W4 Form New York - After signing, the employer should fill out their name,. Use the irs withholding estimator tool to decide the amount of income tax to be withheld from your paycheck. In order for the form to be valid, the w4 must be signed and dated by the employee. If too little is withheld, you will. Learn how to change your.

In order for the form to be valid, the w4 must be signed and dated by the employee. After signing, the employer should fill out their name,. Use the irs withholding estimator tool to decide the amount of income tax to be withheld from your paycheck. Learn how to change your. If too little is withheld, you will.

If too little is withheld, you will. Use the irs withholding estimator tool to decide the amount of income tax to be withheld from your paycheck. After signing, the employer should fill out their name,. Learn how to change your. In order for the form to be valid, the w4 must be signed and dated by the employee.

New York State W4 Form 2024 Sharl Demetris

Learn how to change your. Use the irs withholding estimator tool to decide the amount of income tax to be withheld from your paycheck. If too little is withheld, you will. After signing, the employer should fill out their name,. In order for the form to be valid, the w4 must be signed and dated by the employee.

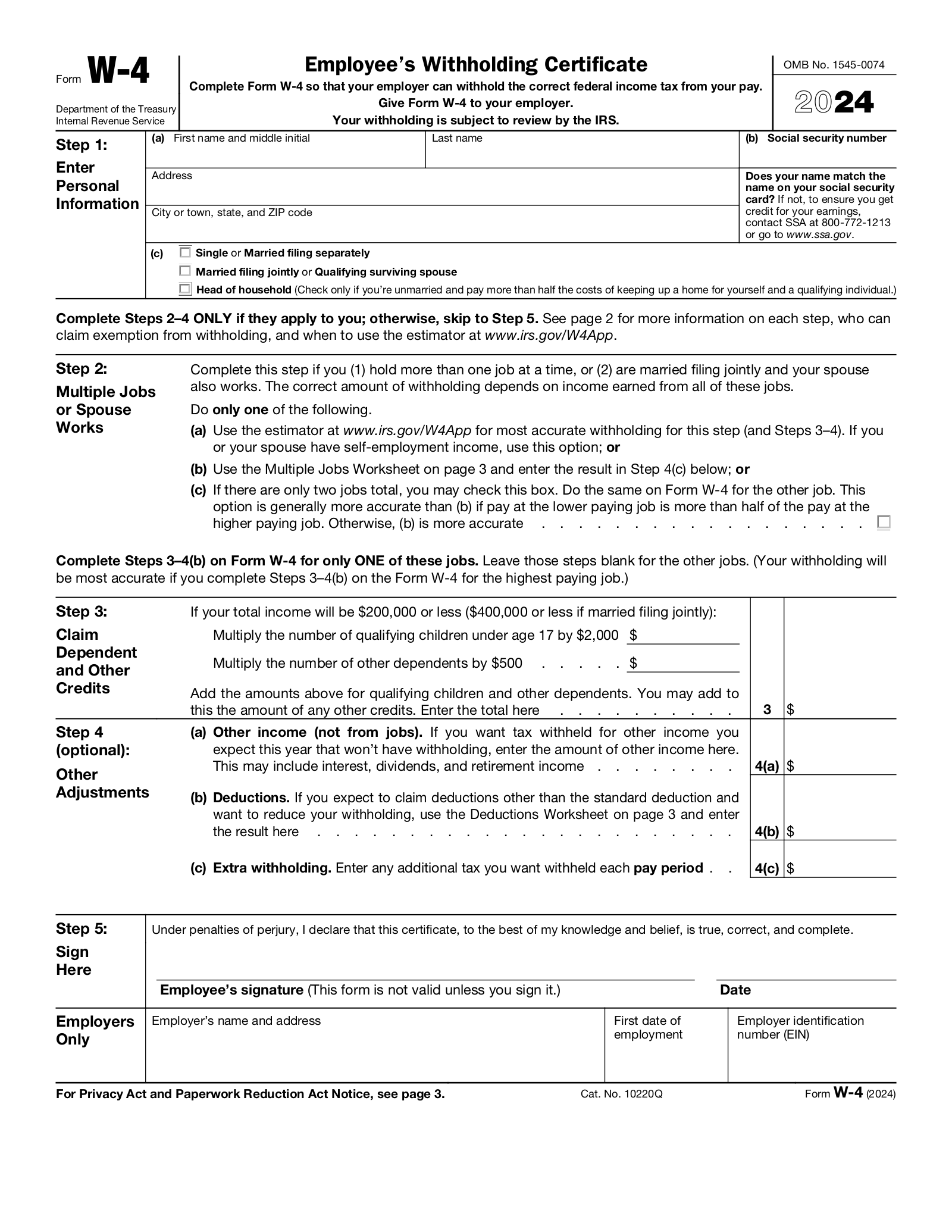

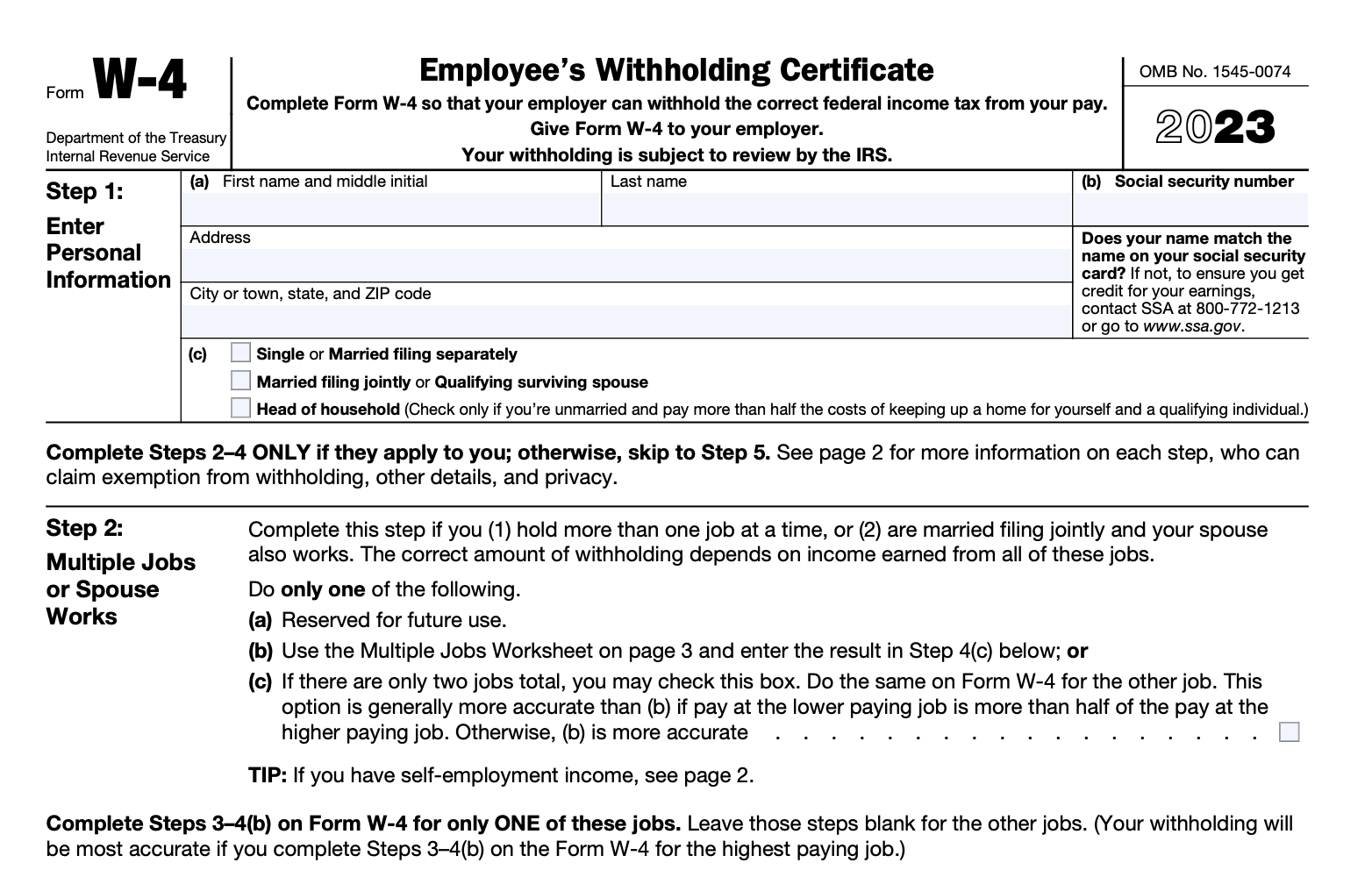

Free IRS Form W4 (2024) PDF eForms

After signing, the employer should fill out their name,. Learn how to change your. In order for the form to be valid, the w4 must be signed and dated by the employee. Use the irs withholding estimator tool to decide the amount of income tax to be withheld from your paycheck. If too little is withheld, you will.

