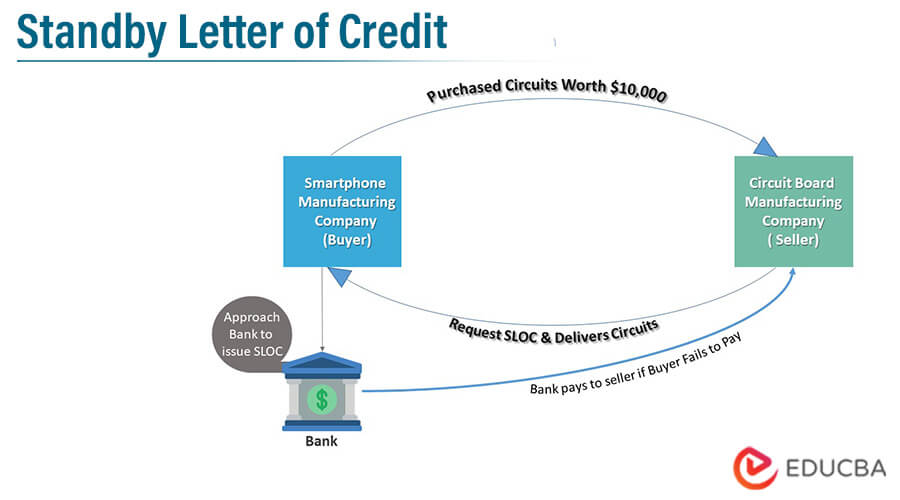

Sblc Verbiage Template - The regular letter of credit and standby letter of credit (lc & sblc) are payment instruments used in international trade. For example, a delay in shipping or misspelling a company's. A standby letter of credit (sblc) works as an additional guarantee or cover in a trade agreement. An sblc guarantees payment, but the terms must be followed precisely. A standby letter of credit (sblc / sloc) is a guarantee that is made by a bank on behalf of a client, which ensures payment will be. It is a form of documentary credit where the bank. A standby letter of credit, abbreviated as sblc, refers to a legal document where a bank guarantees the payment of a specific amount of money to a.

For example, a delay in shipping or misspelling a company's. It is a form of documentary credit where the bank. The regular letter of credit and standby letter of credit (lc & sblc) are payment instruments used in international trade. A standby letter of credit (sblc / sloc) is a guarantee that is made by a bank on behalf of a client, which ensures payment will be. An sblc guarantees payment, but the terms must be followed precisely. A standby letter of credit (sblc) works as an additional guarantee or cover in a trade agreement. A standby letter of credit, abbreviated as sblc, refers to a legal document where a bank guarantees the payment of a specific amount of money to a.

A standby letter of credit (sblc) works as an additional guarantee or cover in a trade agreement. For example, a delay in shipping or misspelling a company's. A standby letter of credit (sblc / sloc) is a guarantee that is made by a bank on behalf of a client, which ensures payment will be. An sblc guarantees payment, but the terms must be followed precisely. The regular letter of credit and standby letter of credit (lc & sblc) are payment instruments used in international trade. It is a form of documentary credit where the bank. A standby letter of credit, abbreviated as sblc, refers to a legal document where a bank guarantees the payment of a specific amount of money to a.

Standby Letter Of Credit (SBLC) Types, Features, Work, 41 OFF

A standby letter of credit (sblc / sloc) is a guarantee that is made by a bank on behalf of a client, which ensures payment will be. A standby letter of credit, abbreviated as sblc, refers to a legal document where a bank guarantees the payment of a specific amount of money to a. A standby letter of credit (sblc).

Infographic SBLC Issuance How to Avail SBLC MT760 Trade finance

A standby letter of credit (sblc) works as an additional guarantee or cover in a trade agreement. A standby letter of credit (sblc / sloc) is a guarantee that is made by a bank on behalf of a client, which ensures payment will be. An sblc guarantees payment, but the terms must be followed precisely. The regular letter of credit.

SBLC (Stand by Letter of Credit) Bank Swift MT760 Verbiage PDF

A standby letter of credit (sblc) works as an additional guarantee or cover in a trade agreement. The regular letter of credit and standby letter of credit (lc & sblc) are payment instruments used in international trade. A standby letter of credit, abbreviated as sblc, refers to a legal document where a bank guarantees the payment of a specific amount.

SBLCBGverbiagetemplateandapplicationinfo PDF Letter Of Credit

A standby letter of credit (sblc / sloc) is a guarantee that is made by a bank on behalf of a client, which ensures payment will be. For example, a delay in shipping or misspelling a company's. A standby letter of credit, abbreviated as sblc, refers to a legal document where a bank guarantees the payment of a specific amount.

SBLC Verbiage 2B PDF Transmission Control Protocol Banking

For example, a delay in shipping or misspelling a company's. The regular letter of credit and standby letter of credit (lc & sblc) are payment instruments used in international trade. A standby letter of credit (sblc) works as an additional guarantee or cover in a trade agreement. It is a form of documentary credit where the bank. An sblc guarantees.

SBLC Swift Verbiage Approved Master Blank PDF Letter Of Credit

A standby letter of credit (sblc) works as an additional guarantee or cover in a trade agreement. The regular letter of credit and standby letter of credit (lc & sblc) are payment instruments used in international trade. For example, a delay in shipping or misspelling a company's. A standby letter of credit, abbreviated as sblc, refers to a legal document.

Swift MT 799 and Mt760 SBLC Verbiage PDF Letter Of Credit Banks

A standby letter of credit, abbreviated as sblc, refers to a legal document where a bank guarantees the payment of a specific amount of money to a. It is a form of documentary credit where the bank. A standby letter of credit (sblc / sloc) is a guarantee that is made by a bank on behalf of a client, which.

Sblc Sample 2020 Fill and Sign Printable Template Online US Legal Forms

The regular letter of credit and standby letter of credit (lc & sblc) are payment instruments used in international trade. A standby letter of credit, abbreviated as sblc, refers to a legal document where a bank guarantees the payment of a specific amount of money to a. A standby letter of credit (sblc) works as an additional guarantee or cover.

Verbiage SBLC Letter Of Credit Credit

A standby letter of credit (sblc / sloc) is a guarantee that is made by a bank on behalf of a client, which ensures payment will be. The regular letter of credit and standby letter of credit (lc & sblc) are payment instruments used in international trade. For example, a delay in shipping or misspelling a company's. A standby letter.

SBLC Draft Verbiage (Var. 02) (Pro Download Free

For example, a delay in shipping or misspelling a company's. A standby letter of credit, abbreviated as sblc, refers to a legal document where a bank guarantees the payment of a specific amount of money to a. A standby letter of credit (sblc) works as an additional guarantee or cover in a trade agreement. A standby letter of credit (sblc.

For Example, A Delay In Shipping Or Misspelling A Company's.

A standby letter of credit (sblc) works as an additional guarantee or cover in a trade agreement. A standby letter of credit, abbreviated as sblc, refers to a legal document where a bank guarantees the payment of a specific amount of money to a. An sblc guarantees payment, but the terms must be followed precisely. It is a form of documentary credit where the bank.

The Regular Letter Of Credit And Standby Letter Of Credit (Lc & Sblc) Are Payment Instruments Used In International Trade.

A standby letter of credit (sblc / sloc) is a guarantee that is made by a bank on behalf of a client, which ensures payment will be.