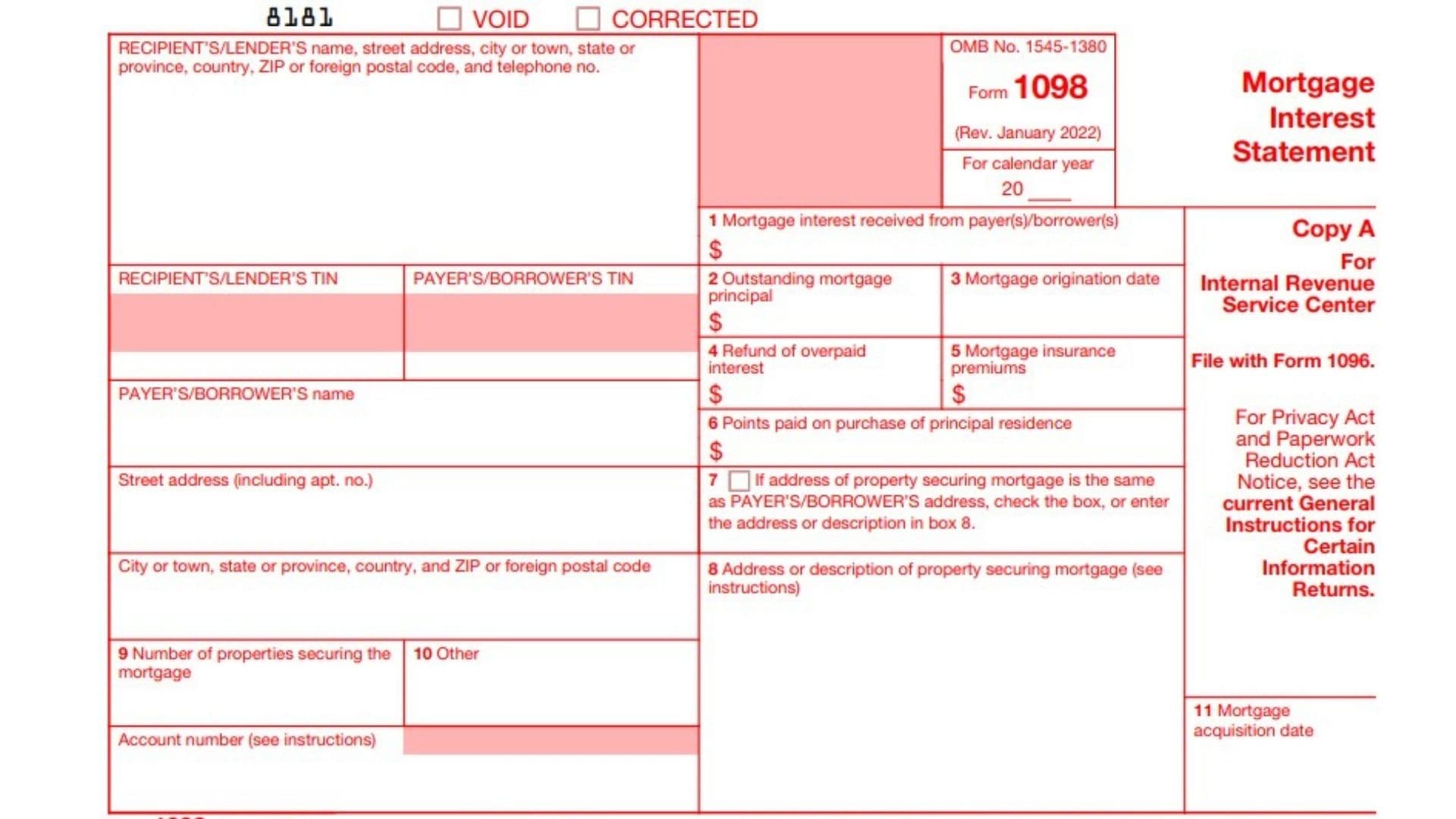

Form 1098 Instructions - Lenders send form 1098 to mortgage borrowers and to the irs. Filling out form 1098 requires accurate and detailed information about the mortgage interest received. If you receive a form 1098, you can use it to potentially deduct the mortgage. The form is divided into several sections, each. You may, at your option, file form 1098 to report mortgage interest of less than $600, but if you do, you are subject to the rules in these instructions. You must file form 1098 to report interest paid by a nonresident alien only if all or part of the security for the mortgage is real property located in the united.

