Where Can I Find My 1040 Form - You will not find that on their form 1040. Everyone uses a form 1040. Your income after all adjustments, deductions, and. You have to access your own account and/or print it for yourself using exactly the same account and user. If you want to know your effective tax rate on only your taxable income (i.e. Student grant and scholarship aid are not reported to the irs in your parents' income.

Student grant and scholarship aid are not reported to the irs in your parents' income. Your income after all adjustments, deductions, and. Everyone uses a form 1040. You will not find that on their form 1040. You have to access your own account and/or print it for yourself using exactly the same account and user. If you want to know your effective tax rate on only your taxable income (i.e.

Everyone uses a form 1040. You have to access your own account and/or print it for yourself using exactly the same account and user. You will not find that on their form 1040. If you want to know your effective tax rate on only your taxable income (i.e. Student grant and scholarship aid are not reported to the irs in your parents' income. Your income after all adjustments, deductions, and.

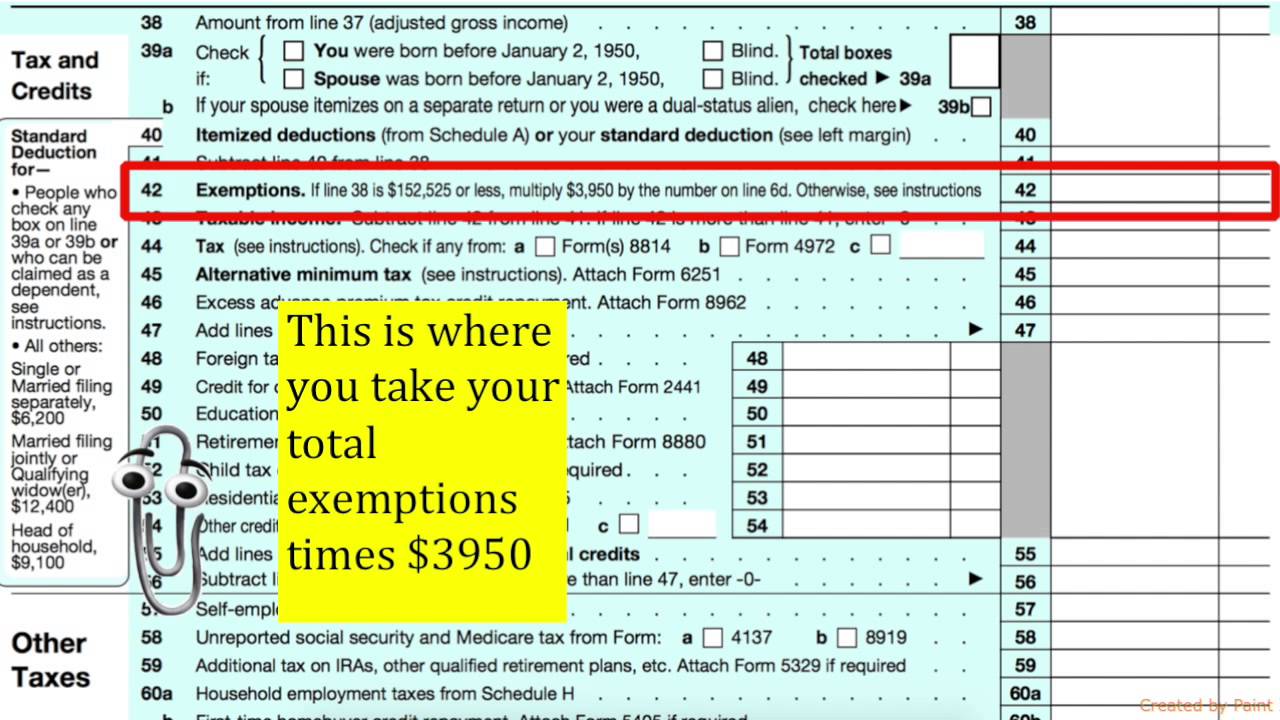

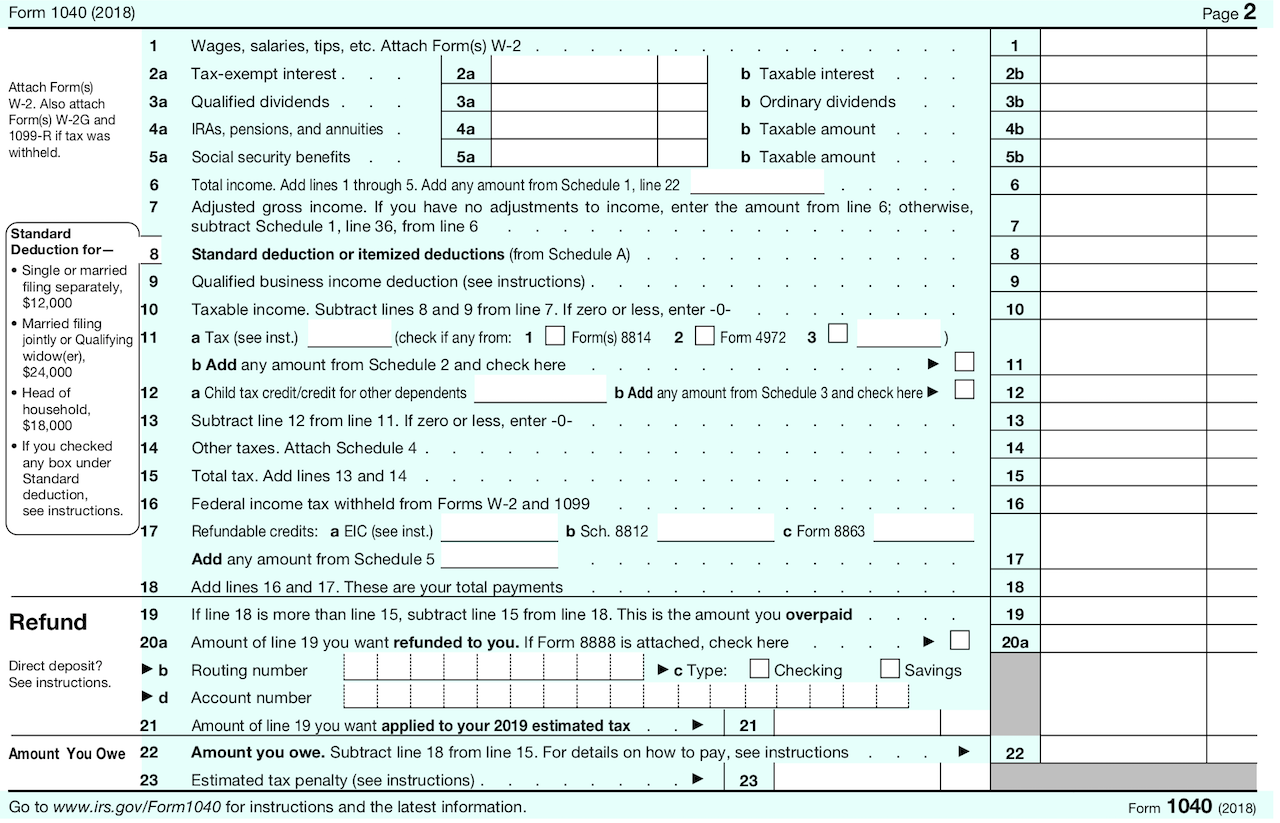

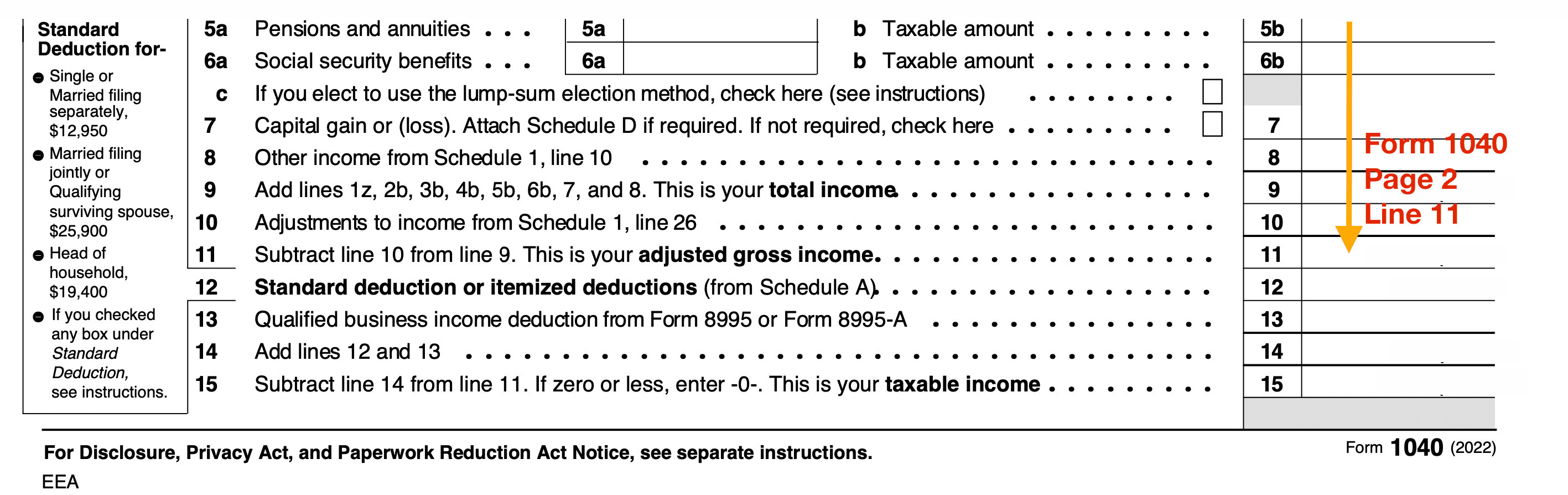

Form 1040 Tax Return Guide YouTube