2024 2024 Forms And Instructions Nyc Cam Maribel

In order for the form to be valid, the w4 must be signed and dated by the employee. Use the irs withholding estimator tool to decide the amount of income tax to be withheld from your paycheck. If too little is withheld, you will. Learn how to change your. After signing, the employer should fill out their name,.

New York W4 2024 Tax Form Laney Mirella

In order for the form to be valid, the w4 must be signed and dated by the employee. If too little is withheld, you will. After signing, the employer should fill out their name,. Learn how to change your. Use the irs withholding estimator tool to decide the amount of income tax to be withheld from your paycheck.

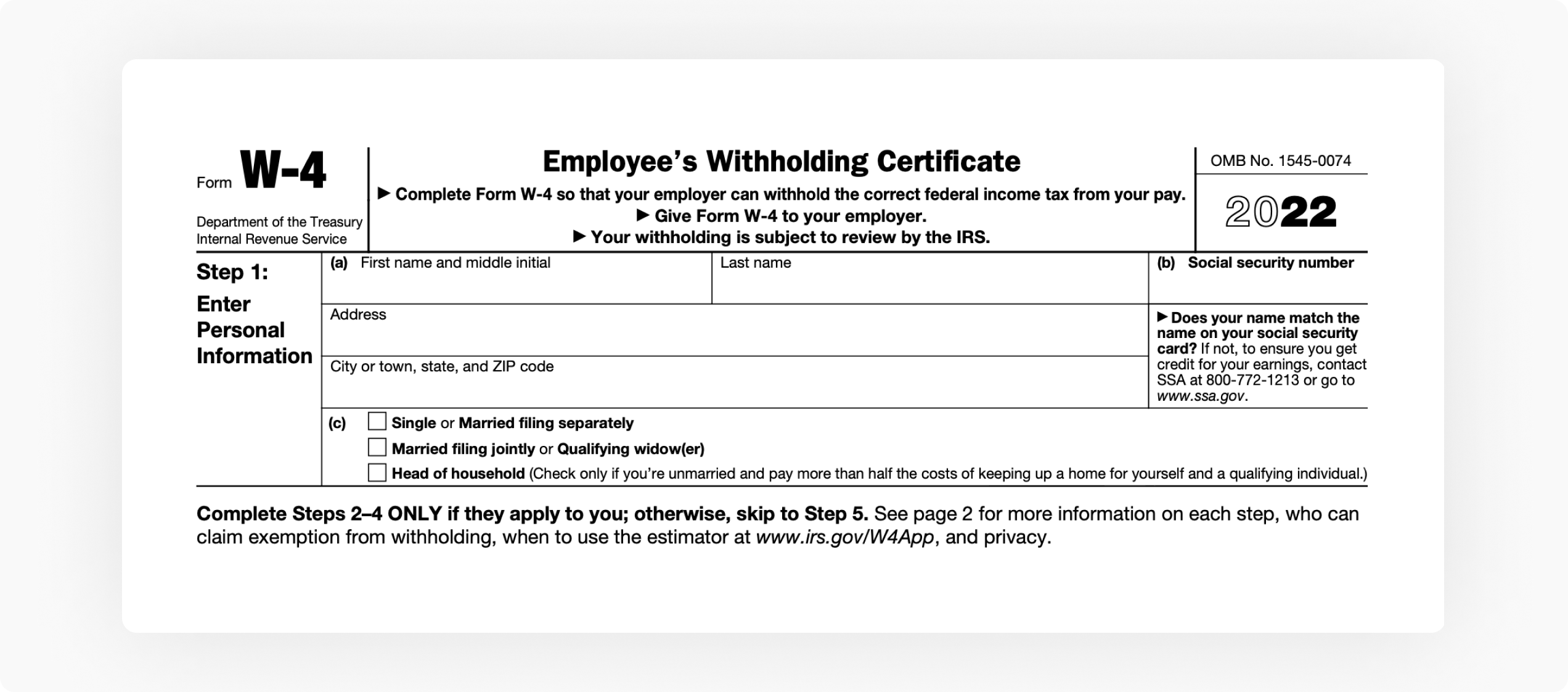

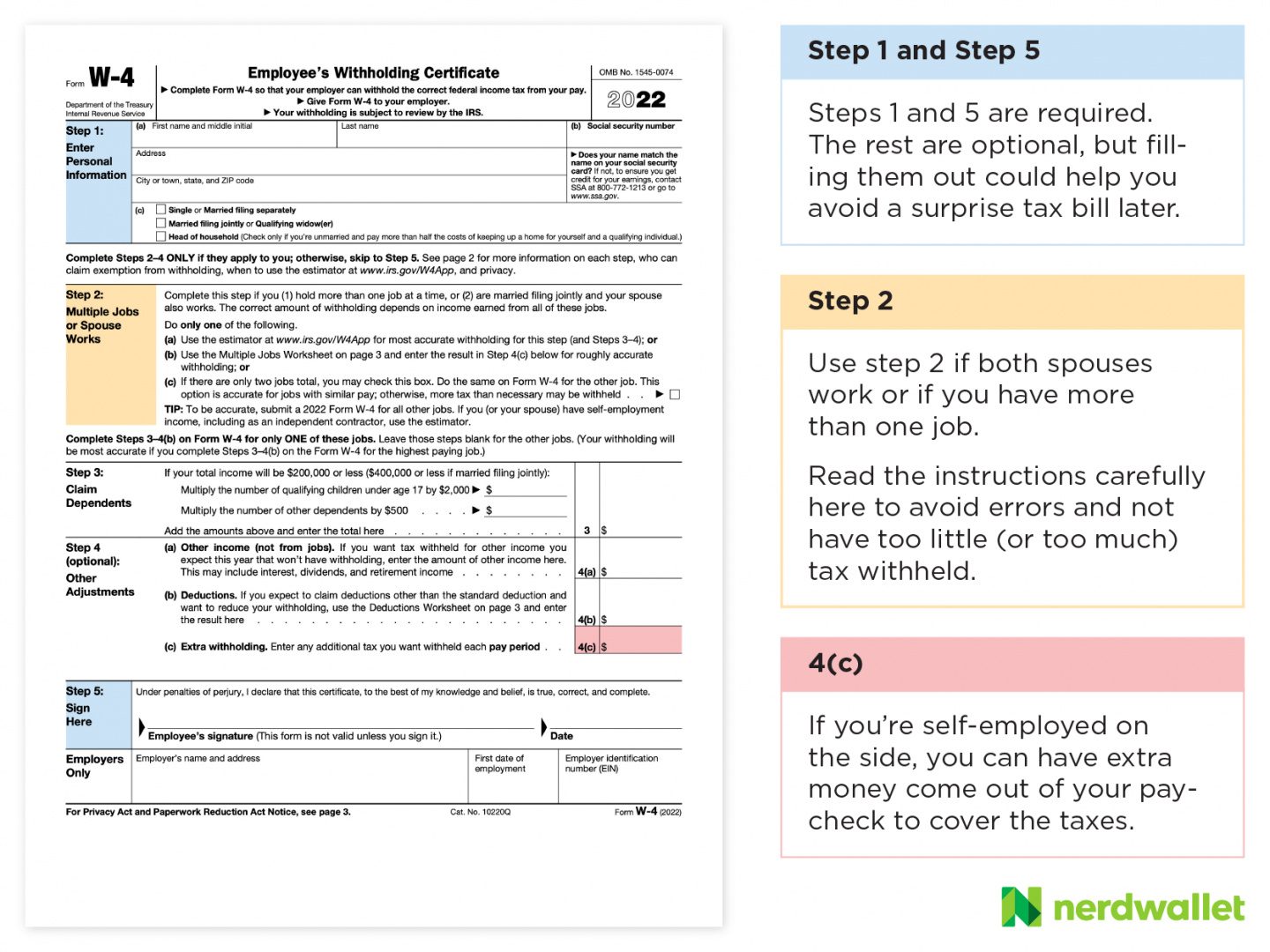

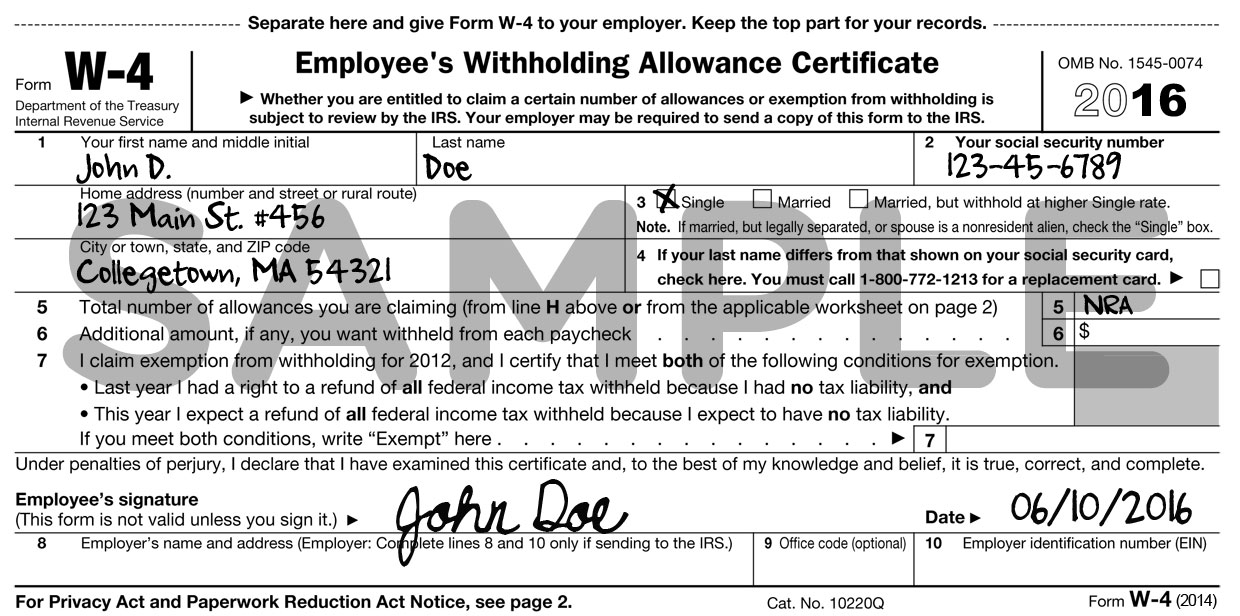

What Is a W4 Form? How to Fill Out an Employee’s Withholding

Use the irs withholding estimator tool to decide the amount of income tax to be withheld from your paycheck. In order for the form to be valid, the w4 must be signed and dated by the employee. Learn how to change your. After signing, the employer should fill out their name,. If too little is withheld, you will.

New York W4 2024 Tax Form Laney Mirella

In order for the form to be valid, the w4 must be signed and dated by the employee. If too little is withheld, you will. Use the irs withholding estimator tool to decide the amount of income tax to be withheld from your paycheck. After signing, the employer should fill out their name,. Learn how to change your.