You must file form 1098 to report interest paid by a nonresident alien only if all or part of the security for the mortgage is real property located in the united. You may, at your option, file form 1098 to report mortgage interest of less than $600, but if you do, you are subject to the rules in these instructions. Filling out form 1098 requires accurate and detailed information about the mortgage interest received. If you receive a form 1098, you can use it to potentially deduct the mortgage. The form is divided into several sections, each. Lenders send form 1098 to mortgage borrowers and to the irs.

You must file form 1098 to report interest paid by a nonresident alien only if all or part of the security for the mortgage is real property located in the united. Filling out form 1098 requires accurate and detailed information about the mortgage interest received. You may, at your option, file form 1098 to report mortgage interest of less than $600, but if you do, you are subject to the rules in these instructions. If you receive a form 1098, you can use it to potentially deduct the mortgage. Lenders send form 1098 to mortgage borrowers and to the irs. The form is divided into several sections, each.

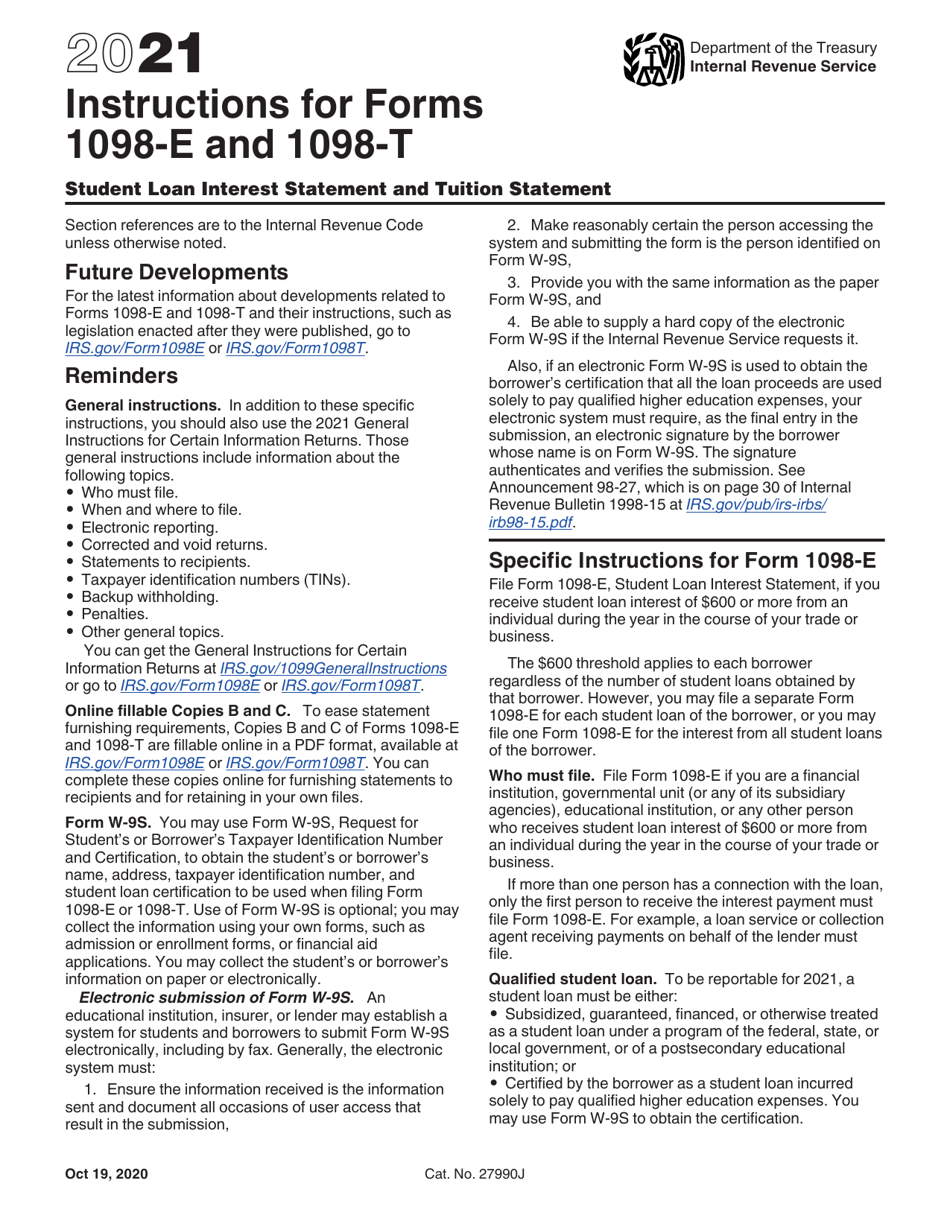

IRS Form 1098T Instructions Tuition Statement

You must file form 1098 to report interest paid by a nonresident alien only if all or part of the security for the mortgage is real property located in the united. Lenders send form 1098 to mortgage borrowers and to the irs. Filling out form 1098 requires accurate and detailed information about the mortgage interest received. The form is divided.

