or cash, or.

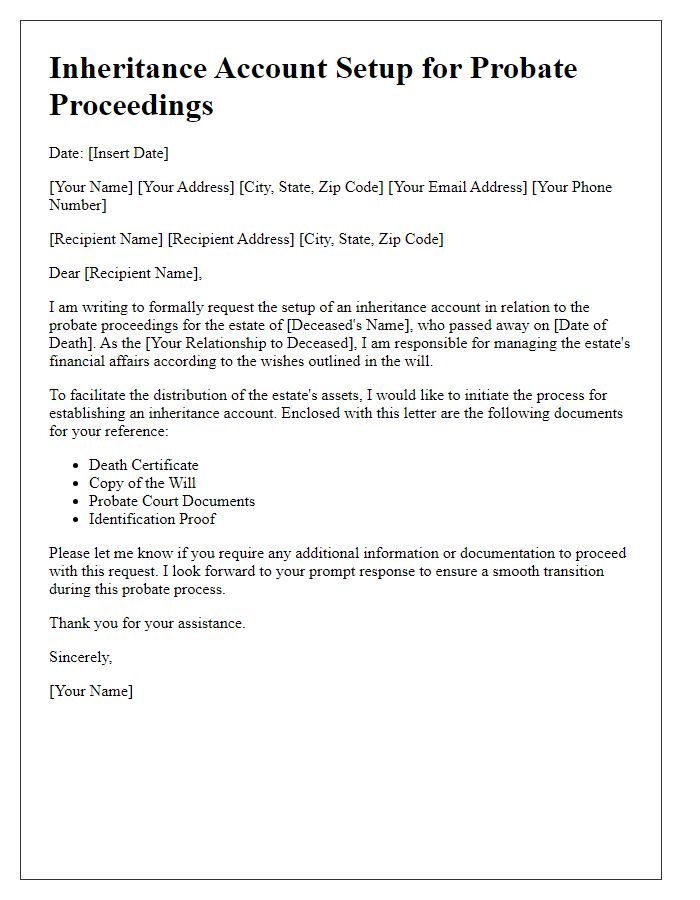

Letter Template For Inheritance Account Setup Free Samples in PDF

When you receive an inheritance via a will, such as a house or cash, or as a beneficiary of an ira or 401 (k), or an estate, you can say thanks but no thanks. Understand the steps, deadlines, tax effects, and reasons to say no to an. Description the template letter for inheritance for decline is a legal document that.

