What Is Irs Form 8332 - Tax form 8332 determines which parent can claim tax benefits for a dependent child after a divorce or separation. Form 8332 is used by the custodial parent to release their right to claim a child as a dependent to the noncustodial parent. Information about form 8332, release/revocation of release of claim to exemption for child by custodial parent, including. This irs form plays a vital role in determining which parent gets to claim specific tax benefits related to a child. The form can be used for. Form 8332 is the form custodial parents can use to release their right to claim a child as a dependent to the noncustodial parent.

This irs form plays a vital role in determining which parent gets to claim specific tax benefits related to a child. Information about form 8332, release/revocation of release of claim to exemption for child by custodial parent, including. Form 8332 is used by the custodial parent to release their right to claim a child as a dependent to the noncustodial parent. Form 8332 is the form custodial parents can use to release their right to claim a child as a dependent to the noncustodial parent. Tax form 8332 determines which parent can claim tax benefits for a dependent child after a divorce or separation. The form can be used for.

Form 8332 is the form custodial parents can use to release their right to claim a child as a dependent to the noncustodial parent. Form 8332 is used by the custodial parent to release their right to claim a child as a dependent to the noncustodial parent. The form can be used for. Information about form 8332, release/revocation of release of claim to exemption for child by custodial parent, including. This irs form plays a vital role in determining which parent gets to claim specific tax benefits related to a child. Tax form 8332 determines which parent can claim tax benefits for a dependent child after a divorce or separation.

IRS Form 8332 A Guide for Custodial Parents

Form 8332 is the form custodial parents can use to release their right to claim a child as a dependent to the noncustodial parent. Information about form 8332, release/revocation of release of claim to exemption for child by custodial parent, including. This irs form plays a vital role in determining which parent gets to claim specific tax benefits related to.

Irs Form 8332 Printable

This irs form plays a vital role in determining which parent gets to claim specific tax benefits related to a child. Form 8332 is the form custodial parents can use to release their right to claim a child as a dependent to the noncustodial parent. Information about form 8332, release/revocation of release of claim to exemption for child by custodial.

StepbyStep Guide to IRS Form 8332 How to Claim My Child As a

Form 8332 is the form custodial parents can use to release their right to claim a child as a dependent to the noncustodial parent. Information about form 8332, release/revocation of release of claim to exemption for child by custodial parent, including. Form 8332 is used by the custodial parent to release their right to claim a child as a dependent.