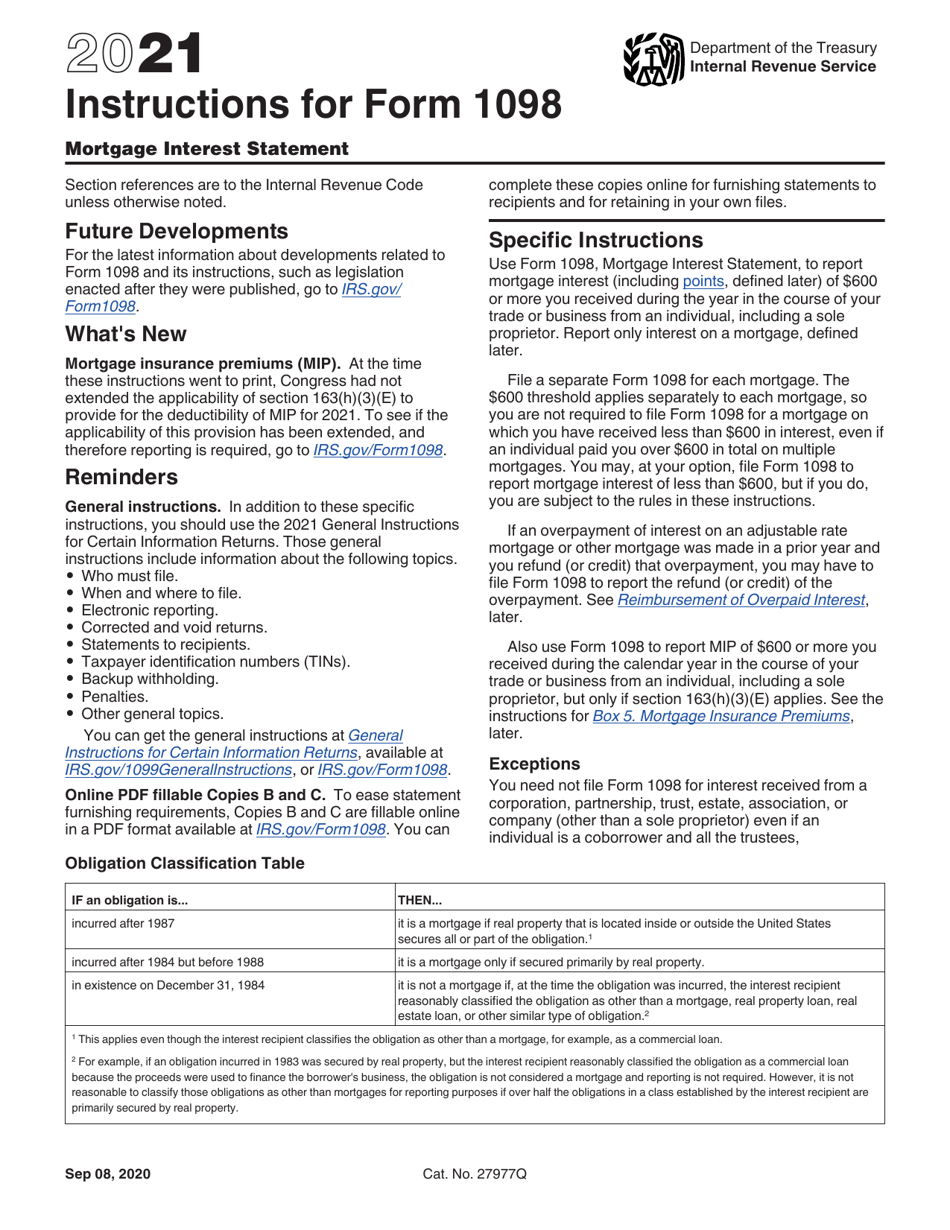

IRS Form 1098 Instructions Mortgage Interest Statement

You may, at your option, file form 1098 to report mortgage interest of less than $600, but if you do, you are subject to the rules in these instructions. Filling out form 1098 requires accurate and detailed information about the mortgage interest received. If you receive a form 1098, you can use it to potentially deduct the mortgage. The form.