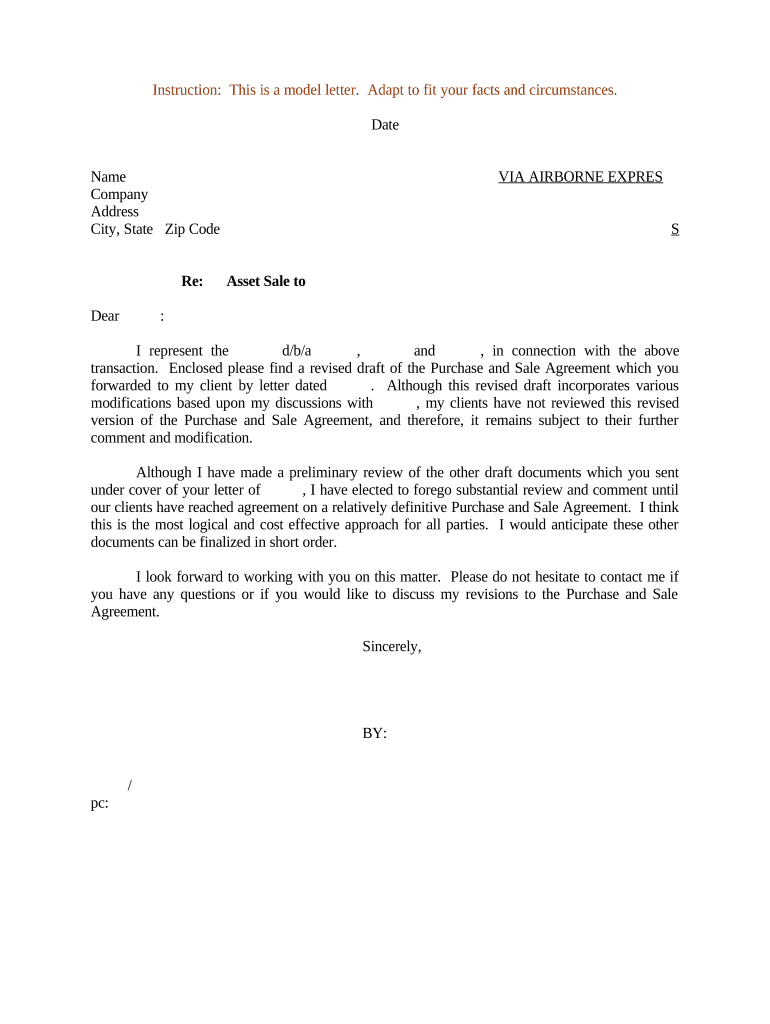

Letter of Inheritance Sample PDF Complete with ease airSlate SignNow

Understand the steps, deadlines, tax effects, and reasons to say no to an. Learn how to refuse an inheritance with a qualified disclaimer. The undersigned acknowledges that the executors of the estate will rely on this renunciation of inheritance in distributing the property and assets. When you receive an inheritance via a will, such as a house or cash, or.

