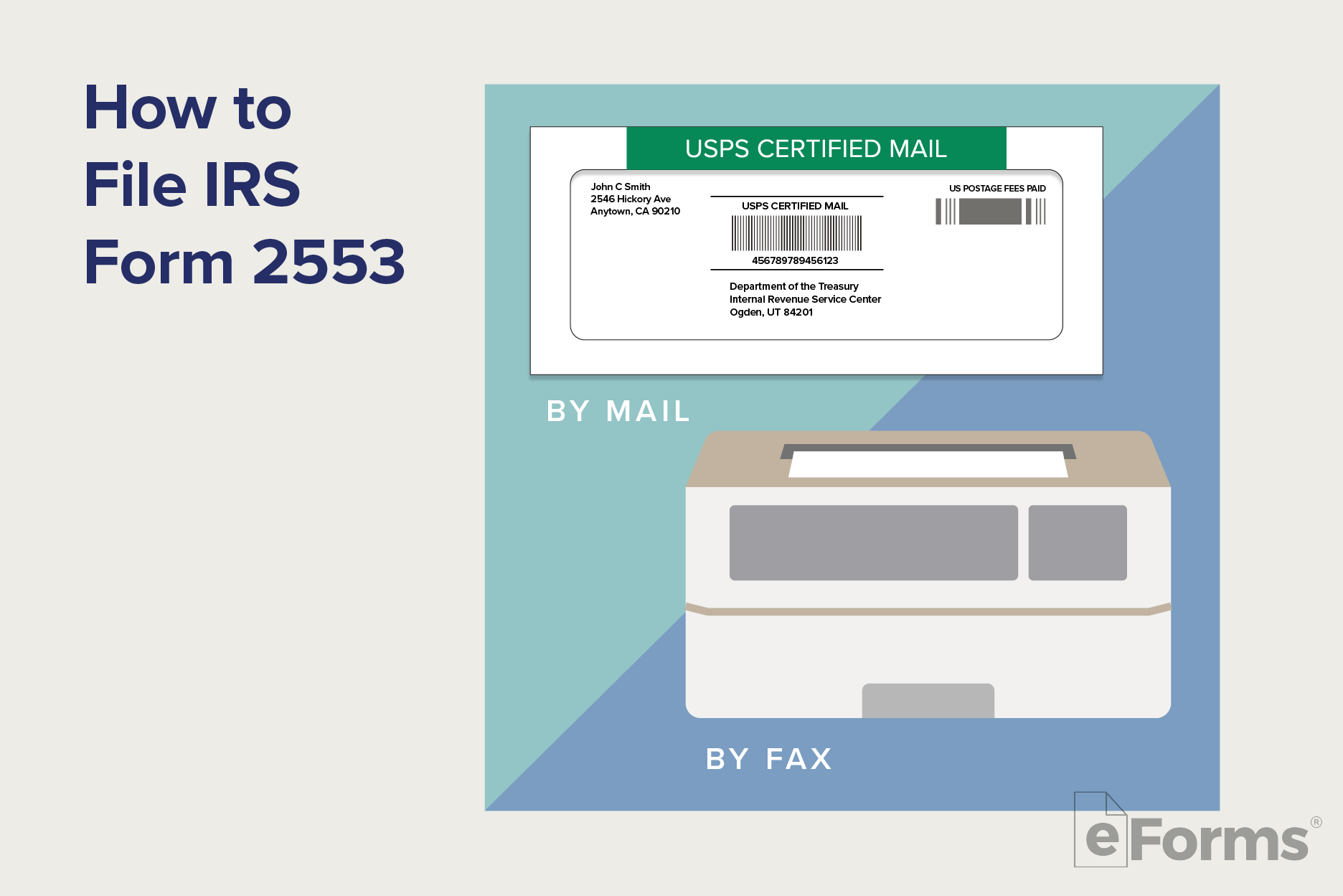

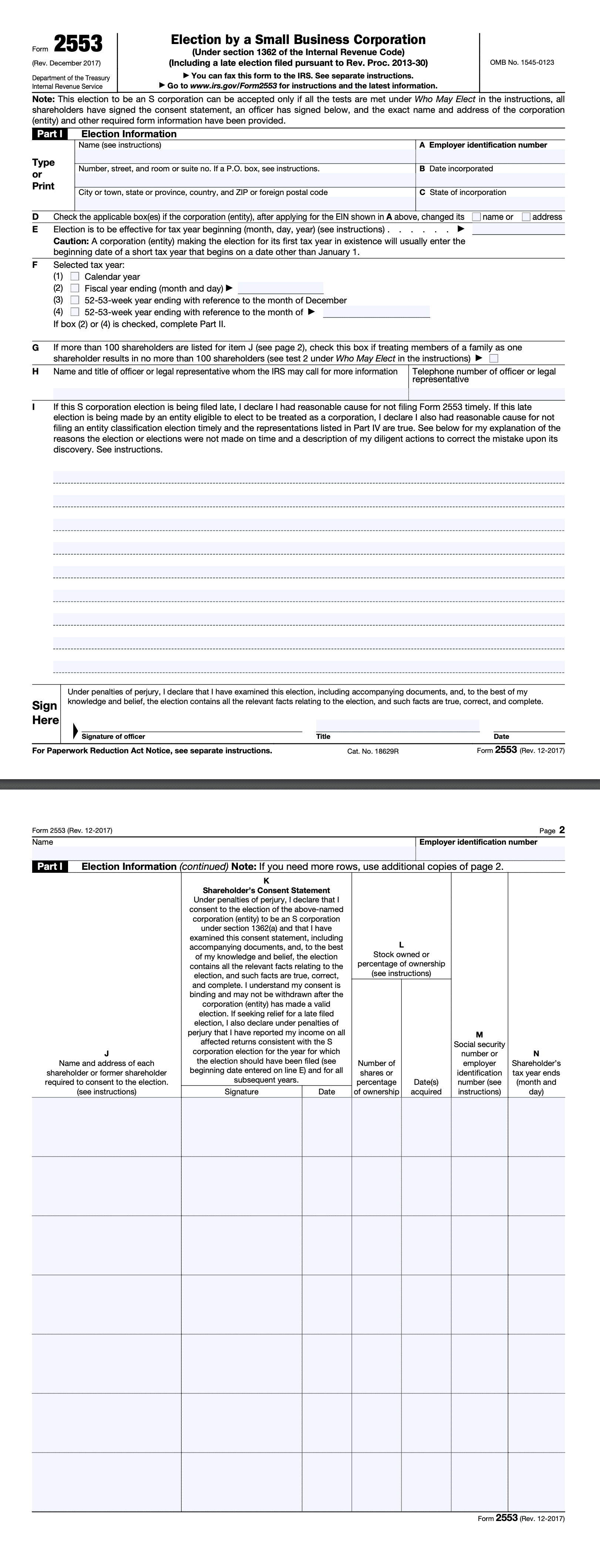

How To File Form 2553 Online - You need to file form 2553, election by a small business corporation to be treated as an s corporation by the irs. Learn how to accurately file irs form 2553 to elect s corporation status. Instructions for form 2553 (12/2020) (for use with the december 2017 revision of form 2553, election by a small business corporation). You may file the form. Whether you’re running a small llc retail shop or planning to convert a sole proprietorship to an llc, this guide will walk you. Learn how to file irs form 2553 for s corporation status, including eligibility, deadlines, and common filing mistakes. This guide covers eligibility, deadlines, late election relief, and filing. A complete guide to irs form 2553, including eligibility requirements, filing instructions, and benefits of electing s corporation status. Form 2553 can be filed by mail or fax as there is no online submission. The process for filing form 2553 is detailed on the irs web site.

Learn how to efficiently file form 2553 online to elect s corporation status, ensuring compliance and optimizing your business structure. You need to file form 2553, election by a small business corporation to be treated as an s corporation by the irs. Instructions for form 2553 (12/2020) (for use with the december 2017 revision of form 2553, election by a small business corporation). Form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. Learn how to accurately file irs form 2553 to elect s corporation status. Form 2553 can be filed by mail or fax as there is no online submission. It includes identifying information for the business and its shareholders, signed consent. The mailing address will vary depending on the state in which. This guide covers eligibility, deadlines, late election relief, and filing. You may file the form.

Form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. Learn how to accurately file irs form 2553 to elect s corporation status. You may file the form. The process for filing form 2553 is detailed on the irs web site. It includes identifying information for the business and its shareholders, signed consent. The mailing address will vary depending on the state in which. Form 2553 can be filed by mail or fax as there is no online submission. A complete guide to irs form 2553, including eligibility requirements, filing instructions, and benefits of electing s corporation status. You need to file form 2553, election by a small business corporation to be treated as an s corporation by the irs. Learn how to efficiently file form 2553 online to elect s corporation status, ensuring compliance and optimizing your business structure.