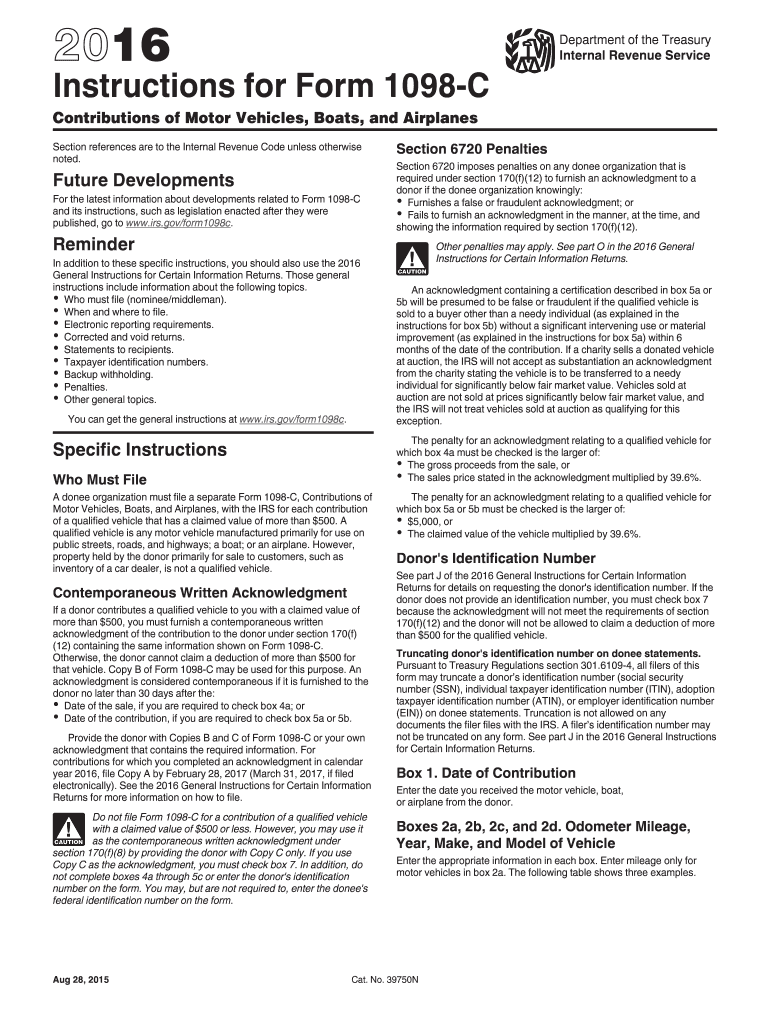

Irs Form 1098 C Instructions Fill Out and Sign Printable PDF Template

If you receive a form 1098, you can use it to potentially deduct the mortgage. You may, at your option, file form 1098 to report mortgage interest of less than $600, but if you do, you are subject to the rules in these instructions. Filling out form 1098 requires accurate and detailed information about the mortgage interest received. The form.