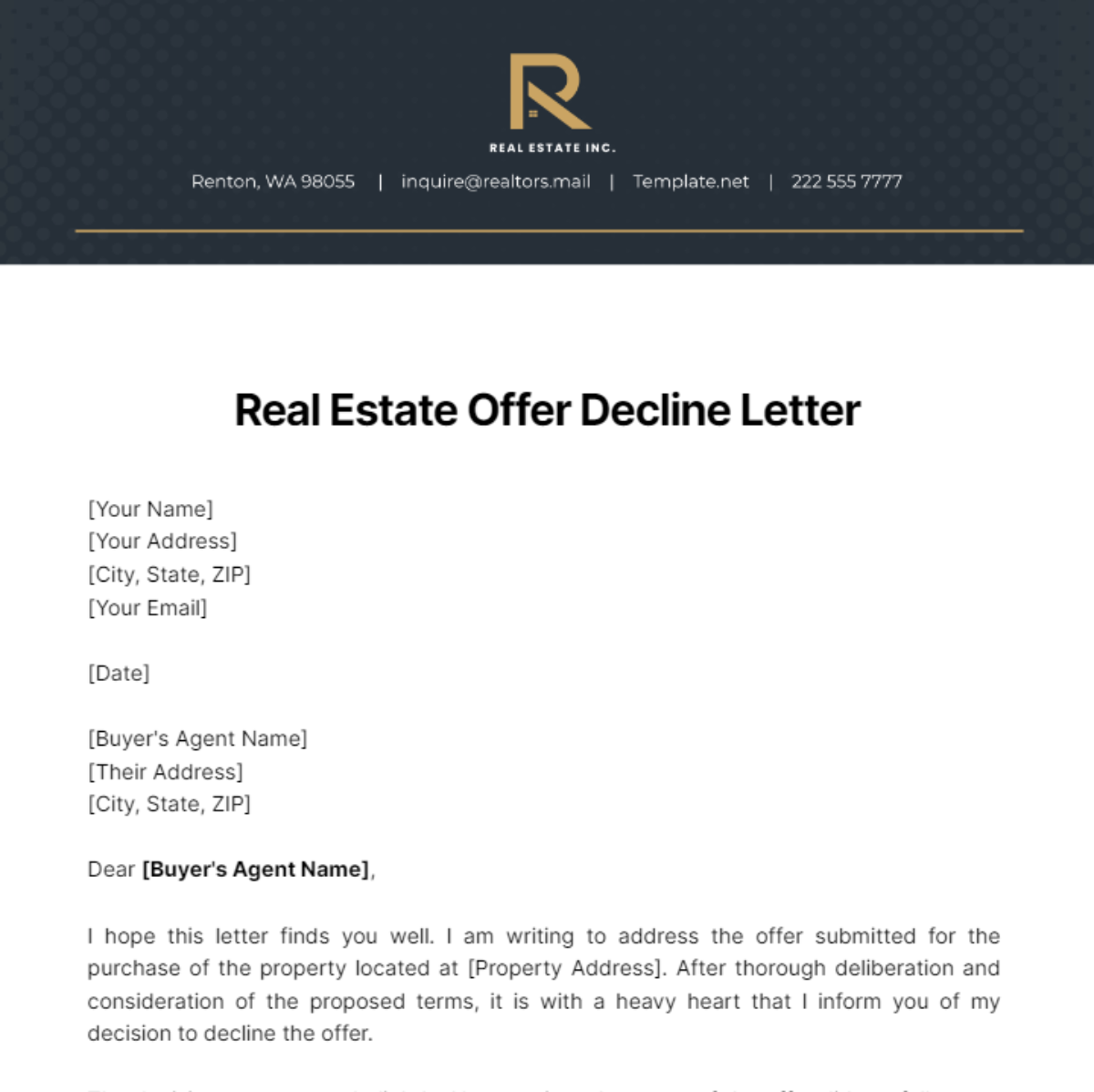

Free Real Estate Offer Decline Letter Template to Edit Online

Understand the steps, deadlines, tax effects, and reasons to say no to an. Learn how to refuse an inheritance with a qualified disclaimer. When you receive an inheritance via a will, such as a house or cash, or as a beneficiary of an ira or 401 (k), or an estate, you can say thanks but no thanks. Description the template.

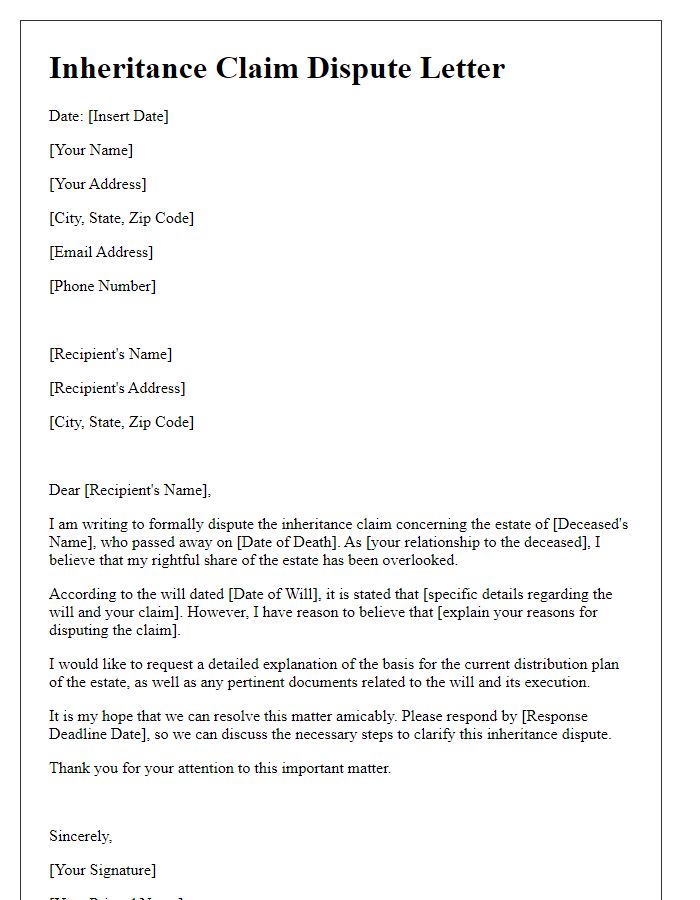

Letter Template For Inheritance Dispute Notice Free Samples in PDF

When you receive an inheritance via a will, such as a house or cash, or as a beneficiary of an ira or 401 (k), or an estate, you can say thanks but no thanks. Understand the steps, deadlines, tax effects, and reasons to say no to an. Description the template letter for inheritance for decline is a legal document that.