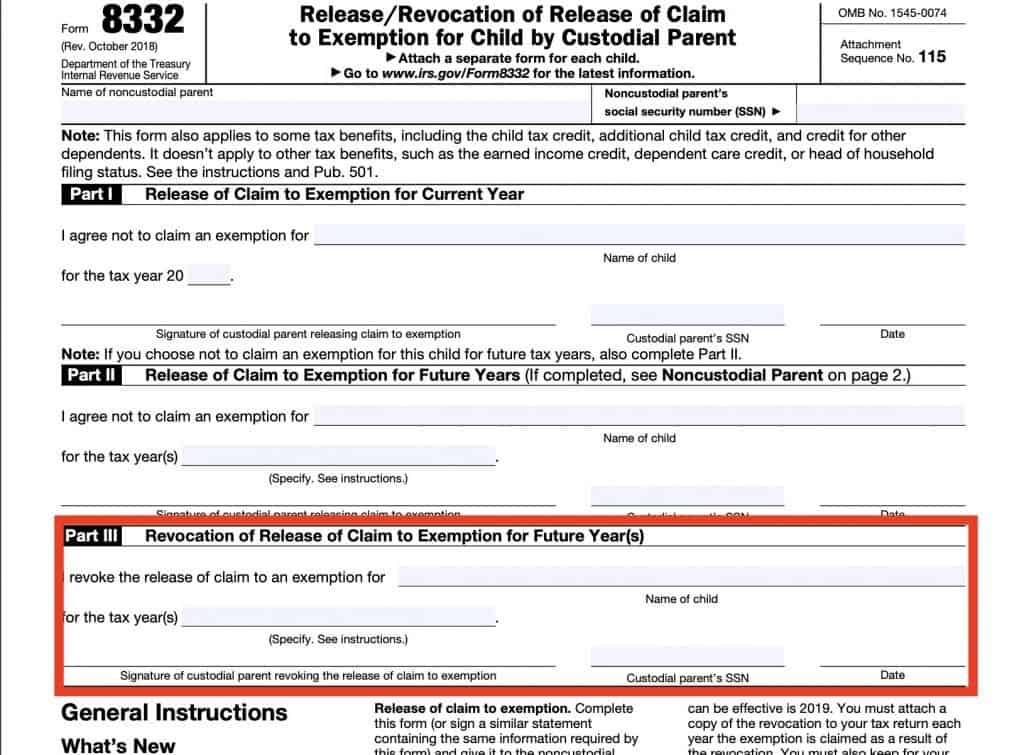

IRS Form 8332 Instructions Release of Child Exemption

Form 8332 is the form custodial parents can use to release their right to claim a child as a dependent to the noncustodial parent. Form 8332 is used by the custodial parent to release their right to claim a child as a dependent to the noncustodial parent. The form can be used for. Tax form 8332 determines which parent can.

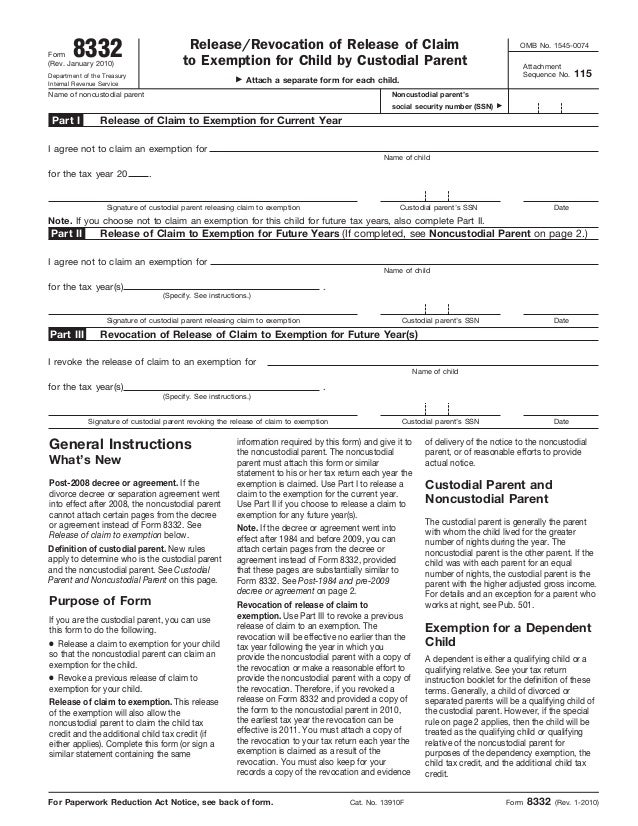

Form 8332 Release/Revocation of Release of Claim to Exemption for

This irs form plays a vital role in determining which parent gets to claim specific tax benefits related to a child. Form 8332 is used by the custodial parent to release their right to claim a child as a dependent to the noncustodial parent. Tax form 8332 determines which parent can claim tax benefits for a dependent child after a.

Form 8332 Release/Revocation of Release of Claim to Exemption for Ch…

Form 8332 is used by the custodial parent to release their right to claim a child as a dependent to the noncustodial parent. This irs form plays a vital role in determining which parent gets to claim specific tax benefits related to a child. Tax form 8332 determines which parent can claim tax benefits for a dependent child after a.