Student grant and scholarship aid are not reported to the irs in your parents' income. You will not find that on their form 1040. Your income after all adjustments, deductions, and. Everyone uses a form 1040. If you want to know your effective tax rate on only your taxable income (i.e.

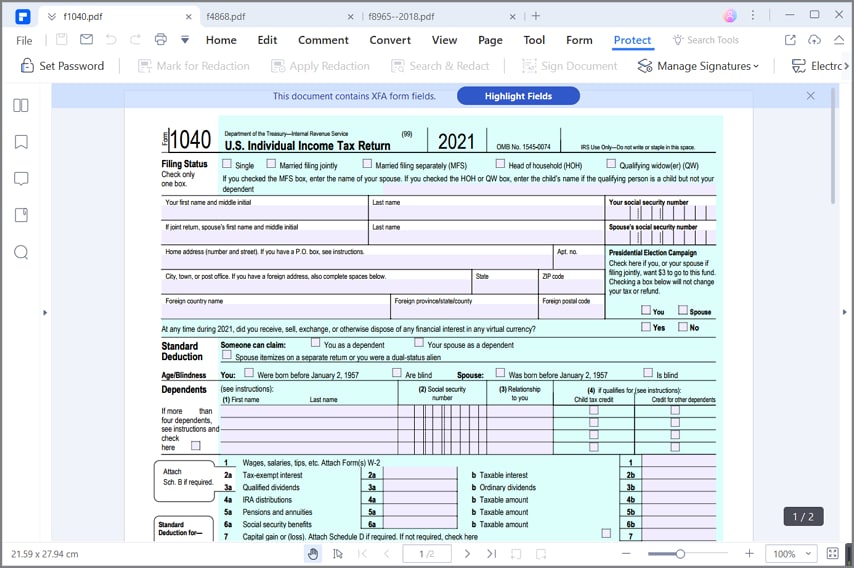

Irs 1040 Form IRS Offers New Look At Form 1040SR (U.S. Tax Return

You will not find that on their form 1040. Everyone uses a form 1040. Student grant and scholarship aid are not reported to the irs in your parents' income. You have to access your own account and/or print it for yourself using exactly the same account and user. Your income after all adjustments, deductions, and.

