Pcori Form 720 - As a business owner, you may have heard of pcori and the fees that come with it. Although form 720 is a. We'll answer common questions about form 720 and. Discover everything about pcori fees—who pays, how to calculate covered lives, form 720 filing steps, deadlines, and irs rules for 2025 compliance. File form 720 annually to report and pay the fee on the second quarter form 720 no later than july 31 of the calendar year immediately following the last. The pcori fee is reported and paid annually using irs form 720, the quarterly federal excise tax return.

As a business owner, you may have heard of pcori and the fees that come with it. The pcori fee is reported and paid annually using irs form 720, the quarterly federal excise tax return. File form 720 annually to report and pay the fee on the second quarter form 720 no later than july 31 of the calendar year immediately following the last. Although form 720 is a. Discover everything about pcori fees—who pays, how to calculate covered lives, form 720 filing steps, deadlines, and irs rules for 2025 compliance. We'll answer common questions about form 720 and.

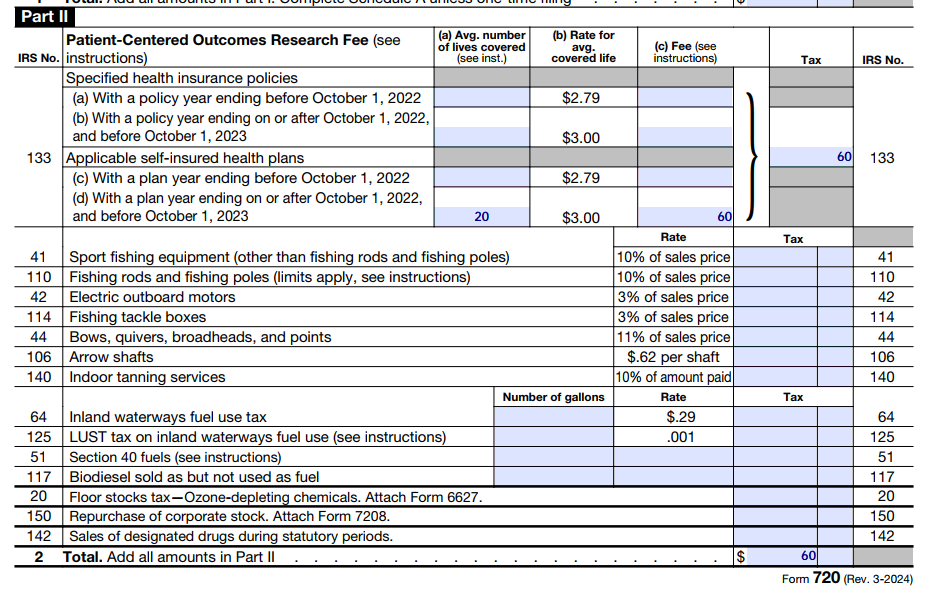

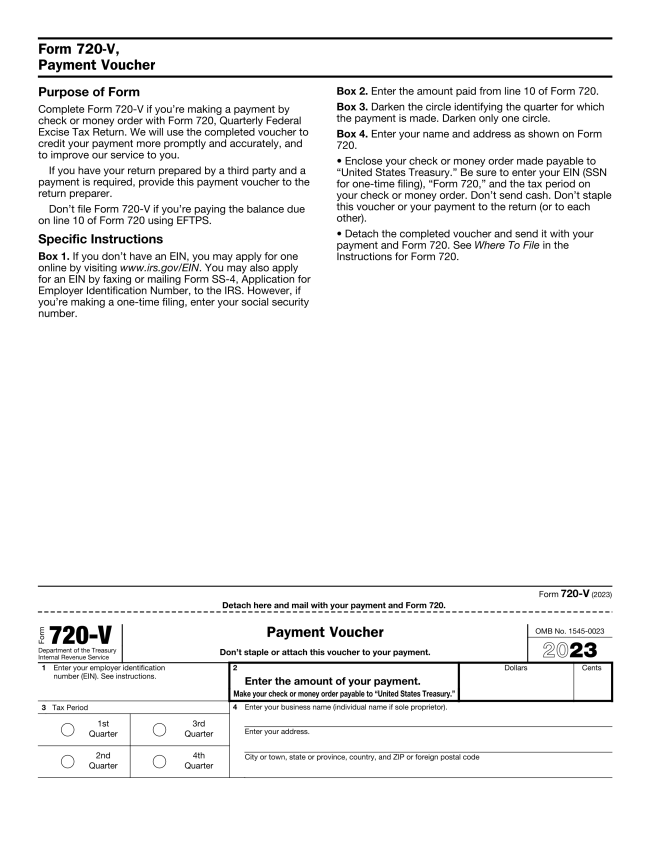

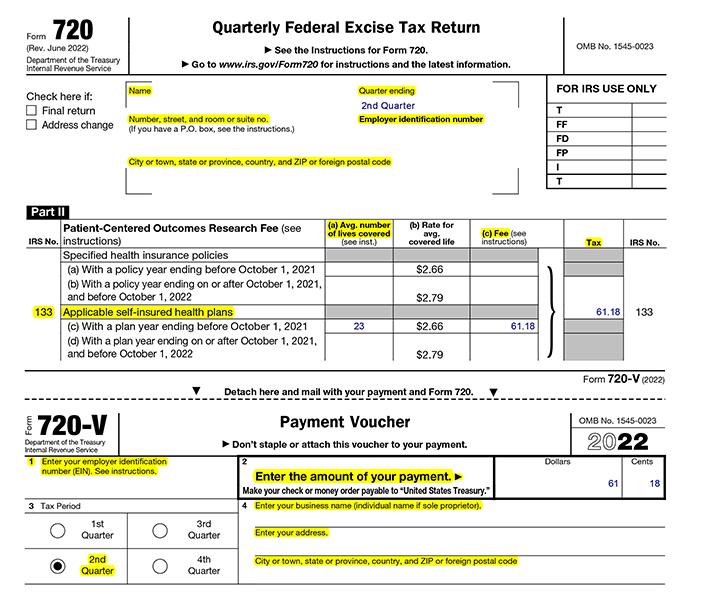

The pcori fee is reported and paid annually using irs form 720, the quarterly federal excise tax return. Discover everything about pcori fees—who pays, how to calculate covered lives, form 720 filing steps, deadlines, and irs rules for 2025 compliance. File form 720 annually to report and pay the fee on the second quarter form 720 no later than july 31 of the calendar year immediately following the last. As a business owner, you may have heard of pcori and the fees that come with it. Although form 720 is a. We'll answer common questions about form 720 and.

PCORI fee Form 720 available now

Although form 720 is a. File form 720 annually to report and pay the fee on the second quarter form 720 no later than july 31 of the calendar year immediately following the last. The pcori fee is reported and paid annually using irs form 720, the quarterly federal excise tax return. Discover everything about pcori fees—who pays, how to.

IRS Form 720 Instructions for the PatientCentered Research

Discover everything about pcori fees—who pays, how to calculate covered lives, form 720 filing steps, deadlines, and irs rules for 2025 compliance. Although form 720 is a. We'll answer common questions about form 720 and. File form 720 annually to report and pay the fee on the second quarter form 720 no later than july 31 of the calendar year.

Understanding PCORI Fees OCA

Although form 720 is a. Discover everything about pcori fees—who pays, how to calculate covered lives, form 720 filing steps, deadlines, and irs rules for 2025 compliance. The pcori fee is reported and paid annually using irs form 720, the quarterly federal excise tax return. File form 720 annually to report and pay the fee on the second quarter form.

Reminder for PCORI Fee Form 720 Filing Due July 31