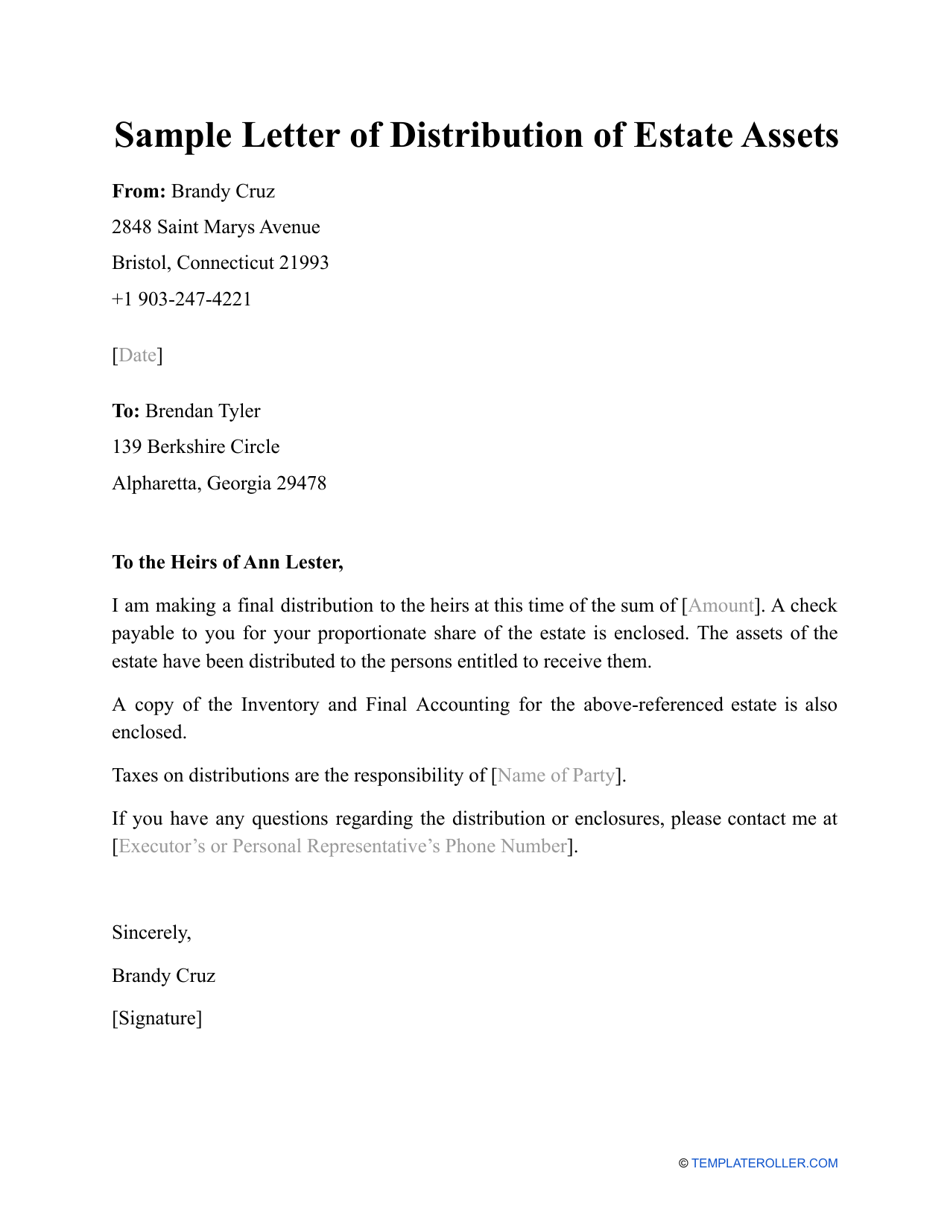

Inheritance Sample Letter To Beneficiary With Distribution

When you receive an inheritance via a will, such as a house or cash, or as a beneficiary of an ira or 401 (k), or an estate, you can say thanks but no thanks. Learn how to refuse an inheritance with a qualified disclaimer. The undersigned acknowledges that the executors of the estate will rely on this renunciation of inheritance.