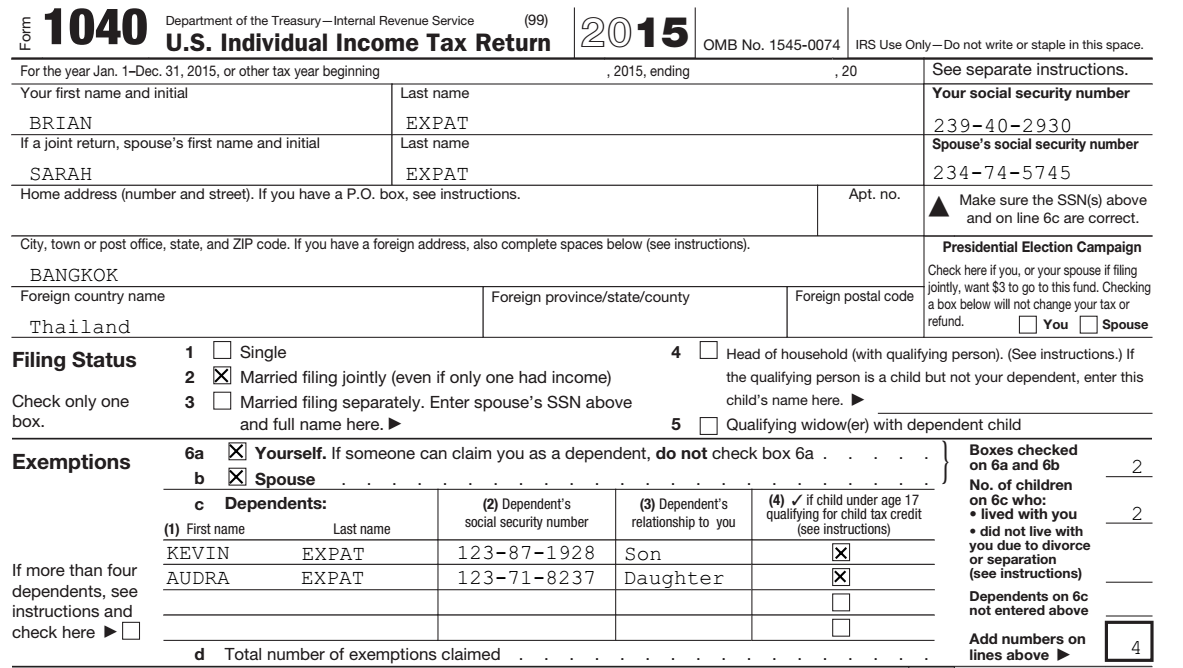

IRS Form 1040 How to Fill it Wisely

You will not find that on their form 1040. Everyone uses a form 1040. Student grant and scholarship aid are not reported to the irs in your parents' income. You have to access your own account and/or print it for yourself using exactly the same account and user. Your income after all adjustments, deductions, and.