The pcori fee is reported and paid annually using irs form 720, the quarterly federal excise tax return. As a business owner, you may have heard of pcori and the fees that come with it. Although form 720 is a. Discover everything about pcori fees—who pays, how to calculate covered lives, form 720 filing steps, deadlines, and irs rules for.

Completing IRS Form 720 (PCORI) Fee ICHRA2

Although form 720 is a. Discover everything about pcori fees—who pays, how to calculate covered lives, form 720 filing steps, deadlines, and irs rules for 2025 compliance. We'll answer common questions about form 720 and. The pcori fee is reported and paid annually using irs form 720, the quarterly federal excise tax return. File form 720 annually to report and.

IRS Form 720 Excise Tax 720 Form for 2023 & PCORI Instructions

Discover everything about pcori fees—who pays, how to calculate covered lives, form 720 filing steps, deadlines, and irs rules for 2025 compliance. File form 720 annually to report and pay the fee on the second quarter form 720 no later than july 31 of the calendar year immediately following the last. The pcori fee is reported and paid annually using.

PCORI Reports Available Online! FEE Due July 31, 2023

Discover everything about pcori fees—who pays, how to calculate covered lives, form 720 filing steps, deadlines, and irs rules for 2025 compliance. Although form 720 is a. The pcori fee is reported and paid annually using irs form 720, the quarterly federal excise tax return. We'll answer common questions about form 720 and. As a business owner, you may have.

PCORI Fees Special Counting Rules for HRAs

The pcori fee is reported and paid annually using irs form 720, the quarterly federal excise tax return. As a business owner, you may have heard of pcori and the fees that come with it. Although form 720 is a. Discover everything about pcori fees—who pays, how to calculate covered lives, form 720 filing steps, deadlines, and irs rules for.

IRS Form 720 Instructions for the PatientCentered Research

File form 720 annually to report and pay the fee on the second quarter form 720 no later than july 31 of the calendar year immediately following the last. The pcori fee is reported and paid annually using irs form 720, the quarterly federal excise tax return. We'll answer common questions about form 720 and. As a business owner, you.

IRS Form 720 & PCORI Fees The Boom Post

The pcori fee is reported and paid annually using irs form 720, the quarterly federal excise tax return. As a business owner, you may have heard of pcori and the fees that come with it. Discover everything about pcori fees—who pays, how to calculate covered lives, form 720 filing steps, deadlines, and irs rules for 2025 compliance. We'll answer common.

As A Business Owner, You May Have Heard Of Pcori And The Fees That Come With It.

Discover everything about pcori fees—who pays, how to calculate covered lives, form 720 filing steps, deadlines, and irs rules for 2025 compliance. Although form 720 is a. The pcori fee is reported and paid annually using irs form 720, the quarterly federal excise tax return. File form 720 annually to report and pay the fee on the second quarter form 720 no later than july 31 of the calendar year immediately following the last.