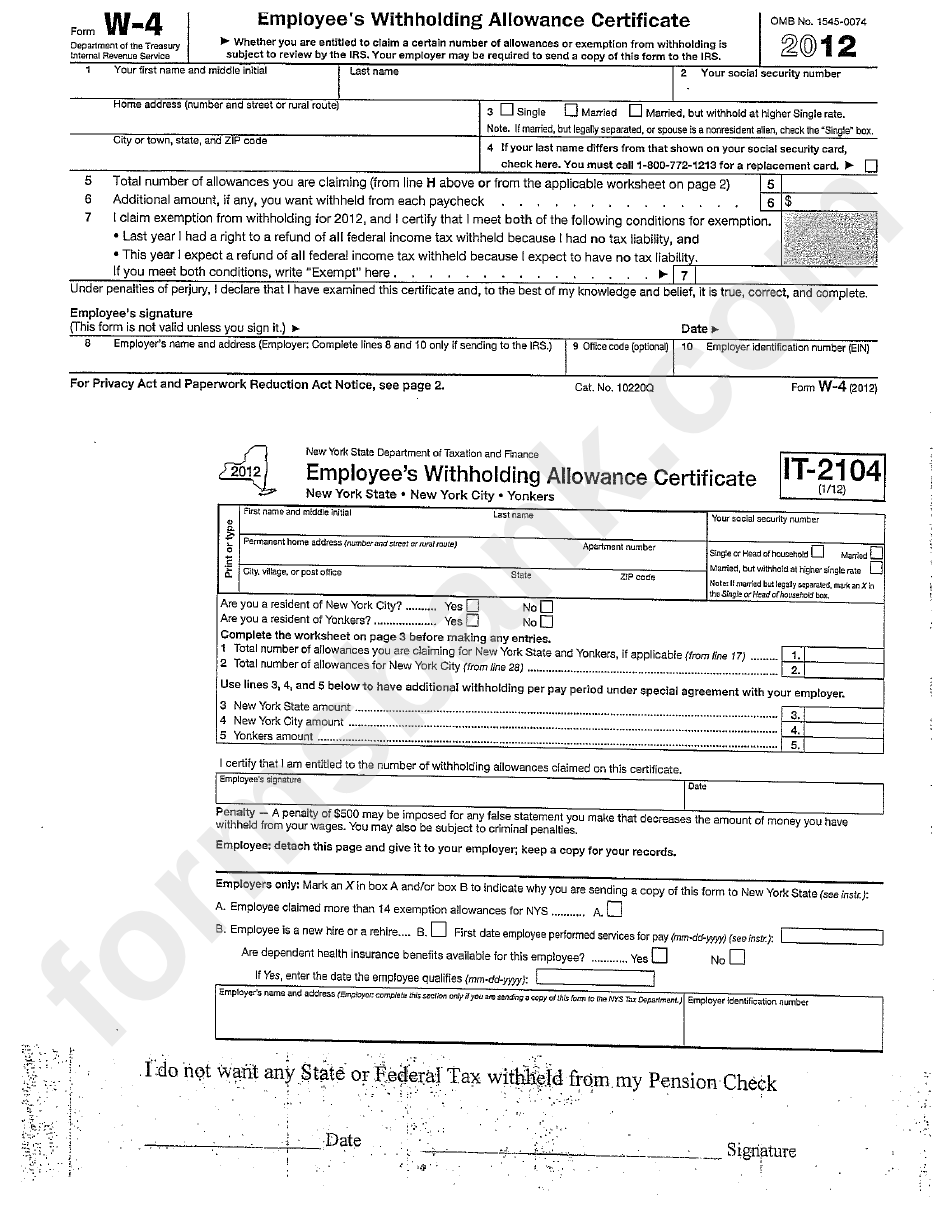

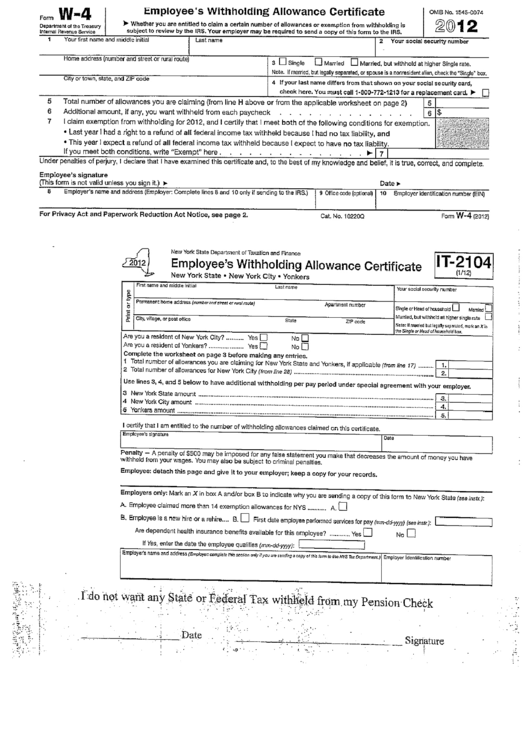

Form W4 Employee'S Withholding Allowance Certificate 2012, New

In order for the form to be valid, the w4 must be signed and dated by the employee. After signing, the employer should fill out their name,. Learn how to change your. Use the irs withholding estimator tool to decide the amount of income tax to be withheld from your paycheck. If too little is withheld, you will.