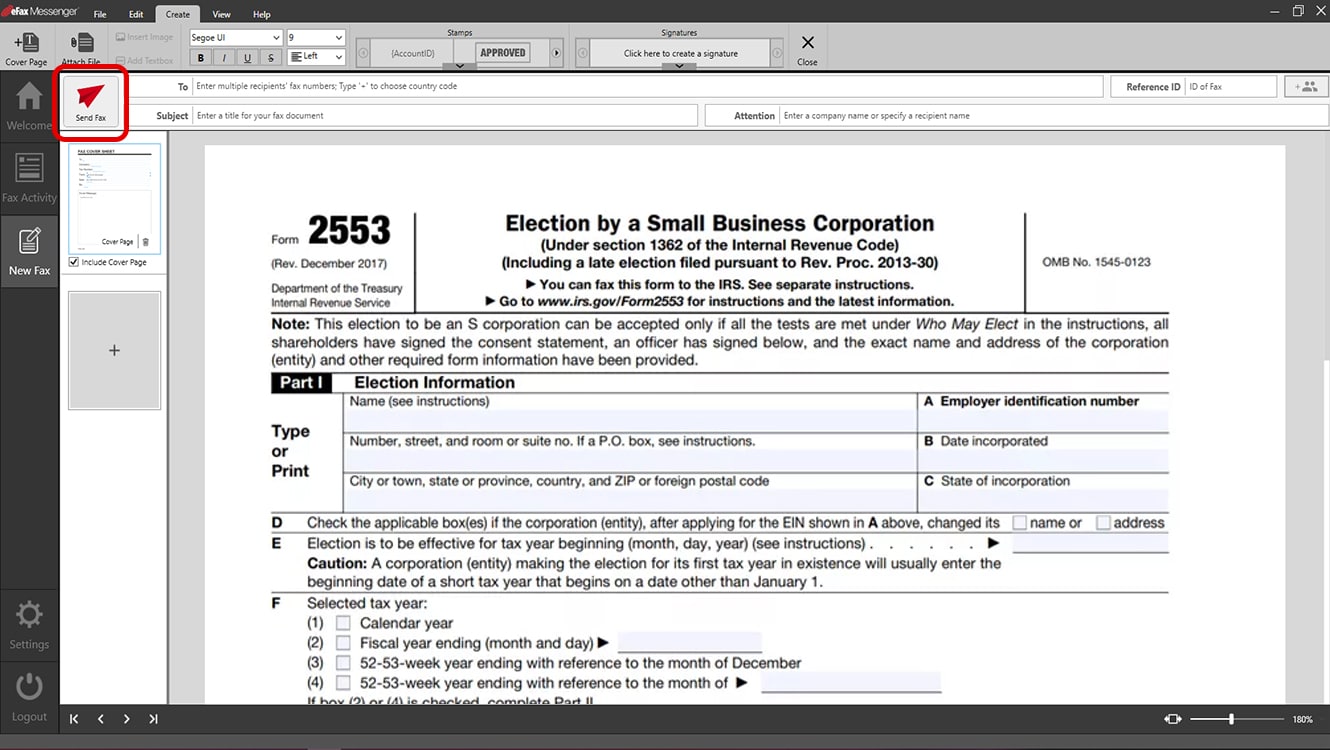

How to Fax IRS Form 2553 Online? eFax

Learn how to accurately file irs form 2553 to elect s corporation status. Whether you’re running a small llc retail shop or planning to convert a sole proprietorship to an llc, this guide will walk you. You may file the form. Form 2553 can be filed by mail or fax as there is no online submission. Learn how to file.