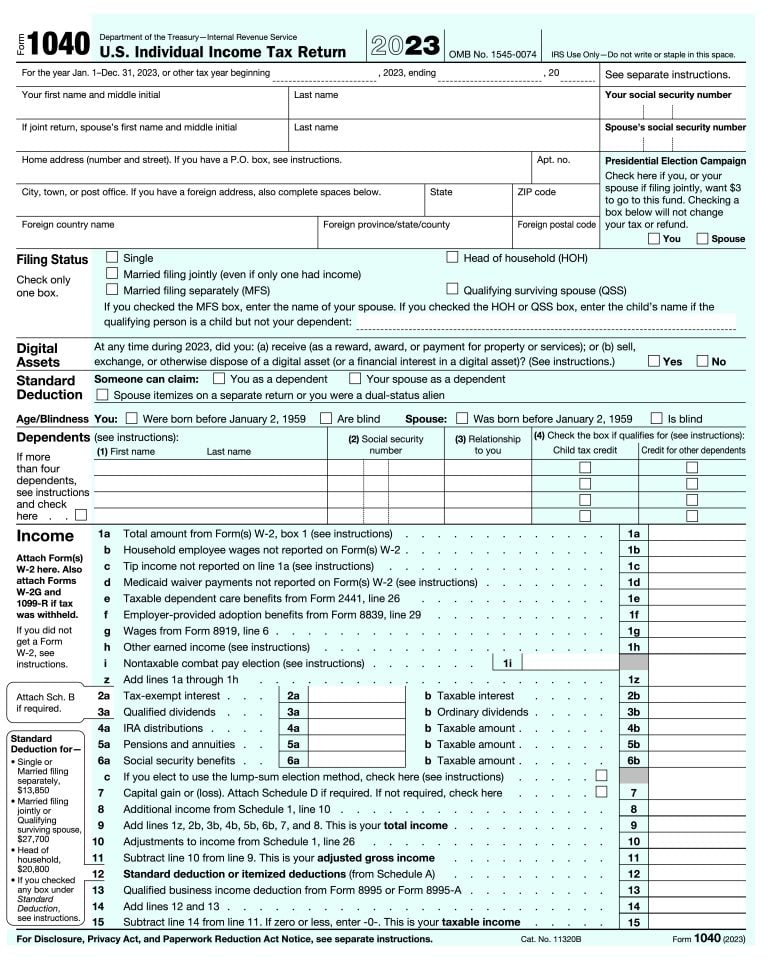

What Is the 1040 Tax Form? How to Fill It Out NerdWallet

Everyone uses a form 1040. You have to access your own account and/or print it for yourself using exactly the same account and user. You will not find that on their form 1040. Your income after all adjustments, deductions, and. If you want to know your effective tax rate on only your taxable income (i.e.

Describes new Form 1040, Schedules & Tax Tables

You have to access your own account and/or print it for yourself using exactly the same account and user. Everyone uses a form 1040. Your income after all adjustments, deductions, and. If you want to know your effective tax rate on only your taxable income (i.e. You will not find that on their form 1040.

How to Fill Out a Form 1040 Buy Side from WSJ

Your income after all adjustments, deductions, and. You have to access your own account and/or print it for yourself using exactly the same account and user. You will not find that on their form 1040. Student grant and scholarship aid are not reported to the irs in your parents' income. If you want to know your effective tax rate on.

IRS Releases Form 1040 For 2020 Tax Year Taxgirl

You have to access your own account and/or print it for yourself using exactly the same account and user. Student grant and scholarship aid are not reported to the irs in your parents' income. You will not find that on their form 1040. If you want to know your effective tax rate on only your taxable income (i.e. Everyone uses.

How to find your 1040 Individual Tax Form online YouTube

Student grant and scholarship aid are not reported to the irs in your parents' income. If you want to know your effective tax rate on only your taxable income (i.e. You will not find that on their form 1040. Everyone uses a form 1040. You have to access your own account and/or print it for yourself using exactly the same.

How To Obtain Your Previous Tax Return AGI to eFile Your Return.

Student grant and scholarship aid are not reported to the irs in your parents' income. You have to access your own account and/or print it for yourself using exactly the same account and user. Everyone uses a form 1040. If you want to know your effective tax rate on only your taxable income (i.e. Your income after all adjustments, deductions,.

Form 1040 Review Russell Investments

You have to access your own account and/or print it for yourself using exactly the same account and user. Your income after all adjustments, deductions, and. Everyone uses a form 1040. Student grant and scholarship aid are not reported to the irs in your parents' income. If you want to know your effective tax rate on only your taxable income.

You Have To Access Your Own Account And/Or Print It For Yourself Using Exactly The Same Account And User.

Student grant and scholarship aid are not reported to the irs in your parents' income. You will not find that on their form 1040. Everyone uses a form 1040. If you want to know your effective tax rate on only your taxable income (i.e.