Form 1098 Instructions 2024 Sonni Olympe

The form is divided into several sections, each. You must file form 1098 to report interest paid by a nonresident alien only if all or part of the security for the mortgage is real property located in the united. If you receive a form 1098, you can use it to potentially deduct the mortgage. You may, at your option, file.

Download Instructions for IRS Form 1098 Mortgage Interest Statement PDF

Lenders send form 1098 to mortgage borrowers and to the irs. If you receive a form 1098, you can use it to potentially deduct the mortgage. You must file form 1098 to report interest paid by a nonresident alien only if all or part of the security for the mortgage is real property located in the united. You may, at.

Form 1098 Instructions 2024 2025

Lenders send form 1098 to mortgage borrowers and to the irs. If you receive a form 1098, you can use it to potentially deduct the mortgage. Filling out form 1098 requires accurate and detailed information about the mortgage interest received. The form is divided into several sections, each. You may, at your option, file form 1098 to report mortgage interest.

Download Instructions for IRS Form 1098E, 1098T PDF, 2021

The form is divided into several sections, each. You must file form 1098 to report interest paid by a nonresident alien only if all or part of the security for the mortgage is real property located in the united. Lenders send form 1098 to mortgage borrowers and to the irs. If you receive a form 1098, you can use it.

1098T IRS Tax Form Instructions 1098T Forms

Lenders send form 1098 to mortgage borrowers and to the irs. Filling out form 1098 requires accurate and detailed information about the mortgage interest received. If you receive a form 1098, you can use it to potentially deduct the mortgage. You may, at your option, file form 1098 to report mortgage interest of less than $600, but if you do,.

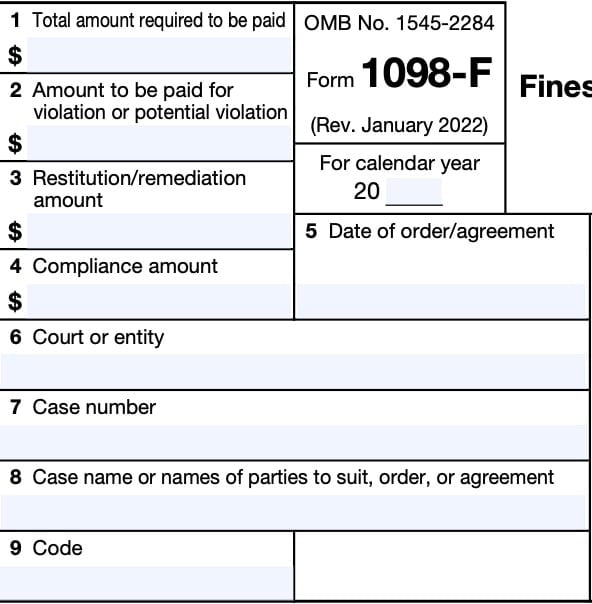

IRS Form 1098F Instructions Fines, Penalties and Other Amounts

You may, at your option, file form 1098 to report mortgage interest of less than $600, but if you do, you are subject to the rules in these instructions. The form is divided into several sections, each. Filling out form 1098 requires accurate and detailed information about the mortgage interest received. If you receive a form 1098, you can use.

IRS Form 1098 Instructions Mortgage Interest Statement

Lenders send form 1098 to mortgage borrowers and to the irs. If you receive a form 1098, you can use it to potentially deduct the mortgage. You must file form 1098 to report interest paid by a nonresident alien only if all or part of the security for the mortgage is real property located in the united. You may, at.

If You Receive A Form 1098, You Can Use It To Potentially Deduct The Mortgage.

The form is divided into several sections, each. You must file form 1098 to report interest paid by a nonresident alien only if all or part of the security for the mortgage is real property located in the united. Filling out form 1098 requires accurate and detailed information about the mortgage interest received. Lenders send form 1098 to mortgage borrowers and to the irs.