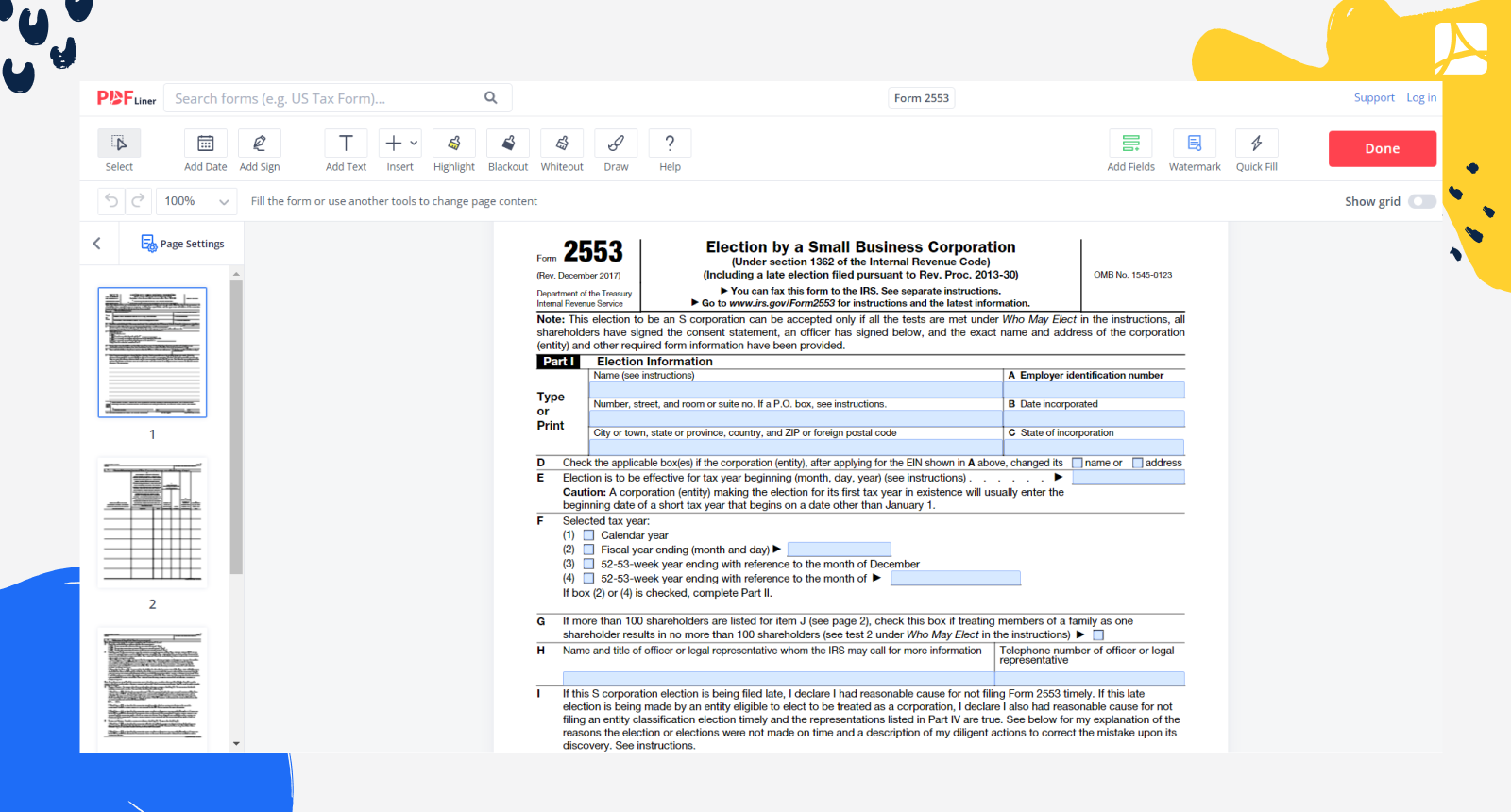

SCorp Election How to file form 2553 online with the IRS? (2021)

Learn how to accurately file irs form 2553 to elect s corporation status. The process for filing form 2553 is detailed on the irs web site. Learn how to efficiently file form 2553 online to elect s corporation status, ensuring compliance and optimizing your business structure. This guide covers eligibility, deadlines, late election relief, and filing. Form 2553 can be.