Inheritance Sample Letter To Beneficiary With Distribution

The undersigned acknowledges that the executors of the estate will rely on this renunciation of inheritance in distributing the property and assets. Understand the steps, deadlines, tax effects, and reasons to say no to an. Learn how to refuse an inheritance with a qualified disclaimer. Description the template letter for inheritance for decline is a legal document that allows an.

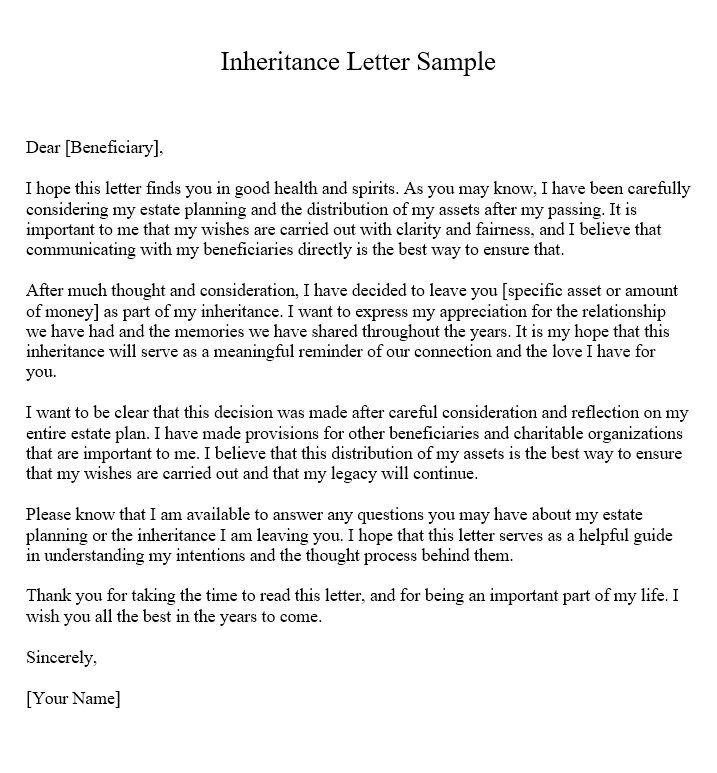

Inheritance Letter Sample How To Write An Inheritance Letter

Description the template letter for inheritance for decline is a legal document that allows an individual to renounce their right to inherit from a deceased. When you receive an inheritance via a will, such as a house or cash, or as a beneficiary of an ira or 401 (k), or an estate, you can say thanks but no thanks. The.