Form W4 Employee'S Withholding Allowance Certificate 2012, New

After signing, the employer should fill out their name,. Learn how to change your. Use the irs withholding estimator tool to decide the amount of income tax to be withheld from your paycheck. In order for the form to be valid, the w4 must be signed and dated by the employee. If too little is withheld, you will.

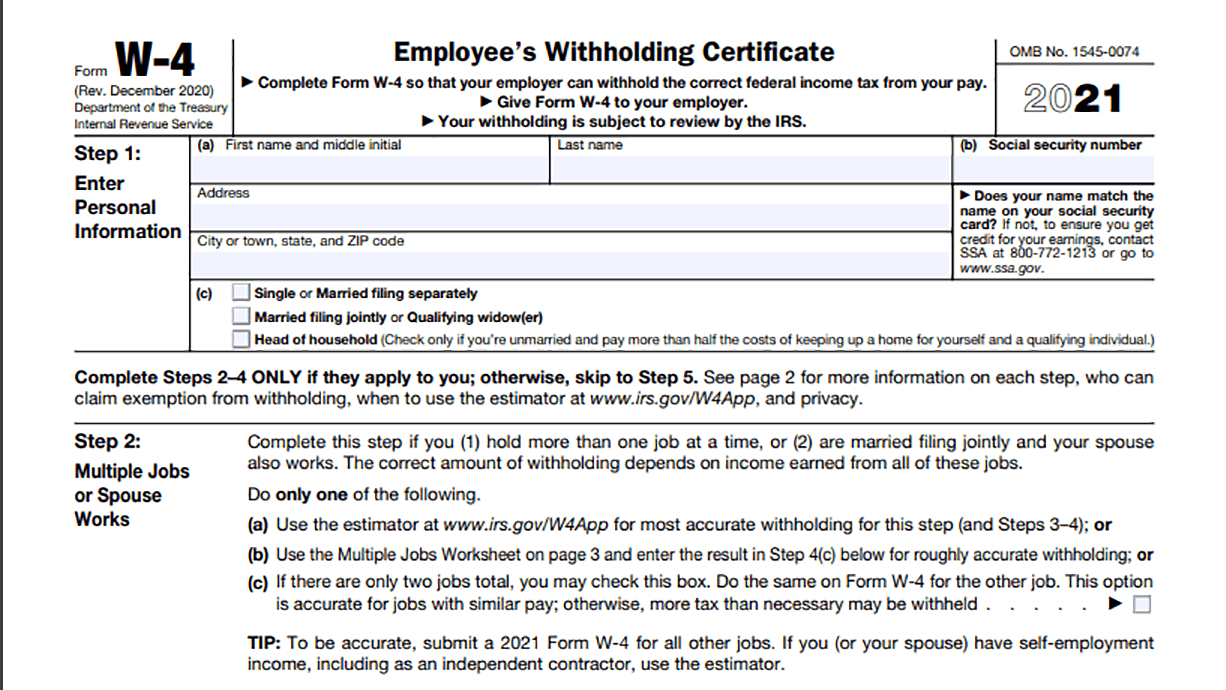

W 4 Form

After signing, the employer should fill out their name,. If too little is withheld, you will. Use the irs withholding estimator tool to decide the amount of income tax to be withheld from your paycheck. Learn how to change your. In order for the form to be valid, the w4 must be signed and dated by the employee.

Ny State W4 2024 Iris Melissa

After signing, the employer should fill out their name,. Learn how to change your. If too little is withheld, you will. In order for the form to be valid, the w4 must be signed and dated by the employee. Use the irs withholding estimator tool to decide the amount of income tax to be withheld from your paycheck.

If Too Little Is Withheld, You Will.

In order for the form to be valid, the w4 must be signed and dated by the employee. Use the irs withholding estimator tool to decide the amount of income tax to be withheld from your paycheck. Learn how to change your. After signing, the employer should fill out their name,.