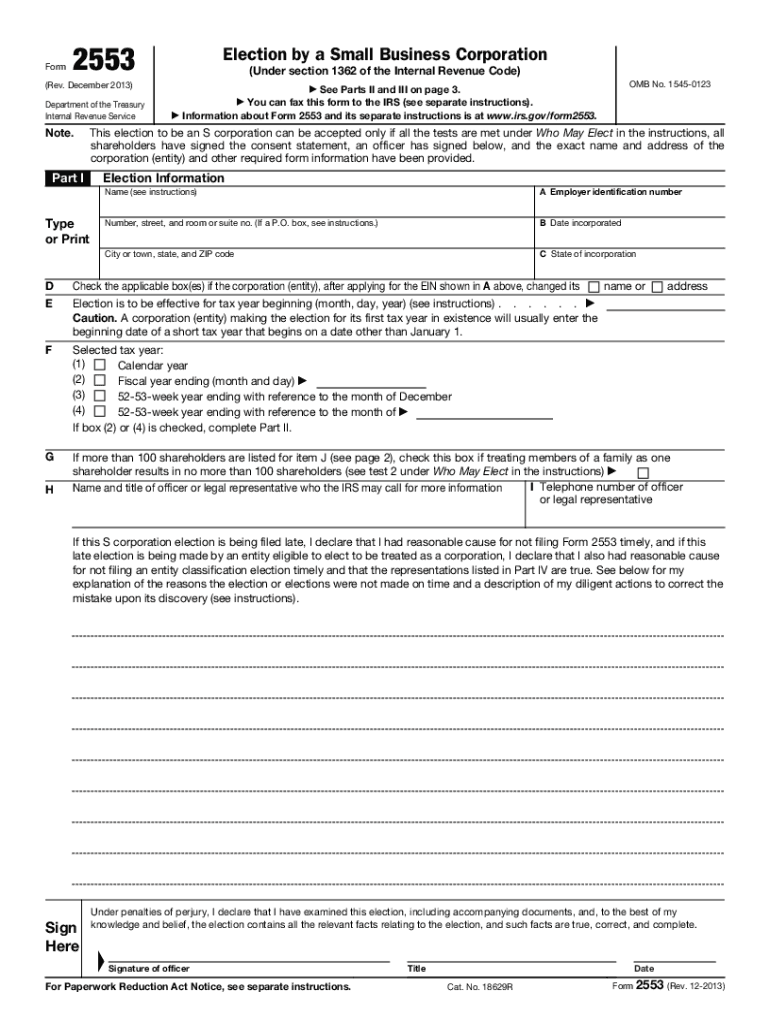

Free IRS Form 2553 PDF eForms

You need to file form 2553, election by a small business corporation to be treated as an s corporation by the irs. Form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. Form 2553 can be filed by mail or fax as there is no online submission. It includes identifying.

Form 2553 Fillable Printable Forms Free Online

It includes identifying information for the business and its shareholders, signed consent. Instructions for form 2553 (12/2020) (for use with the december 2017 revision of form 2553, election by a small business corporation). This guide covers eligibility, deadlines, late election relief, and filing. The process for filing form 2553 is detailed on the irs web site. You need to file.

Free Fillable Form 2553 Printable Forms Free Online

This guide covers eligibility, deadlines, late election relief, and filing. Form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. Learn how to efficiently file form 2553 online to elect s corporation status, ensuring compliance and optimizing your business structure. The mailing address will vary depending on the state in.

Fillable Online Note Form 2553 begins on the next page. IRS tax

It includes identifying information for the business and its shareholders, signed consent. Learn how to efficiently file form 2553 online to elect s corporation status, ensuring compliance and optimizing your business structure. Form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. The mailing address will vary depending on the.

How to Fill out IRS Form 2553 EasytoFollow Instructions YouTube

Form 2553 can be filed by mail or fax as there is no online submission. A complete guide to irs form 2553, including eligibility requirements, filing instructions, and benefits of electing s corporation status. This guide covers eligibility, deadlines, late election relief, and filing. You need to file form 2553, election by a small business corporation to be treated as.

Fillable 2553 Irs Form Printable Forms Free Online

The process for filing form 2553 is detailed on the irs web site. Learn how to file irs form 2553 for s corporation status, including eligibility, deadlines, and common filing mistakes. Instructions for form 2553 (12/2020) (for use with the december 2017 revision of form 2553, election by a small business corporation). It includes identifying information for the business and.

IRS Form 2553 Instructions For Filing Financial Cents

Learn how to accurately file irs form 2553 to elect s corporation status. Learn how to efficiently file form 2553 online to elect s corporation status, ensuring compliance and optimizing your business structure. You need to file form 2553, election by a small business corporation to be treated as an s corporation by the irs. A complete guide to irs.

IRS Form 2553 Everything You Need To Know

Form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. A complete guide to irs form 2553, including eligibility requirements, filing instructions, and benefits of electing s corporation status. The mailing address will vary depending on the state in which. The process for filing form 2553 is detailed on the.

You May File The Form.

The process for filing form 2553 is detailed on the irs web site. Instructions for form 2553 (12/2020) (for use with the december 2017 revision of form 2553, election by a small business corporation). Learn how to accurately file irs form 2553 to elect s corporation status. It includes identifying information for the business and its shareholders, signed consent.

A Complete Guide To Irs Form 2553, Including Eligibility Requirements, Filing Instructions, And Benefits Of Electing S Corporation Status.

Learn how to efficiently file form 2553 online to elect s corporation status, ensuring compliance and optimizing your business structure. Form 2553 can be filed by mail or fax as there is no online submission. The mailing address will vary depending on the state in which. Form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec.

Whether You’re Running A Small Llc Retail Shop Or Planning To Convert A Sole Proprietorship To An Llc, This Guide Will Walk You.

Learn how to file irs form 2553 for s corporation status, including eligibility, deadlines, and common filing mistakes. You need to file form 2553, election by a small business corporation to be treated as an s corporation by the irs. This guide covers eligibility, deadlines, late election relief, and filing.