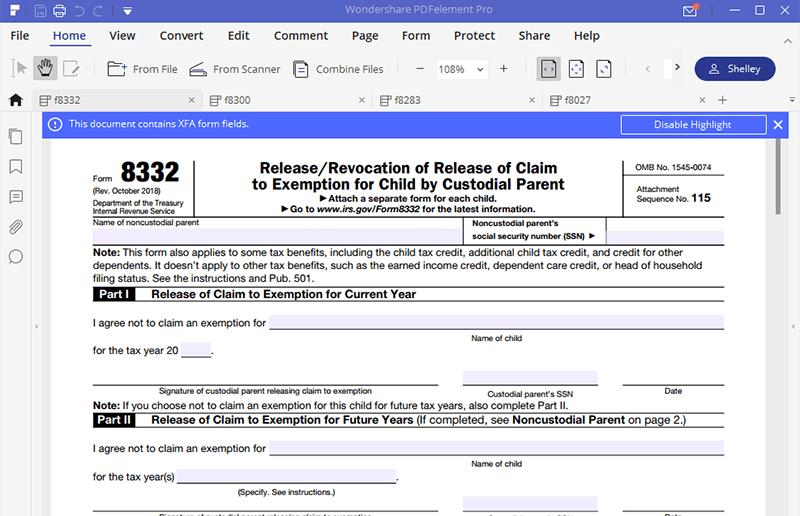

IRS Form 8332 Fill it with the Best PDF Form Filler

Form 8332 is used by the custodial parent to release their right to claim a child as a dependent to the noncustodial parent. Tax form 8332 determines which parent can claim tax benefits for a dependent child after a divorce or separation. The form can be used for. Information about form 8332, release/revocation of release of claim to exemption for.

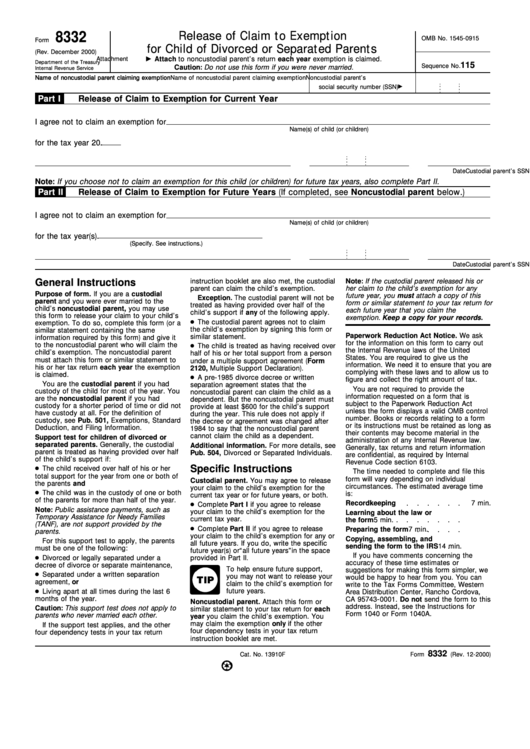

Fillable Form 8332 Release Of Claim To Exemption For Child Of

This irs form plays a vital role in determining which parent gets to claim specific tax benefits related to a child. Information about form 8332, release/revocation of release of claim to exemption for child by custodial parent, including. Form 8332 is the form custodial parents can use to release their right to claim a child as a dependent to the.

IRS 8332 20182022 Fill and Sign Printable Template Online US Legal

The form can be used for. Information about form 8332, release/revocation of release of claim to exemption for child by custodial parent, including. Tax form 8332 determines which parent can claim tax benefits for a dependent child after a divorce or separation. This irs form plays a vital role in determining which parent gets to claim specific tax benefits related.

IRS Form 8332

The form can be used for. This irs form plays a vital role in determining which parent gets to claim specific tax benefits related to a child. Form 8332 is the form custodial parents can use to release their right to claim a child as a dependent to the noncustodial parent. Information about form 8332, release/revocation of release of claim.

The Form Can Be Used For.

Form 8332 is used by the custodial parent to release their right to claim a child as a dependent to the noncustodial parent. This irs form plays a vital role in determining which parent gets to claim specific tax benefits related to a child. Form 8332 is the form custodial parents can use to release their right to claim a child as a dependent to the noncustodial parent. Information about form 8332, release/revocation of release of claim to exemption for child by custodial parent, including.