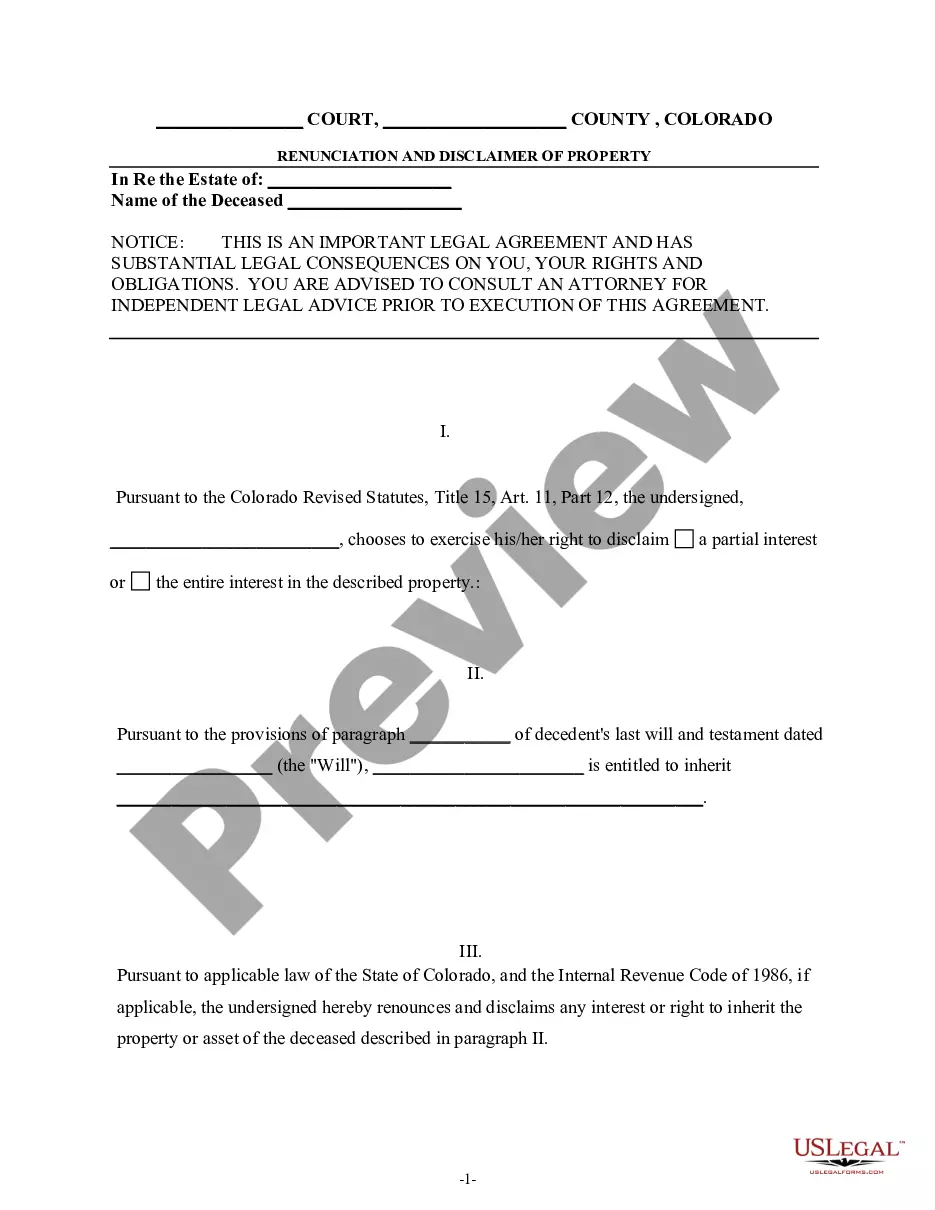

Sample Letter Of Disclaimer Of Inheritance Form US Legal Forms

The undersigned acknowledges that the executors of the estate will rely on this renunciation of inheritance in distributing the property and assets. When you receive an inheritance via a will, such as a house or cash, or as a beneficiary of an ira or 401 (k), or an estate, you can say thanks but no thanks. Understand the steps, deadlines,.

Inheritance Letter PDF

Understand the steps, deadlines, tax effects, and reasons to say no to an. Description the template letter for inheritance for decline is a legal document that allows an individual to renounce their right to inherit from a deceased. When you receive an inheritance via a will, such as a house or cash, or as a beneficiary of an ira or.

Understand The Steps, Deadlines, Tax Effects, And Reasons To Say No To An.

Learn how to refuse an inheritance with a qualified disclaimer. Description the template letter for inheritance for decline is a legal document that allows an individual to renounce their right to inherit from a deceased. The undersigned acknowledges that the executors of the estate will rely on this renunciation of inheritance in distributing the property and assets. When you receive an inheritance via a will, such as a house or cash, or as a beneficiary of an ira or 401 (k), or an estate, you can say thanks but no thanks.